Stock Analysis

- Germany

- /

- Specialty Stores

- /

- XTRA:AG1

AUTO1 Group (ETR:AG1) Is Carrying A Fair Bit Of Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies AUTO1 Group SE (ETR:AG1) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for AUTO1 Group

How Much Debt Does AUTO1 Group Carry?

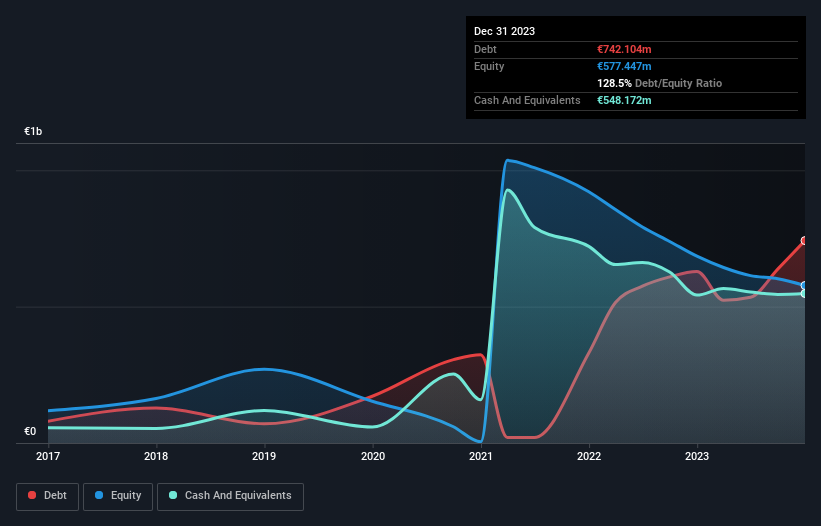

As you can see below, at the end of December 2023, AUTO1 Group had €742.1m of debt, up from €628.7m a year ago. Click the image for more detail. However, it also had €548.2m in cash, and so its net debt is €193.9m.

How Strong Is AUTO1 Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that AUTO1 Group had liabilities of €338.1m due within 12 months and liabilities of €789.2m due beyond that. On the other hand, it had cash of €548.2m and €150.8m worth of receivables due within a year. So its liabilities total €428.3m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because AUTO1 Group is worth €1.03b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if AUTO1 Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year AUTO1 Group had a loss before interest and tax, and actually shrunk its revenue by 16%, to €5.5b. We would much prefer see growth.

Caveat Emptor

While AUTO1 Group's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost a very considerable €106m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled €79m in negative free cash flow over the last twelve months. So suffice it to say we consider the stock very risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for AUTO1 Group that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're helping make it simple.

Find out whether AUTO1 Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About XTRA:AG1

AUTO1 Group

AUTO1 Group SE operates a digital automotive platform for buying and selling used cars online in Europe.

Good value with reasonable growth potential.