Stock Analysis

- Brazil

- /

- Metals and Mining

- /

- BOVESPA:CBAV3

Companhia Brasileira de Alumínio (BVMF:CBAV3) Stock Rockets 26% But Many Are Still Ignoring The Company

Companhia Brasileira de Alumínio (BVMF:CBAV3) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 19% in the last twelve months.

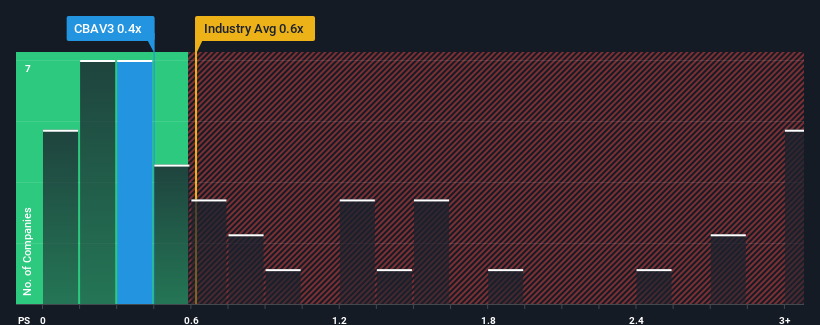

In spite of the firm bounce in price, there still wouldn't be many who think Companhia Brasileira de Alumínio's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Brazil's Metals and Mining industry is similar at about 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Companhia Brasileira de Alumínio

What Does Companhia Brasileira de Alumínio's Recent Performance Look Like?

Recent times haven't been great for Companhia Brasileira de Alumínio as its revenue has been falling quicker than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Companhia Brasileira de Alumínio.What Are Revenue Growth Metrics Telling Us About The P/S?

Companhia Brasileira de Alumínio's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 17%. Even so, admirably revenue has lifted 36% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 5.3% each year during the coming three years according to the six analysts following the company. Meanwhile, the broader industry is forecast to contract by 0.8% each year, which would indicate the company is doing very well.

With this in mind, we find it intriguing that Companhia Brasileira de Alumínio's P/S trades in-line with its industry peers. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Key Takeaway

Companhia Brasileira de Alumínio's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Companhia Brasileira de Alumínio currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. It appears some are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Companhia Brasileira de Alumínio (at least 2 which are significant), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether Companhia Brasileira de Alumínio is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:CBAV3

Companhia Brasileira de Alumínio

Companhia Brasileira de Alumínio produces and sells aluminum products.

Moderate growth potential and slightly overvalued.