- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (NasdaqGS:AMZN) Offers Prime Members Exclusive Early Superman Screenings

Reviewed by Simply Wall St

Amazon.com (NasdaqGS:AMZN) allowed Amazon Prime members exclusive access to early screenings of the new Superman movie, potentially boosting its share price by enhancing member engagement. Additionally, Amazon's tech sector advancements, including a $10 billion investment in North Carolina for data centers and the launch of the AWS Asia Pacific region, align with broader market movements, as major indices saw gains amid ongoing US-China trade talks. A 10.62% rise in Amazon's share price over the past month reflects this, in tune with market trends, bolstered by robust tech performance and economic stability.

Buy, Hold or Sell Amazon.com? View our complete analysis and fair value estimate and you decide.

The exclusive early screening of the Superman movie for Amazon Prime members is an initiative that could enhance customer loyalty and engagement. This, alongside Amazon's extensive investments in data centers and AWS expansion, aligns with efforts to bolster revenue through heightened member services and tech advancements. Over the past three years, Amazon shares have seen extraordinary growth, posting a total return of 106.01%, which provides a solid context for the company's overall positive trajectory.

In terms of short-term performance, Amazon's shares rose 10.62% in the past month, reflecting a positive reception to recent technological developments and strategic moves. This is despite the more moderate 12.4% overall market return over the past year, where Amazon outpaced the broader US market. However, within its industry, Amazon's performance slightly lagged, as the US Multiline Retail industry returned 16% over the same period.

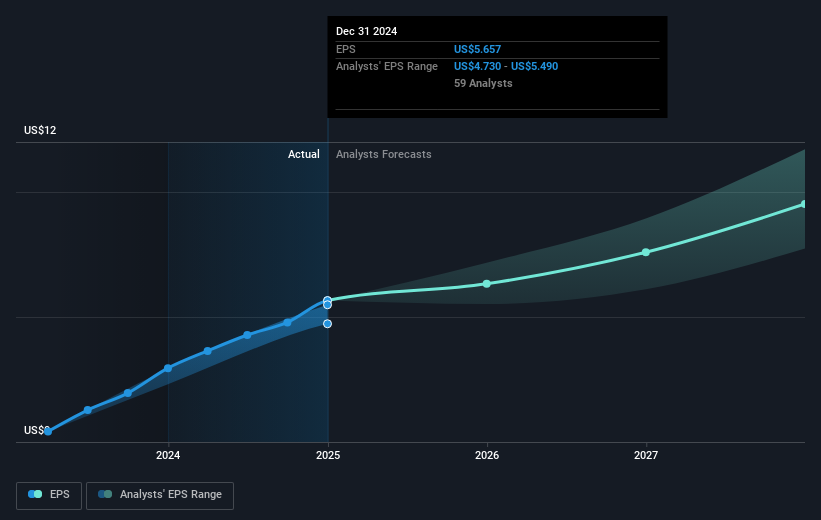

On the earnings front, the introduction of AI-powered services like Trainium2 and the expansion into more stable supply chains may facilitate operational efficiency gains, potentially uplifting revenue and earnings forecasts. However, significant investments and market pressures, such as tariffs and intense competition, could impose challenges on future earnings. The current share price of $185.01 remains below the consensus analyst price target of $239.33, indicating an expectation of further growth and potential value to be realized as Amazon continues to advance its operations and strategic initiatives.

Unlock comprehensive insights into our analysis of Amazon.com stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives