- India

- /

- Trade Distributors

- /

- NSEI:HINDWAREAP

Greenlam Industries And 2 Insider Picks For High Growth On The Indian Exchange

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 1.7%, driven by a pullback of 2.3% in the Financials sector. However, over the longer term, it has risen by 43% in the last year with earnings forecast to grow by 17% annually. In this context, identifying growth companies with high insider ownership can be crucial as it often signals confidence from those who know the business best and can offer strong potential for investors seeking long-term gains.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 35% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 30.1% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 35.7% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 31.9% | 20.7% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| JNK India (NSEI:JNKINDIA) | 21% | 31.8% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 35.8% |

| Aether Industries (NSEI:AETHER) | 31.1% | 43.6% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

We're going to check out a few of the best picks from our screener tool.

Greenlam Industries (NSEI:GREENLAM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Greenlam Industries Limited manufactures and sells laminates, decorative veneers, and related products both in India and internationally, with a market cap of ₹73.72 billion.

Operations: The company's revenue segments include ₹21.02 billion from Laminate & Allied Products, ₹2.09 billion from Veneers & Allied Products, and ₹847.70 million from Plywood & Allied Products.

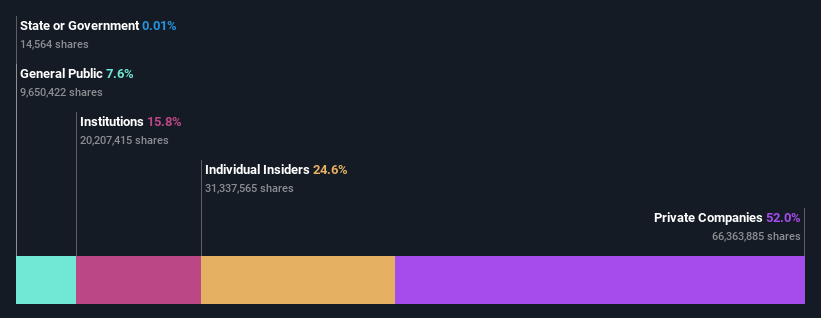

Insider Ownership: 24.6%

Earnings Growth Forecast: 34% p.a.

Greenlam Industries shows strong growth potential with earnings expected to grow at 34% annually, significantly outpacing the Indian market's 16.8%. Revenue is forecasted to increase by 19.2% per year, also surpassing market averages. Despite a low dividend yield of 0.29%, recent financials indicate robust sales growth from INR 5,152.4 million to INR 6,047.1 million in Q1 FY2025. However, net income decreased from INR 331 million to INR 202.7 million over the same period.

- Navigate through the intricacies of Greenlam Industries with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Greenlam Industries is trading beyond its estimated value.

Hindware Home Innovation (NSEI:HINDWAREAP)

