Stock Analysis

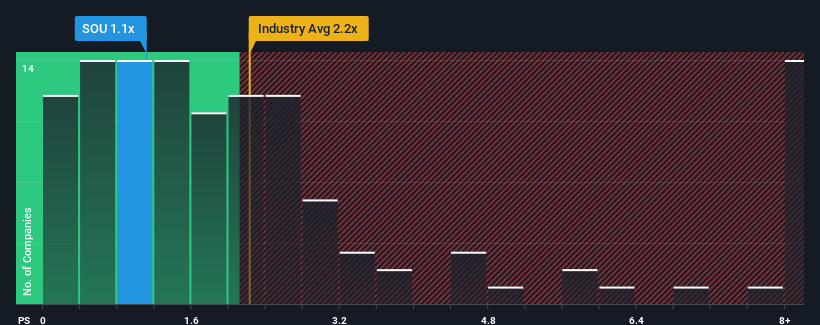

You may think that with a price-to-sales (or "P/S") ratio of 1.1x Southern Energy Corp. (CVE:SOU) is a stock worth checking out, seeing as almost half of all the Oil and Gas companies in Canada have P/S ratios greater than 2.2x and even P/S higher than 6x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Southern Energy

What Does Southern Energy's P/S Mean For Shareholders?

Southern Energy could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Southern Energy will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Southern Energy?

The only time you'd be truly comfortable seeing a P/S as low as Southern Energy's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 38%. Still, the latest three year period has seen an excellent 143% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 59% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 11%, which is noticeably less attractive.

With this information, we find it odd that Southern Energy is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Southern Energy's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems Southern Energy currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You should always think about risks. Case in point, we've spotted 3 warning signs for Southern Energy you should be aware of.

If you're unsure about the strength of Southern Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether Southern Energy is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:SOU

Southern Energy

Southern Energy Corp. operates as an oil and natural gas exploration and production company in Canada.

Undervalued with limited growth.