Stock Analysis

- Australia

- /

- Metals and Mining

- /

- ASX:29M

29Metals Limited (ASX:29M) Surges 36% Yet Its Low P/S Is No Reason For Excitement

29Metals Limited (ASX:29M) shareholders are no doubt pleased to see that the share price has bounced 36% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 59% share price drop in the last twelve months.

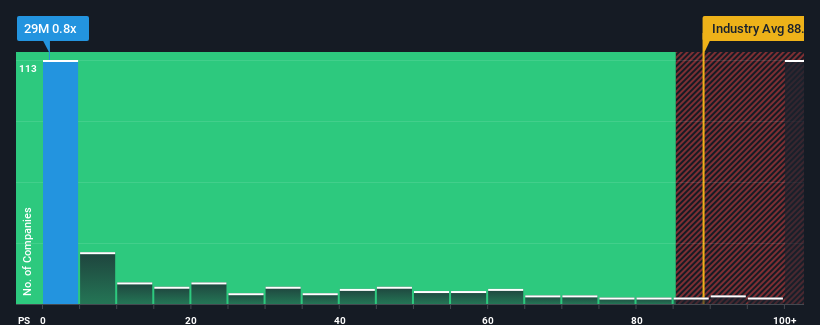

In spite of the firm bounce in price, 29Metals may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.8x, considering almost half of all companies in the Metals and Mining industry in Australia have P/S ratios greater than 88.9x and even P/S higher than 560x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for 29Metals

How Has 29Metals Performed Recently?

29Metals hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on 29Metals will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

29Metals' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a frustrating 38% decrease to the company's top line. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 23% per annum over the next three years. That's shaping up to be materially lower than the 141% per annum growth forecast for the broader industry.

With this in consideration, its clear as to why 29Metals' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From 29Metals' P/S?

29Metals' recent share price jump still sees fails to bring its P/S alongside the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that 29Metals maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

It is also worth noting that we have found 2 warning signs for 29Metals (1 is potentially serious!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're helping make it simple.

Find out whether 29Metals is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About ASX:29M

29Metals

29Metals Limited explores, develops, and produces copper focused base and precious metals.

Good value with reasonable growth potential.