We often see insiders buying up shares in companies that perform well over the long term. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So shareholders might well want to know whether insiders have been buying or selling shares in Valsoia S.p.A. (BIT:VLS).

What Is Insider Selling?

It is perfectly legal for company insiders, including board members, to buy and sell stock in a company. However, such insiders must disclose their trading activities, and not trade on inside information.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.

View our latest analysis for Valsoia

Valsoia Insider Transactions Over The Last Year

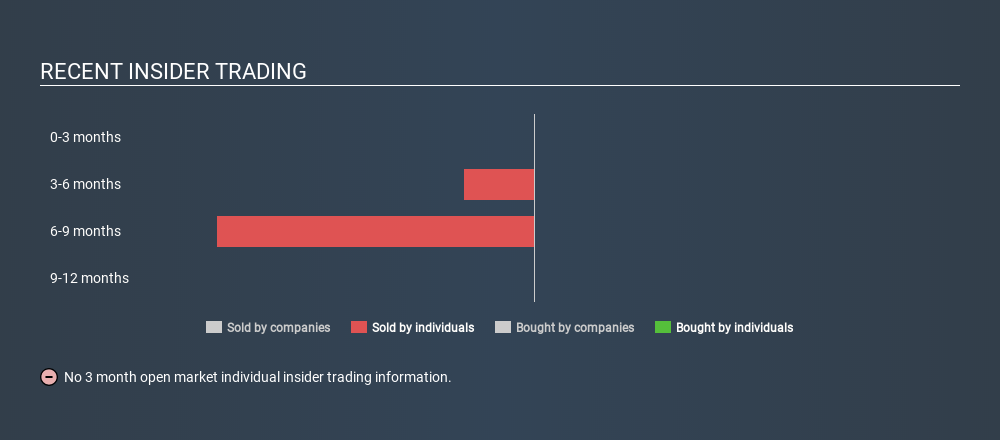

In the last twelve months, the biggest single sale by an insider was when the Honorary Chairman, Cesare de Zuliani, sold €59k worth of shares at a price of €10.67 per share. That means that even when the share price was below the current price of €11.75, an insider wanted to cash in some shares. As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. This single sale was just 1.9% of Cesare de Zuliani's stake. Cesare de Zuliani was the only individual insider to sell shares in the last twelve months.

Cesare de Zuliani ditched 23790 shares over the year. The average price per share was €10.98. The chart below shows insider transactions (by individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Does Valsoia Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. We usually like to see fairly high levels of insider ownership. Valsoia insiders own about €94m worth of shares (which is 75% of the company). I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Does This Data Suggest About Valsoia Insiders?

The fact that there have been no Valsoia insider transactions recently certainly doesn't bother us. It's great to see high levels of insider ownership, but looking back over the last year, we don't gain confidence from the Valsoia insiders selling. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Valsoia. You'd be interested to know, that we found 2 warning signs for Valsoia and we suggest you have a look.

But note: Valsoia may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About BIT:VLS

Valsoia

Provides plant-based and healthy food products in Italy and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026