Stock Analysis

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Vertex, Inc. (NASDAQ:VERX) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Vertex

How Much Debt Does Vertex Carry?

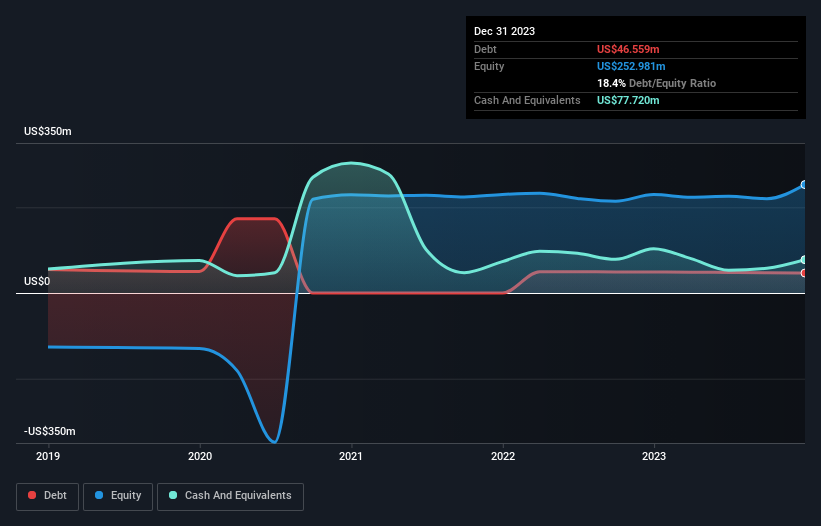

As you can see below, Vertex had US$46.6m of debt at December 2023, down from US$48.9m a year prior. But on the other hand it also has US$77.7m in cash, leading to a US$31.2m net cash position.

A Look At Vertex's Liabilities

According to the last reported balance sheet, Vertex had liabilities of US$440.8m due within 12 months, and liabilities of US$66.2m due beyond 12 months. On the other hand, it had cash of US$77.7m and US$141.8m worth of receivables due within a year. So it has liabilities totalling US$287.5m more than its cash and near-term receivables, combined.

Of course, Vertex has a market capitalization of US$4.60b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, Vertex also has more cash than debt, so we're pretty confident it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Vertex's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Vertex reported revenue of US$572m, which is a gain of 16%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is Vertex?

Although Vertex had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of US$6.1m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. With revenue growth uninspiring, we'd really need to see some positive EBIT before mustering much enthusiasm for this business. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Vertex has 3 warning signs we think you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're helping make it simple.

Find out whether Vertex is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:VERX

Vertex

Vertex, Inc., together with its subsidiaries, provides enterprise tax technology solutions for retail trade, wholesale trade, and manufacturing industries in the United States and internationally.

High growth potential with excellent balance sheet.