Stock Analysis

- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:QNST

Cautious Investors Not Rewarding QuinStreet, Inc.'s (NASDAQ:QNST) Performance Completely

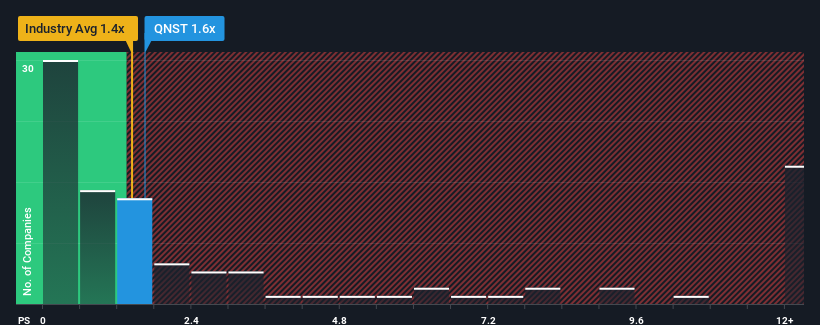

With a median price-to-sales (or "P/S") ratio of close to 1.4x in the Interactive Media and Services industry in the United States, you could be forgiven for feeling indifferent about QuinStreet, Inc.'s (NASDAQ:QNST) P/S ratio of 1.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for QuinStreet

What Does QuinStreet's Recent Performance Look Like?

While the industry has experienced revenue growth lately, QuinStreet's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on QuinStreet will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, QuinStreet would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.4%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 5.7% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 22% over the next year. With the industry only predicted to deliver 14%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that QuinStreet's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From QuinStreet's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that QuinStreet currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 2 warning signs for QuinStreet that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether QuinStreet is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:QNST

QuinStreet

QuinStreet, Inc., an online performance marketing company, provides customer acquisition services for its clients in the United States and internationally.

Excellent balance sheet with reasonable growth potential.