- United States

- /

- Life Sciences

- /

- NYSE:A

Agilent Technologies (A) Announces CFO Bob McMahon's Departure and Interim Replacement

Reviewed by Simply Wall St

Agilent Technologies (A) experienced significant executive changes with the departure of Senior Vice President and CFO Bob McMahon. Such leadership transitions may have added weight to the company's 10% price movement last quarter, during a period in which the broader market remained flat. Other factors, such as the company's raised revenue guidance, new product launches, and inclusion in the Russell 1000 Dynamic Index, may have influenced investor sentiment. Meanwhile, market volatility persisted due to mixed news around interest rates and geopolitical events, potentially offsetting positive developments within the company.

The departure of Agilent Technologies' CFO, Bob McMahon, combined with the company's inclusion in the Russell 1000 Dynamic Index and raised revenue guidance, may renew investor interest and potentially boost market confidence. These factors could influence Agilent's revenue and earnings forecasts. The Ignite transformation initiative, focusing on new pricing and digital improvements, is poised to enhance revenues and margins, supporting the company's growth trajectory amidst market volatility.

Over the past five years, Agilent's total shareholder return, including share price and dividends, was 21.66%, signifying a consistent upward trend. In the last year, Agilent underperformed the US market, which returned 11.4%. Despite these results, Agilent's current share price of US$112.94 represents a discount of approximately 21% to the consensus price target of US$136.83, highlighting potential upside based on analysts' evaluations.

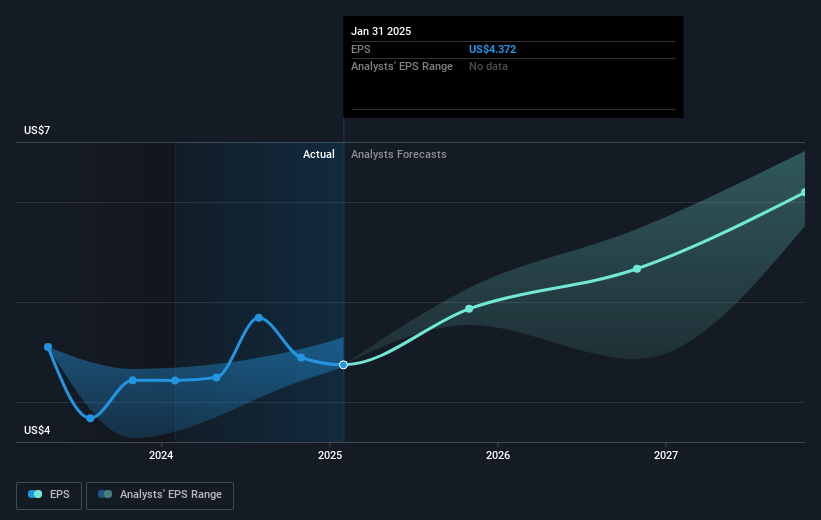

The recent announcement of new executive leadership might impact future revenue and earnings projections by introducing fresh strategies or priorities. With analysts suggesting annual revenue growth of 5.6% and earnings growth forecasted to reach US$1.7 billion by May 2028, these organizational changes could play a role in achieving or reassessing these forecasts. Investors should consider Agilent's strategic initiatives alongside broader economic factors to gauge future performance potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:A

Agilent Technologies

Provides application focused solutions to the life sciences, diagnostics, and applied chemical markets worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives