- United States

- /

- Semiconductors

- /

- NasdaqGS:NVMI

A Rising Share Price Has Us Looking Closely At Nova Measuring Instruments Ltd.'s (NASDAQ:NVMI) P/E Ratio

Nova Measuring Instruments (NASDAQ:NVMI) shareholders are no doubt pleased to see that the share price has had a great month, posting a 31% gain, recovering from prior weakness. That brought the twelve month gain to a very sharp 82%.

All else being equal, a sharp share price increase should make a stock less attractive to potential investors. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. So some would prefer to hold off buying when there is a lot of optimism towards a stock. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). Investors have optimistic expectations of companies with higher P/E ratios, compared to companies with lower P/E ratios.

View our latest analysis for Nova Measuring Instruments

How Does Nova Measuring Instruments's P/E Ratio Compare To Its Peers?

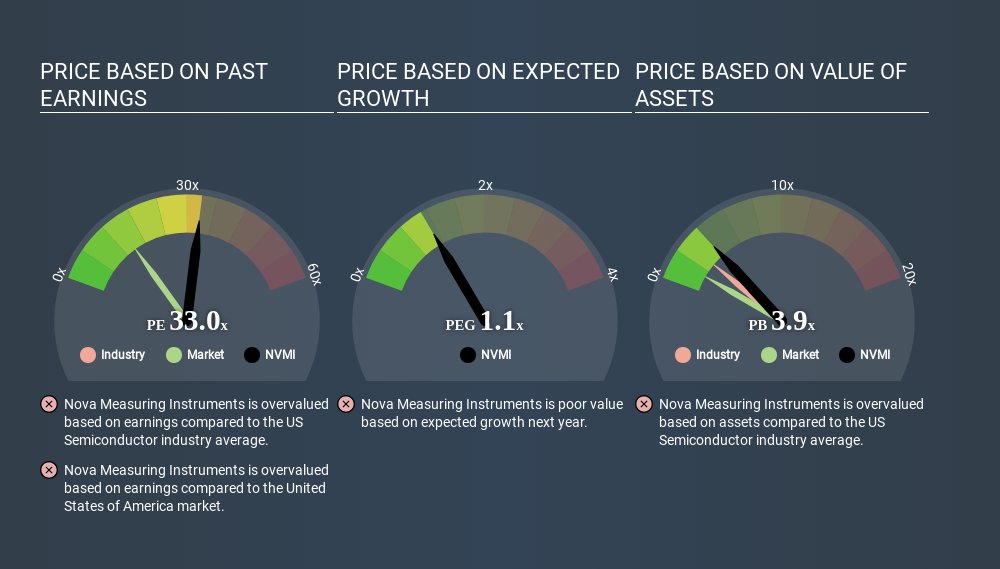

Nova Measuring Instruments has a P/E ratio of 32.98. The image below shows that Nova Measuring Instruments has a P/E ratio that is roughly in line with the semiconductor industry average (35.0).

Nova Measuring Instruments's P/E tells us that market participants think its prospects are roughly in line with its industry. So if Nova Measuring Instruments actually outperforms its peers going forward, that should be a positive for the share price. Checking factors such as director buying and selling. could help you form your own view on if that will happen.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. Earnings growth means that in the future the 'E' will be higher. That means even if the current P/E is high, it will reduce over time if the share price stays flat. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

Nova Measuring Instruments shrunk earnings per share by 18% over the last year. But over the longer term (5 years) earnings per share have increased by 20%.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. That means it doesn't take debt or cash into account. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

Nova Measuring Instruments's Balance Sheet

With net cash of US$198m, Nova Measuring Instruments has a very strong balance sheet, which may be important for its business. Having said that, at 15% of its market capitalization the cash hoard would contribute towards a higher P/E ratio.

The Bottom Line On Nova Measuring Instruments's P/E Ratio

Nova Measuring Instruments's P/E is 33.0 which is above average (14.8) in its market. Falling earnings per share is probably keeping traditional value investors away, but the relatively strong balance sheet will allow the company time to invest in growth. Clearly, the high P/E indicates shareholders think it will! What we know for sure is that investors have become much more excited about Nova Measuring Instruments recently, since they have pushed its P/E ratio from 25.3 to 33.0 over the last month. If you like to buy stocks that have recently impressed the market, then this one might be a candidate; but if you prefer to invest when there is 'blood in the streets', then you may feel the opportunity has passed.

Investors have an opportunity when market expectations about a stock are wrong. People often underestimate remarkable growth -- so investors can make money when fast growth is not fully appreciated. So this free report on the analyst consensus forecasts could help you make a master move on this stock.

But note: Nova Measuring Instruments may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NasdaqGS:NVMI

Nova

Designs, develops, produces, and sells process control systems used in the manufacture of semiconductors in Israel, Taiwan, the United States, China, Korea, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives