Stock Analysis

Clairvest Group Inc. (TSE:CVG) shareholders (or potential shareholders) will be happy to see that the Director, G. Krediet, recently bought a whopping CA$1.8m worth of stock, at a price of CA$70.54. While that only increased their holding size by 4.7%, it is still a big swing by our standards.

View our latest analysis for Clairvest Group

Clairvest Group Insider Transactions Over The Last Year

The insider, Gerald Heffernan, made the biggest insider sale in the last 12 months. That single transaction was for CA$33m worth of shares at a price of CA$74.00 each. That means that an insider was selling shares at around the current price of CA$72.00. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive).

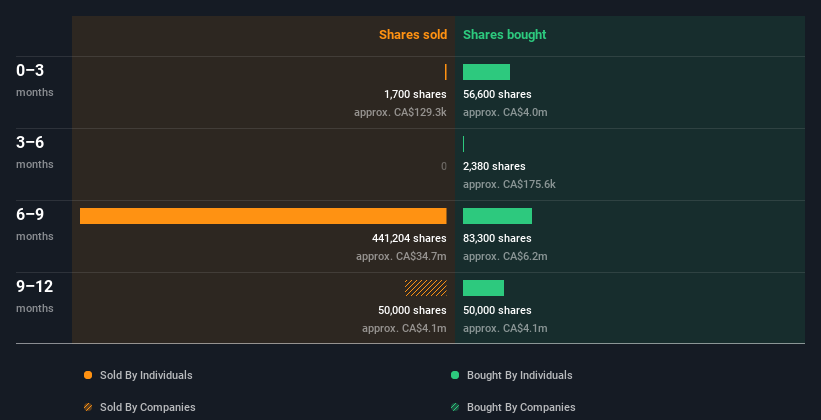

In the last twelve months insiders purchased 192.28k shares for CA$14m. But insiders sold 442.90k shares worth CA$33m. In total, Clairvest Group insiders sold more than they bought over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. We usually like to see fairly high levels of insider ownership. It's great to see that Clairvest Group insiders own 63% of the company, worth about CA$674m. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Does This Data Suggest About Clairvest Group Insiders?

The recent insider purchases are heartening. However, the longer term transactions are not so encouraging. Overall, we'd prefer see a more sustained buying from directors, but with a significant insider holding and more recent purchases, Clairvest Group insiders are reasonably well aligned, and optimistic for the future. I like to dive deeper into how a company has performed in the past. You can find historic revenue and earnings in this detailed graph.

Of course Clairvest Group may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're helping make it simple.

Find out whether Clairvest Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CVG

Clairvest Group

Clairvest Group Inc. is a private equity firm specializing in mid-market, growth equity investments, growth capital, buyouts, and consolidating industries and add-on acquisitions.

Flawless balance sheet and fair value.