Simply Wall St Growth Rating: ★★★★☆☆

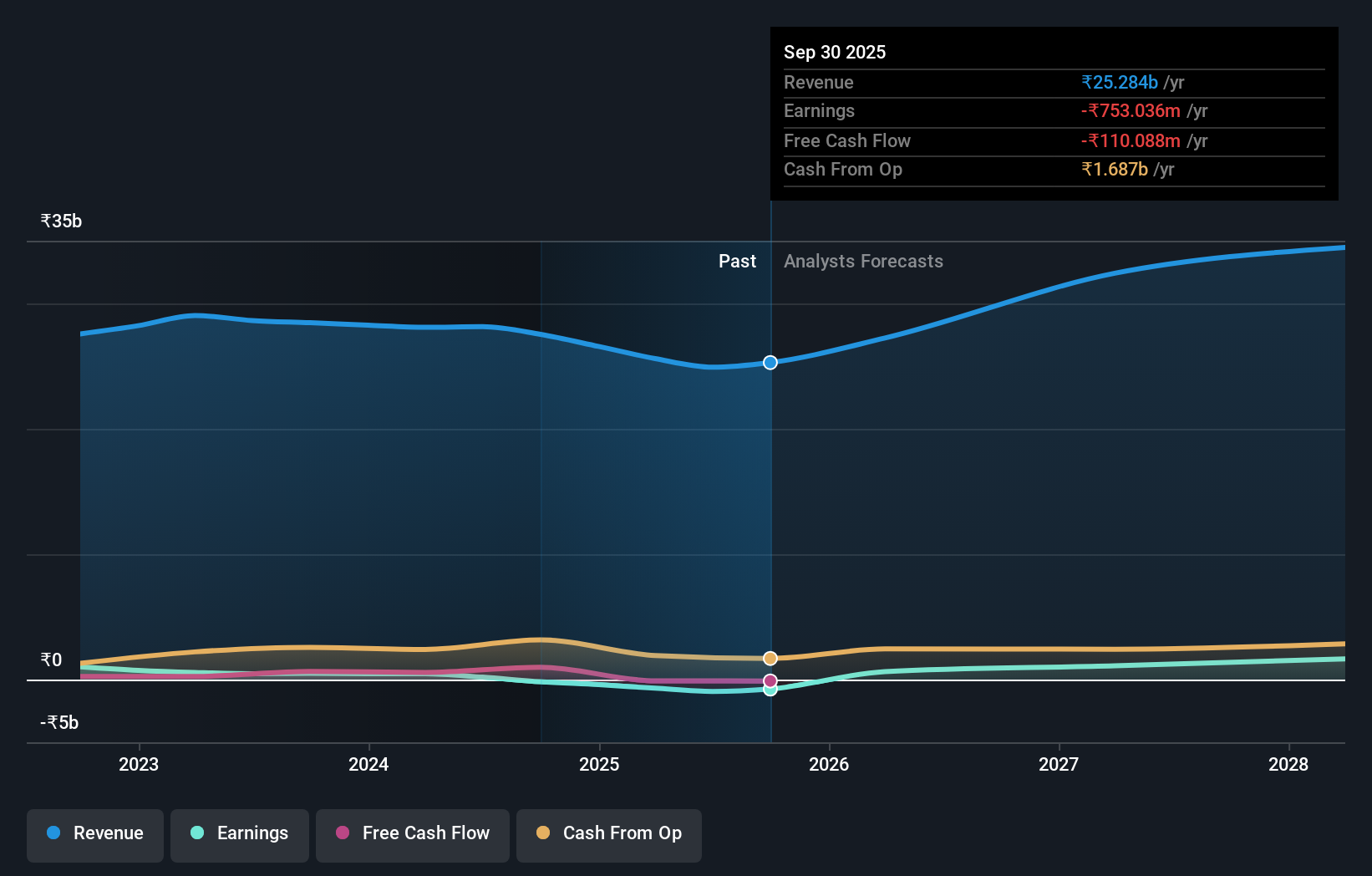

Overview: Hindware Home Innovation Limited is involved in the manufacturing, selling, and trading of building products, consumer appliances, and retail business in India with a market cap of ₹30.15 billion.

Operations: Hindware Home Innovation Limited generates revenue from building products, consumer appliances, and retail business in India.

Insider Ownership: 15%

Earnings Growth Forecast: 86% p.a.

Hindware Home Innovation's earnings are projected to grow significantly at 86% annually, outpacing the Indian market. Revenue growth is forecasted at 12.7% per year, higher than the market average of 9.9%. Despite this, recent financials show a net loss of ₹40.1 million in Q1 FY2025 compared to a net income of ₹2.7 million a year ago, and profit margins have declined from last year. The stock trades at good value relative to peers and industry standards.

- Click here and access our complete growth analysis report to understand the dynamics of Hindware Home Innovation.

- Our comprehensive valuation report raises the possibility that Hindware Home Innovation is priced lower than what may be justified by its financials.

HPL Electric & Power (NSEI:HPL)

Simply Wall St Growth Rating: ★★★★★☆

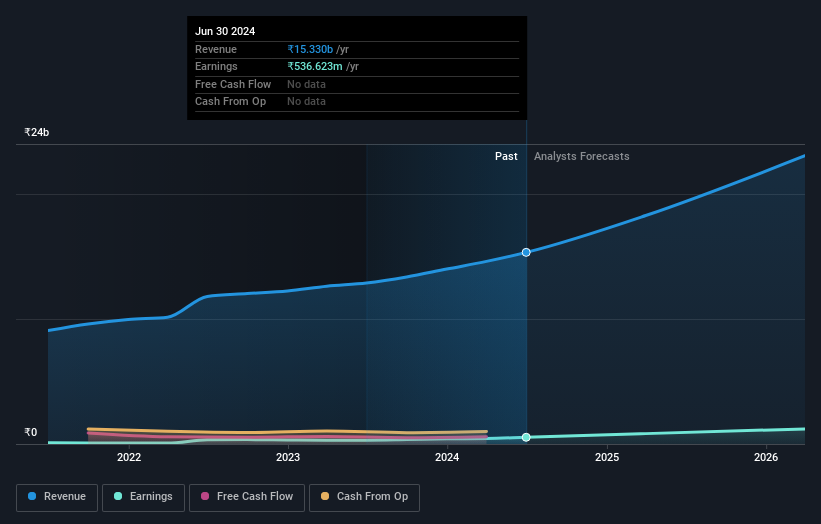

Overview: HPL Electric & Power Limited manufactures and sells electric equipment under the HPL brand in India, with a market cap of ₹38.11 billion.

Operations: The company's revenue segments include Metering, Systems & Services generating ₹9.15 billion and Consumer, Industrial & Services contributing ₹6.18 billion.

Insider Ownership: 22.7%

Earnings Growth Forecast: 44.8% p.a.

HPL Electric & Power is expected to see revenue growth of 23.5% per year and earnings growth of 44.8%, both surpassing the Indian market averages. Despite recent volatility in its share price, the company reported strong Q1 FY2025 results with net income rising to ₹170.23 million from ₹69.25 million a year ago. Additionally, HPL secured significant orders worth over ₹21 billion for smart meters and formed a manufacturing partnership with Guangxi Ramway Technology Co., Ltd., indicating robust future prospects.

- Unlock comprehensive insights into our analysis of HPL Electric & Power stock in this growth report.

- The valuation report we've compiled suggests that HPL Electric & Power's current price could be inflated.

Seize The Opportunity

- Access the full spectrum of 92 Fast Growing Indian Companies With High Insider Ownership by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hindware Home Innovation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:HINDWAREAP

Hindware Home Innovation

Engages in the manufacturing, selling and trading of building products, consumer appliances, and retail business in India.

Reasonable growth potential with imperfect balance sheet.