- United Arab Emirates

- /

- Food

- /

- ADX:AGTHIA

Agthia Group PJSC's (ADX:AGTHIA) Financials Are Too Obscure To Link With Current Share Price Momentum: What's In Store For the Stock?

Most readers would already be aware that Agthia Group PJSC's (ADX:AGTHIA) stock increased significantly by 17% over the past three months. However, we wonder if the company's inconsistent financials would have any adverse impact on the current share price momentum. Specifically, we decided to study Agthia Group PJSC's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for Agthia Group PJSC

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Agthia Group PJSC is:

5.0% = د.إ96m ÷ د.إ1.9b (Based on the trailing twelve months to June 2020).

The 'return' is the yearly profit. One way to conceptualize this is that for each AED1 of shareholders' capital it has, the company made AED0.05 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Agthia Group PJSC's Earnings Growth And 5.0% ROE

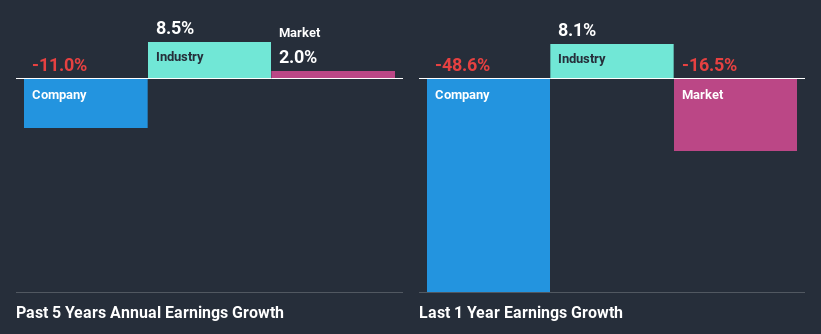

It is quite clear that Agthia Group PJSC's ROE is rather low. Not just that, even compared to the industry average of 9.0%, the company's ROE is entirely unremarkable. For this reason, Agthia Group PJSC's five year net income decline of 11% is not surprising given its lower ROE. However, there could also be other factors causing the earnings to decline. For example, the business has allocated capital poorly, or that the company has a very high payout ratio.

Next, when we compared with the industry, which has shrunk its earnings at a rate of 4.4% in the same period, we still found Agthia Group PJSC's performance to be quite bleak, because the company has been shrinking its earnings faster than the industry.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is AGTHIA fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is Agthia Group PJSC Efficiently Re-investing Its Profits?

Looking at its three-year median payout ratio of 45% (or a retention ratio of 55%) which is pretty normal, Agthia Group PJSC's declining earnings is rather baffling as one would expect to see a fair bit of growth when a company is retaining a good portion of its profits. So there could be some other explanations in that regard. For instance, the company's business may be deteriorating.

Moreover, Agthia Group PJSC has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to rise to 60% over the next three years. However, Agthia Group PJSC's future ROE is expected to rise to 12% despite the expected increase in the company's payout ratio. We infer that there could be other factors that could be driving the anticipated growth in the company's ROE.

Conclusion

On the whole, we feel that the performance shown by Agthia Group PJSC can be open to many interpretations. While the company does have a high rate of reinvestment, the low ROE means that all that reinvestment is not reaping any benefit to its investors, and moreover, its having a negative impact on the earnings growth. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

If you decide to trade Agthia Group PJSC, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ADX:AGTHIA

Agthia Group PJSC

Operates in the food and beverages in the United Arab Emirates and internationally.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion