Announcing: 8common (ASX:8CO) Stock Increased An Energizing 243% In The Last Year

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the 8common Limited (ASX:8CO) share price has soared 243% return in just a single year. And in the last month, the share price has gained 29%. The longer term returns have not been as good, with the stock price only 14% higher than it was three years ago.

Check out our latest analysis for 8common

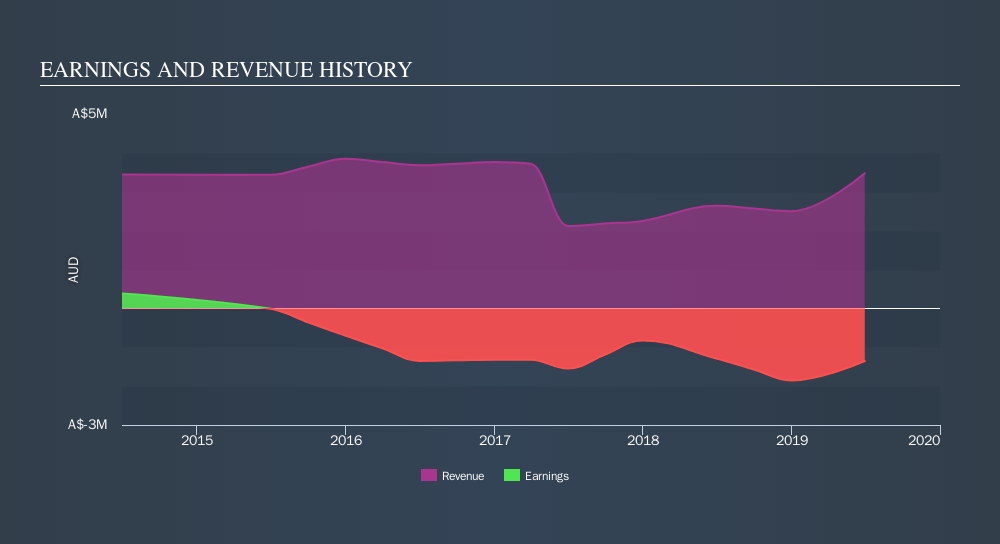

Because 8common is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year 8common saw its revenue grow by 32%. That's a fairly respectable growth rate. The revenue growth is decent but the share price had an even better year, gaining 243%. Given that the business has made good progress on the top line, it would be worth taking a look at its path to profitability. Of course, we are always cautious about succumbing to 'fear of missing out' when a stock has shot up strongly.

You can see below how revenue has changed over time.

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of 8common's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We've already covered 8common's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that 8common's TSR, at 243% is higher than its share price return of 243%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's nice to see that 8common shareholders have received a total shareholder return of 243% over the last year. There's no doubt those recent returns are much better than the TSR loss of 9.7% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:8CO

8common

Engages in the expense management software business in Australia, Asia, North America, and internationally.

Medium-low and slightly overvalued.

Market Insights

Community Narratives