- United States

- /

- Building

- /

- NYSEAM:APT

Alpha Pro Tech's (NYSEMKT:APT) Wonderful 307% Share Price Increase Shows How Capitalism Can Build Wealth

The Alpha Pro Tech, Ltd. (NYSEMKT:APT) share price has had a bad week, falling 25%. But that doesn't change the fact that the returns over the last half decade have been spectacular. To be precise, the stock price is 307% higher than it was five years ago, a wonderful performance by any measure. So it might be that some shareholders are taking profits after good performance. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain.

View our latest analysis for Alpha Pro Tech

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

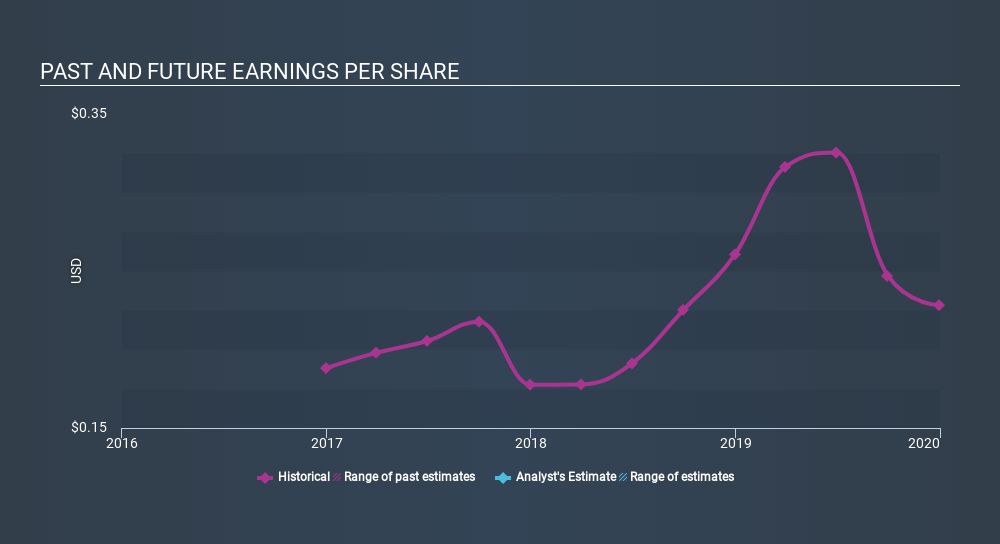

Over half a decade, Alpha Pro Tech managed to grow its earnings per share at 8.9% a year. This EPS growth is lower than the 32% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Alpha Pro Tech's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Alpha Pro Tech shareholders have received a total shareholder return of 153% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 32% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Alpha Pro Tech has 1 warning sign we think you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSEAM:APT

Alpha Pro Tech

Develops, manufactures, and markets a range of disposable protective apparel and infection control products in the United States and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives