- United States

- /

- Semiconductors

- /

- NasdaqGS:ARM

Arm Holdings (ARM) Announces 2026 Q2 Revenue Guidance of US$1.01B to US$1.11B

Reviewed by Simply Wall St

Arm Holdings (ARM) experienced significant market activity over the last quarter with a 42% increase in its share price. This upward momentum was likely influenced by the company's recent earnings guidance, projecting second-quarter 2026 revenue between $1.01 billion and $1.11 billion, reflecting confidence in its growth trajectory. Additionally, Arm's partnership with Cerence Inc. to enhance AI capabilities in vehicles may have bolstered market sentiment. While the broader tech market also enjoyed gains due to strong earnings from giants like Microsoft and Meta, Arm's strategic initiatives appear aligned with these industry movements, adding weight to its robust performance during this period.

Buy, Hold or Sell Arm Holdings? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

The partnership between Arm Holdings and Cerence Inc. to enhance AI capabilities in vehicles is a promising development, significantly contributing to the recent share price increase of 42%. This aligns with Arm's efforts to drive revenue growth through strategic engagements with major AI and semiconductor players. The anticipated revenue range for Q2 2026, coupled with the boost in market sentiment, can potentially result in increased investor confidence in Arm's growth prospects.

Over the last year, Arm's total return, inclusive of both share price movement and dividends, stood at 13.29%. This indicates a steady performance, although it underperformed against the broader US Semiconductor industry, which reported a return of 39.1% in the same period. The current share price of US$163.33 is above the consensus analyst price target of US$145.86, reflecting a 10.69% premium.

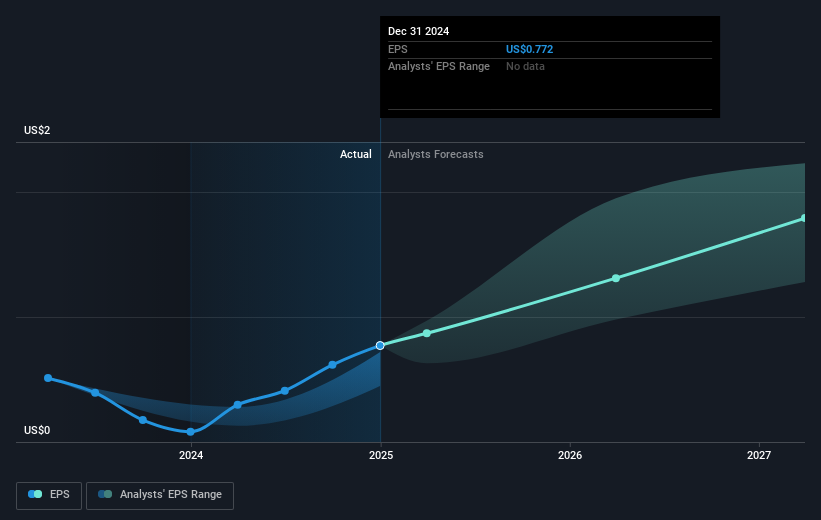

The upbeat projections for Arm's future earnings and revenue, driven by its AI partnerships and R&D investments, may positively influence these forecasts. With earnings currently at US$792 million and forecasts predicting rapid growth, analysts remain divided with price targets ranging from US$80.0 to a more optimistic US$210.0. The broad spectrum of price targets suggests some uncertainty, but bullish expectations are based on robust revenue growth and expanding profit margins.

The valuation report we've compiled suggests that Arm Holdings' current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARM

Arm Holdings

Arm Holdings plc architects, develops, and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives