ALK-Abelló A/S's (CPH:ALK B): ALK-Abelló A/S, a pharmaceutical company, develops and markets products and services for allergy and allergic asthma in Europe, North America, and internationally. The ø21b market-cap company announced a latest loss of -ø50.0m on 31 December 2019 for its most recent financial year result. The most pressing concern for investors is ALK B’s path to profitability – when will it breakeven? Below I will provide a high-level summary of the industry analysts’ expectations for ALK B.

See our latest analysis for ALK-Abelló

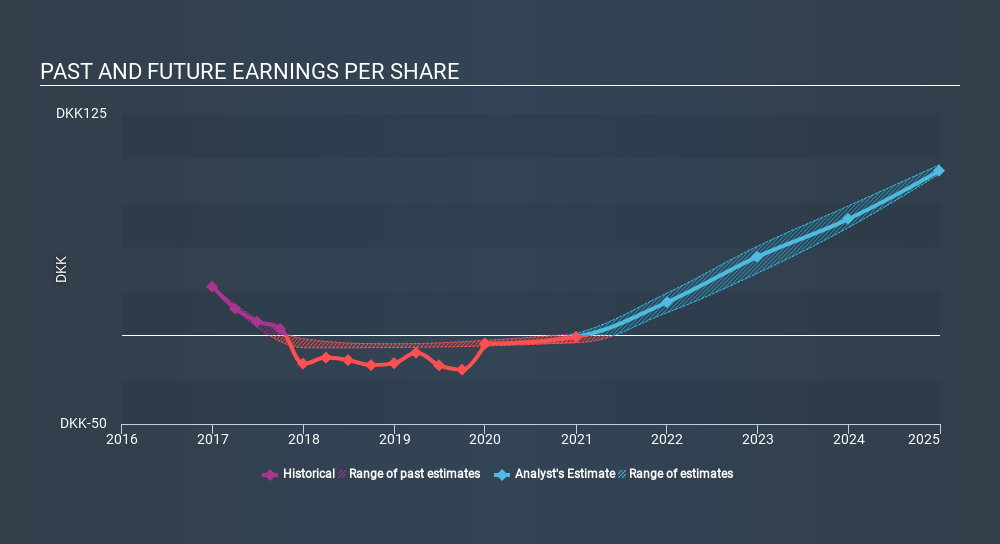

According to the 4 industry analysts covering ALK B, the consensus is breakeven is near. They expect the company to post a final loss in 2020, before turning a profit of ø206m in 2021. ALK B is therefore projected to breakeven around a few months from now. How fast will ALK B have to grow each year in order to reach the breakeven point by 2021? Working backwards from analyst estimates, it turns out that they expect the company to grow 52% year-on-year, on average, which signals high confidence from analysts. If this rate turns out to be too aggressive, ALK B may become profitable much later than analysts predict.

Given this is a high-level overview, I won’t go into details of ALK B’s upcoming projects, however, take into account that typically pharmaceuticals, depending on the stage of product development, have irregular periods of cash flow. So, a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.

Before I wrap up, there’s one aspect worth mentioning. ALK B has managed its capital judiciously, with debt making up 23% of equity. This means that ALK B has predominantly funded its operations from equity capital,and its low debt obligation reduces the risk around investing in the loss-making company.

Next Steps:

There are too many aspects of ALK B to cover in one brief article, but the key fundamentals for the company can all be found in one place – ALK B’s company page on Simply Wall St. I’ve also compiled a list of key factors you should look at:

- Valuation: What is ALK B worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether ALK B is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on ALK-Abelló’s board and the CEO’s back ground.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About CPSE:ALK B

ALK-Abelló

Operates as an allergy solutions company in Europe, North America, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Google Isn’t Just Search It’s Becoming the Internet’s Operating System

High Quality Business and a true compounding machine

Be sceptical about AI Hype - RELX is an undervalued goldmine of data

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion

Looks interesting, I am jumping into the finances now. Your 15% margin seems high for a conservative model, can't just ignore the years they need to invest. You didnt seem to mention that they had to dilute the sharebase by issuing ~40mil shares. raising ~8 mil. should be enough if mouse does OK. If not they will need to raise more to suvive. Losing 20m a year, 14m after there 6m cutbacks. Am I reading it right that they have no debt. have they any history of raising debt? First look it is too dependant on the mouse and GoT games. they do well stock will 2-3x, poorly and it will drop. I am not sure I agree with your work for hire backstop. Unlikely meta horizons will continue with the same size contract going forward. say 10% margins and 15x multiple on 30m. that is 45m, which with the new sharecount is 10c. It is a backstop but maybe not that strong. Mouse fails and devs could start jumping ship and outside contracts could dry up. Hmm on top of all that AI could be disrupting the work for hire model. I think I have mostly talked myself out of it. Although Mouse looks good and does seem like the type of game that could go viral on twitch for a few months. If it does you will likly get a great return 5x plus. crap maybe I am talking myself back in.