- United States

- /

- Software

- /

- NasdaqGS:EGHT

Announcing: 8x8 (NYSE:EGHT) Stock Increased An Energizing 203% In The Last Five Years

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on a lighter note, a good company can see its share price rise well over 100%. For example, the 8x8, Inc. (NYSE:EGHT) share price has soared 203% in the last half decade. Most would be very happy with that. The last week saw the share price soften some 2.4%.

Check out our latest analysis for 8x8

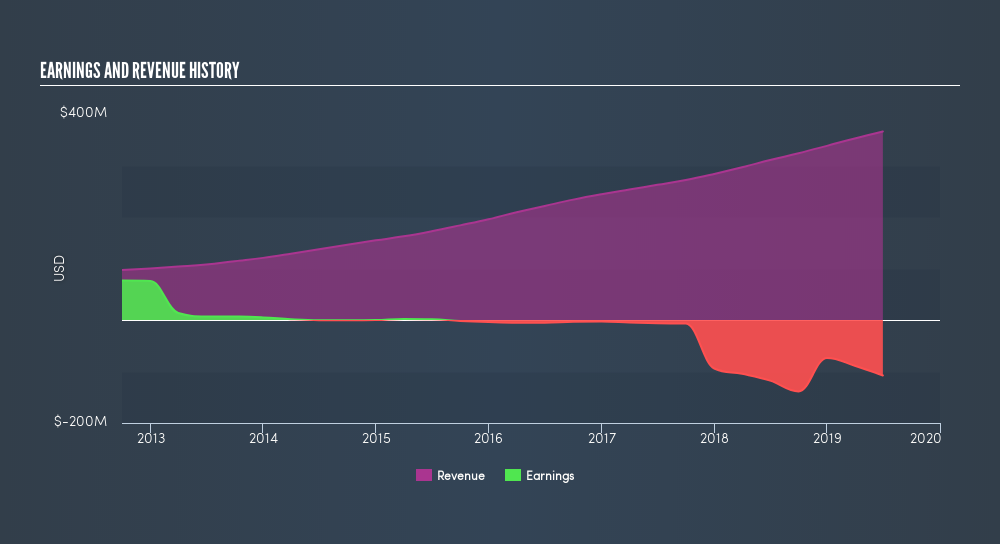

Because 8x8 is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, 8x8 can boast revenue growth at a rate of 19% per year. Even measured against other revenue-focussed companies, that's a good result. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 25% per year, in that time. So it seems likely that buyers have paid attention to the strong revenue growth. 8x8 seems like a high growth stock - so growth investors might want to add it to their watchlist.

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free report showing analyst forecasts should help you form a view on 8x8

A Different Perspective

We're pleased to report that 8x8 shareholders have received a total shareholder return of 2.3% over one year. However, that falls short of the 25% TSR per annum it has made for shareholders, each year, over five years. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of 8x8 by clicking this link.

8x8 is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:EGHT

8x8

Provides contact center, voice, video, chat, and enterprise-class application programmable interface (API) solutions worldwide.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives