- United States

- /

- Chemicals

- /

- NYSE:APD

Air Products and Chemicals (NYSE:APD) Removed From Two Russell 1000 Indexes

Reviewed by Simply Wall St

Air Products and Chemicals (NYSE: APD) recently experienced a significant development as it was dropped from both the Russell 1000 Defensive Index and the Russell 1000 Value-Defensive Index. This removal from the indices comes amid a broader market rally, with the S&P 500 and Nasdaq hitting new highs. Despite its 4% price move over the last week, which aligns with the market's general upward trajectory of 3.4%, these index changes may add some complexity to the company's investor sentiment. However, the overall market trend, buoyed by positive geopolitical and economic factors, likely supported its performance.

The recent removal of Air Products and Chemicals (NYSE: APD) from the Russell 1000 Defensive Index and the Russell 1000 Value-Defensive Index could have multiple implications for the company. While these exclusions may dampen investor sentiment temporarily, they open the door for management to redefine its focus toward core industrial gas projects, which could be more flexible and growth-focused. This redirection aligns with the company's efforts to enhance its operational efficiency and revenue streams in the long run.

Over the past five years, APD has achieved a total return of 27.80%, reflecting a steady long-term performance. This is crucial when compared to its recent underperformance relative to the US market over the last year. The market saw a 13.7% return, while the US Chemicals industry experienced a decline, which APD managed to exceed. These longer-term results underscore the potential resilience and alignment of its business focus with broader market trends.

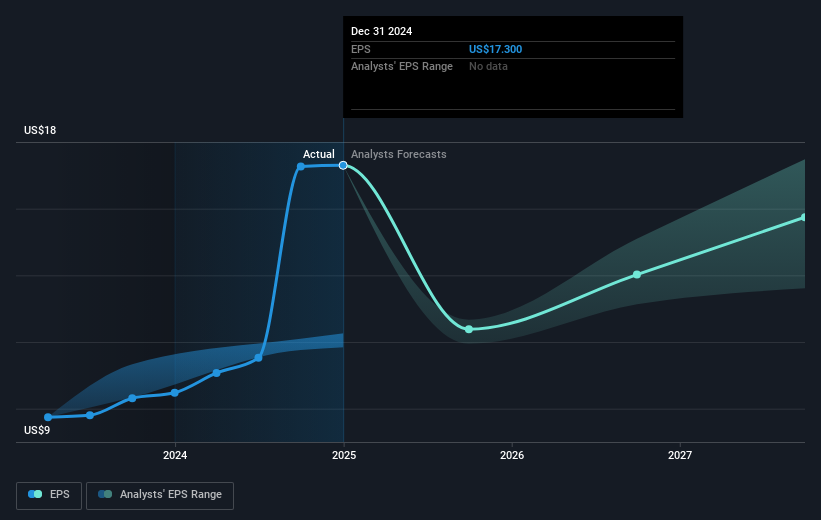

The major strategic initiatives, particularly the industrial gas projects in Saudi Arabia and Louisiana, could significantly influence future revenue and earnings forecasts. By narrowing its scope to high-potential projects, APD aims to improve operating margins over time, which analysts expect will grow to 25.2% by 2028. Meanwhile, APD's share price of US$267.62 remains approximately 16.4% below the consensus price target of US$320.20. Despite this gap, analysts project substantial growth, supported by a vision to advance in clean energy while managing risks associated with higher-cost projects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APD

Air Products and Chemicals

Provides atmospheric gases, process and specialty gases, equipment, and related services in the Americas, Asia, Europe, the Middle East, India, and internationally.

Slight with moderate growth potential.

Similar Companies

Market Insights

Community Narratives