- United States

- /

- Insurance

- /

- NYSE:ORI

Analyst Forecasts For Old Republic International Corporation (NYSE:ORI) Are Surging Higher

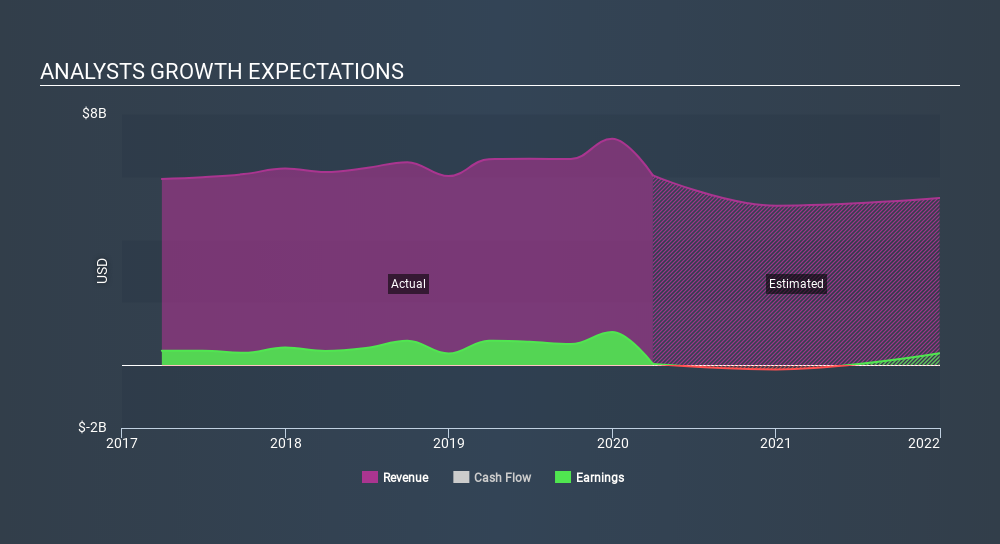

Celebrations may be in order for Old Republic International Corporation (NYSE:ORI) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects.

Following the upgrade, the consensus from twin analysts covering Old Republic International is for revenues of US$5.1b in 2020, implying a chunky 16% decline in sales compared to the last 12 months. After this upgrade, the company is anticipated to report a loss of US$0.44 in 2020, a sharp decline from a profit over the last year. However, before this estimates update, the consensus had been expecting revenues of US$4.4b and US$0.90 per share in losses. We can see there's definitely been a change in sentiment in this update, with the analysts administering a sizeable upgrade to this year's revenue estimates, while at the same time reducing their loss estimates.

See our latest analysis for Old Republic International

Yet despite these upgrades, the analysts cut their price target 8.7% to US$21.00, implicitly signalling that the ongoing losses are likely to weigh negatively on Old Republic International's valuation.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We would highlight that sales are expected to reverse, with the forecast 16% revenue decline a notable change from historical growth of 3.7% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 1.1% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Old Republic International is expected to lag the wider industry.

The Bottom Line

The most important thing here is that analysts reduced their loss per share estimates for this year, reflecting increased optimism around Old Republic International'sprospects. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. A lower price target is not intuitively what we would expect from a company whose business prospects are improving - at least judging by these forecasts - but if the underlying fundamentals are strong, Old Republic International could be one for the watch list.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for Old Republic International going out as far as 2021, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:ORI

Old Republic International

Through its subsidiaries, provides insurance underwriting and related services primarily in the United States and Canada.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives