- United Kingdom

- /

- Biotech

- /

- AIM:ABC

Abcam plc (LON:ABC): Will The Growth Last?

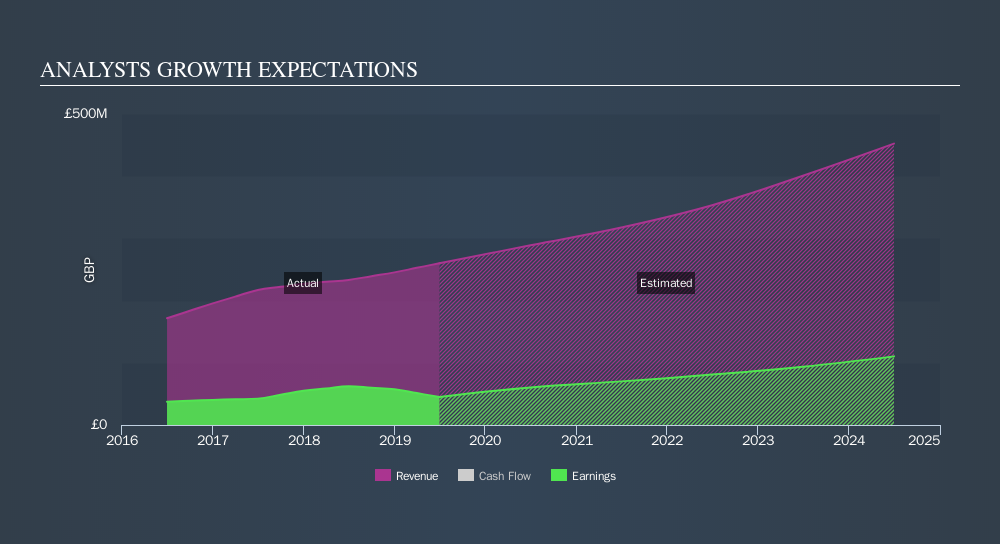

Based on Abcam plc's (LON:ABC) earnings update on 30 June 2019, analysts seem fairly confident, with earnings expected to grow by 34% in the upcoming year against the past 5-year average growth rate of 12%. By 2020, we can expect Abcam’s bottom line to reach UK£60m, a jump from the current trailing-twelve-month of UK£45m. I will provide a brief commentary around the figures and analyst expectations in the near term. Readers that are interested in understanding the company beyond these figures should research its fundamentals here.

View our latest analysis for Abcam

How is Abcam going to perform in the near future?

The 8 analysts covering ABC view its longer term outlook with a positive sentiment. Given that it becomes hard to forecast far into the future, broker analysts tend to project ahead roughly three years. To get an idea of the overall earnings growth trend for ABC, I’ve plotted out each year’s earnings expectations and inserted a line of best fit to determine an annual rate of growth from the slope of this line.

From the current net income level of UK£45m and the final forecast of UK£81m by 2022, the annual rate of growth for ABC’s earnings is 16%. EPS reaches £0.38 in the final year of forecast compared to the current £0.22 EPS today. Margins are currently sitting at 17%, which is expected to expand to 23% by 2022.

Next Steps:

Future outlook is only one aspect when you're building an investment case for a stock. For Abcam, I've put together three essential factors you should further research:

- Valuation: What is Abcam worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether Abcam is currently mispriced by the market.

- Future Earnings: How does Abcam's growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart.

- Other High-Growth Alternatives : Are there other high-growth stocks you could be holding instead of Abcam? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:ABC

Abcam

Abcam plc, a life science company, focuses on identifying, developing, and distributing reagents and tools for scientific research, diagnostics, and drug discovery.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

SoFi Technologies will ride a 33% revenue growth wave in the next 5 years

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.