Stock Analysis

- Netherlands

- /

- Machinery

- /

- ENXTAM:AALB

Aalberts N.V.'s (AMS:AALB) Share Price Could Signal Some Risk

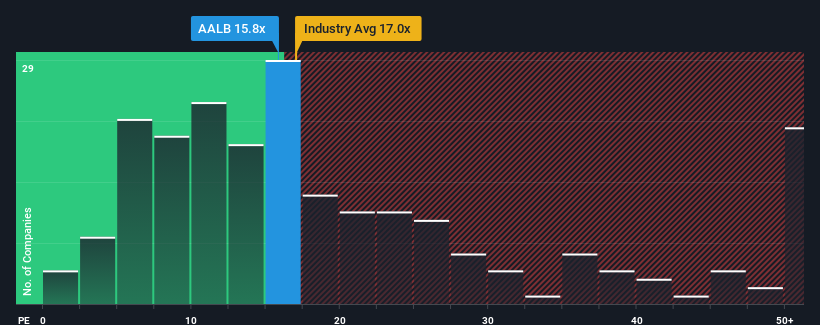

There wouldn't be many who think Aalberts N.V.'s (AMS:AALB) price-to-earnings (or "P/E") ratio of 15.8x is worth a mention when the median P/E in the Netherlands is similar at about 16x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, Aalberts' earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Aalberts

How Is Aalberts' Growth Trending?

The only time you'd be comfortable seeing a P/E like Aalberts' is when the company's growth is tracking the market closely.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Still, the latest three year period has seen an excellent 169% overall rise in EPS, in spite of its uninspiring short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 8.4% per year as estimated by the five analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 14% per annum, which is noticeably more attractive.

With this information, we find it interesting that Aalberts is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Aalberts' analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 1 warning sign for Aalberts that we have uncovered.

Of course, you might also be able to find a better stock than Aalberts. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether Aalberts is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About ENXTAM:AALB

Aalberts

Aalberts N.V. offers mission-critical technologies for aerospace, automotive, building, and maritime sectors.

Flawless balance sheet average dividend payer.