- United States

- /

- Semiconductors

- /

- NasdaqGS:ARM

Arm Holdings (NasdaqGS:ARM) Collaborates With Cerence AI To Enhance In-Car AI Capabilities

Reviewed by Simply Wall St

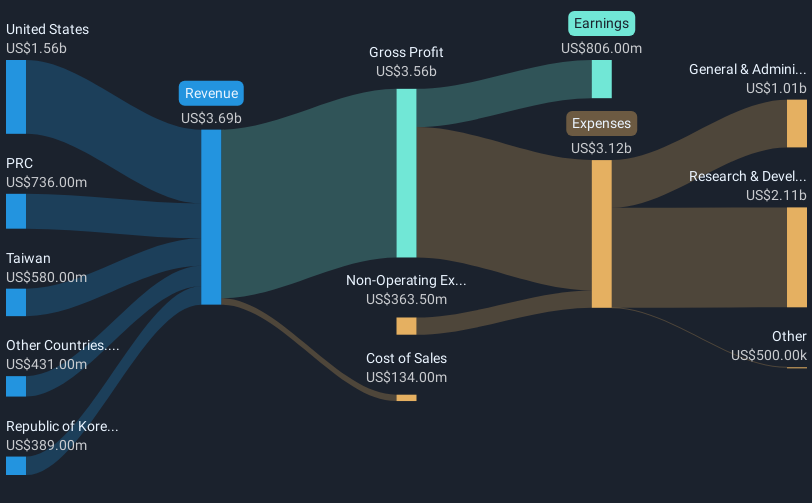

Arm Holdings (NasdaqGS:ARM) has been a focal point in the market, witnessing a 21% price increase over the past month, underpinned by a recent strategic partnership with Cerence Inc. This collaboration aims to enhance AI capabilities, potentially strengthening Arm's position in the competitive tech landscape. Amidst mixed movements in major indexes and a rally in technology stocks following Nvidia's strong earnings report, Arm's partnership news likely added upward momentum in countering broader market shifts. Meanwhile, Arm's promising full-year financial metrics and future guidance could have fortified investor confidence amid fluctuating macroeconomic trends.

Buy, Hold or Sell Arm Holdings? View our complete analysis and fair value estimate and you decide.

The recent collaboration between Arm Holdings and Cerence Inc. to enhance AI capabilities is anticipated to bolster Arm's revenue and earnings forecasts. This strategic move is likely to amplify Arm's potential in driving royalty revenues from partnerships with industry giants like AWS and NVIDIA, as AI becomes a cornerstone technology across multiple sectors including smartphones, autos, and IoT. Arm's investment in R&D and effort to expand their market presence through advanced technologies may further sustain this revenue trajectory despite existing challenges like the Qualcomm lawsuit and concentrated customer base.

Over the longer term, Arm's shares have seen a total return of 12.34% over the past year, indicating steady performance amidst broader market fluctuations. Although Arm's one-year return matched the US Market, it surpassed the Semiconductors industry growth of 9.1%, underscoring its resilience and competitive edge in the tech sector.

Given the recent strategic developments, analysts remain optimistic about Arm's future prospects, setting a consensus price target of US$131.81. This stands in contrast to the 21% share price jump in recent months, yet Arm's current share price at US$122.44 reflects a 2.75% discount to this target. However, bullish analysts suggest a higher fair value target of US$203.0, based on expectations of significant revenue growth and improved profit margins through 2028. Investors might assess these factors when considering Arm's valuation in the context of projected earnings growth and market expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARM

Arm Holdings

Arm Holdings plc architects, develops, and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion