Are Strong Financial Prospects The Force That Is Driving The Momentum In Bharat Rasayan Limited's NSE:BHARATRAS) Stock?

Bharat Rasayan's's (NSE:BHARATRAS) stock is up by a considerable 41% over the past three months. Since the market usually pay for a company’s long-term fundamentals, we decided to study the company’s key performance indicators to see if they could be influencing the market. Particularly, we will be paying attention to Bharat Rasayan's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Bharat Rasayan

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Bharat Rasayan is:

30% = ₹1.5b ÷ ₹5.0b (Based on the trailing twelve months to December 2019).

The 'return' is the profit over the last twelve months. That means that for every ₹1 worth of shareholders' equity, the company generated ₹0.30 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learnt that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Bharat Rasayan's Earnings Growth And 30% ROE

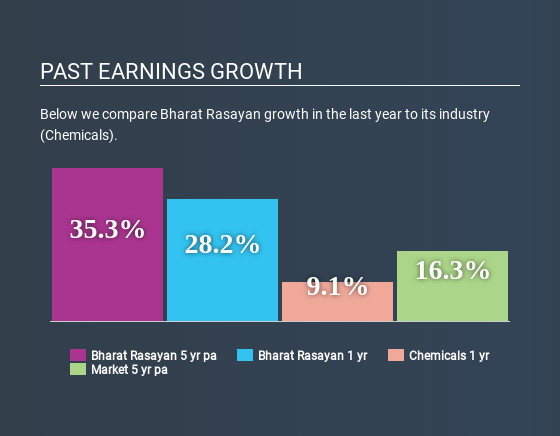

Firstly, we acknowledge that Bharat Rasayan has a significantly high ROE. Additionally, the company's ROE is higher compared to the industry average of 12% which is quite remarkable. As a result, Bharat Rasayan's exceptional 35% net income growth seen over the past five years, doesn't come as a surprise.

Next, on comparing with the industry net income growth, we found that Bharat Rasayan's growth is quite high when compared to the industry average growth of 19% in the same period, which is great to see.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Bharat Rasayan fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Bharat Rasayan Efficiently Re-investing Its Profits?

Bharat Rasayan's three-year median payout ratio to shareholders is 0.6%, which is quite low. This implies that the company is retaining 99% of its profits. So it looks like Bharat Rasayan is reinvesting profits heavily to grow its business, which shows in its earnings growth.

Moreover, Bharat Rasayan is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years.

Summary

On the whole, we feel that Bharat Rasayan's performance has been quite good. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Not to forget, share price outcomes are also dependent on the potential risks a company may face. So it is important for investors to be aware of the risks involved in the business. You can see the 1 risk we have identified for Bharat Rasayan by visiting our risks dashboard for free on our platform here.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NSEI:BHARATRAS

Bharat Rasayan

Engages in the manufacture and sale of technical grade pesticides and intermediates in India.

Excellent balance sheet with poor track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026