The analysts covering IVE Group Limited (ASX:IGL) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Revenue and earnings per share (EPS) forecasts were both revised downwards, with analysts seeing grey clouds on the horizon.

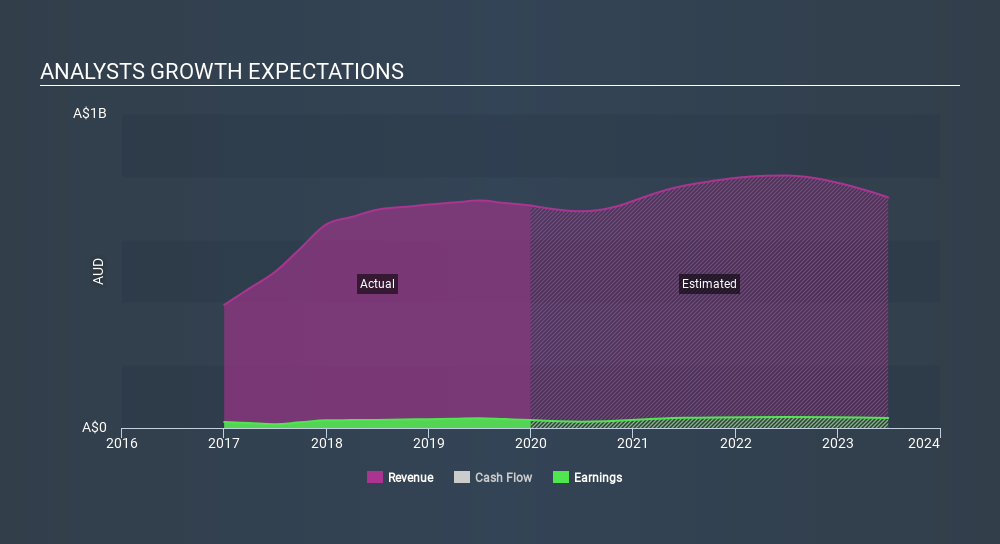

Following this downgrade, IVE Group's three analysts are forecasting 2020 revenues to be AU$703m, approximately in line with the last 12 months. Statutory earnings per share are supposed to sink 20% to AU$0.14 in the same period. Prior to this update, the analysts had been forecasting revenues of AU$769m and earnings per share (EPS) of AU$0.17 in 2020. The forecasts seem less optimistic after the new consensus numbers, with lower sales estimates and making a real cut to earnings per share forecasts.

Check out our latest analysis for IVE Group

It'll come as no surprise then, to learn that the analysts have cut their price target 28% to AU$1.65. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on IVE Group, with the most bullish analyst valuing it at AU$2.44 and the most bearish at AU$1.87 per share. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await IVE Group shareholders.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would highlight that sales are expected to reverse, with the forecast 0.9% revenue decline a notable change from historical growth of 17% over the last three years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 3.8% next year. It's pretty clear that IVE Group's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for IVE Group. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that IVE Group's revenues are expected to grow slower than the wider market. Given the scope of the downgrades, it would not be a surprise to see the market become more wary of the business.

Unfortunately, the earnings downgrade - if accurate - may also place pressure on IVE Group's mountain of debt, which could lead to some belt tightening for shareholders. You can learn more about our debt analysis for free on our platform here.

You can also see our analysis of IVE Group's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:IGL

IVE Group

Engages in the marketing business in Australia.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Investment Thesis: Olvi Oyj (OLVAS)

UnitedHealth Group's Future Revenue Grows by 3.59%: What Will It Mean?

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.