- United Kingdom

- /

- Machinery

- /

- AIM:SOM

3 UK Dividend Stocks To Consider With At Least 3.1% Yield

Reviewed by Simply Wall St

As the FTSE 100 index experiences fluctuations due to global economic challenges, particularly from China, investors are closely monitoring dividend stocks as a potential source of steady income in uncertain times. In such a volatile environment, selecting UK dividend stocks with reliable yields can offer a measure of stability and income generation for those looking to navigate these market conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.80% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 5.59% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.15% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.97% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.26% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.87% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.11% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.15% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.47% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.22% | ★★★★★☆ |

Click here to see the full list of 56 stocks from our Top UK Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Somero Enterprises (AIM:SOM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Somero Enterprises, Inc. specializes in designing, assembling, remanufacturing, selling, and distributing concrete leveling and contouring equipment with a market cap of £121.26 million.

Operations: Somero Enterprises, Inc. generates revenue primarily from its construction machinery and equipment segment, which amounted to $109.15 million.

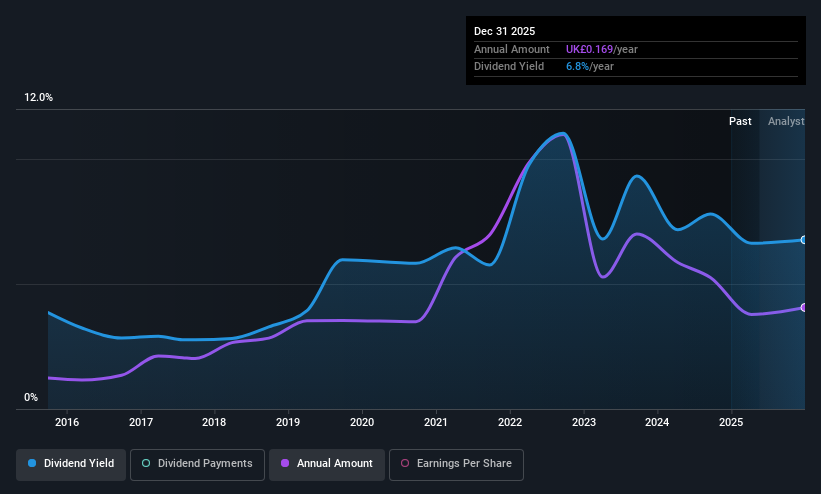

Dividend Yield: 7.0%

Somero Enterprises offers a dividend yield of 7.03%, placing it in the top 25% of UK dividend payers, with dividends covered by earnings (payout ratio: 50.1%) and cash flows (cash payout ratio: 75.4%). However, its dividend track record is unstable and has been volatile over the past decade. Recent guidance lowered revenue expectations to US$90 million for 2025, which may impact future cash generation and dividend sustainability.

- Unlock comprehensive insights into our analysis of Somero Enterprises stock in this dividend report.

- According our valuation report, there's an indication that Somero Enterprises' share price might be on the cheaper side.

Bunzl (LSE:BNZL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bunzl plc is a distribution and services company operating in North America, Continental Europe, the United Kingdom, Ireland, and internationally with a market cap of £7.76 billion.

Operations: Bunzl plc generates revenue primarily from its Packaging & Containers segment, which amounts to £11.78 billion.

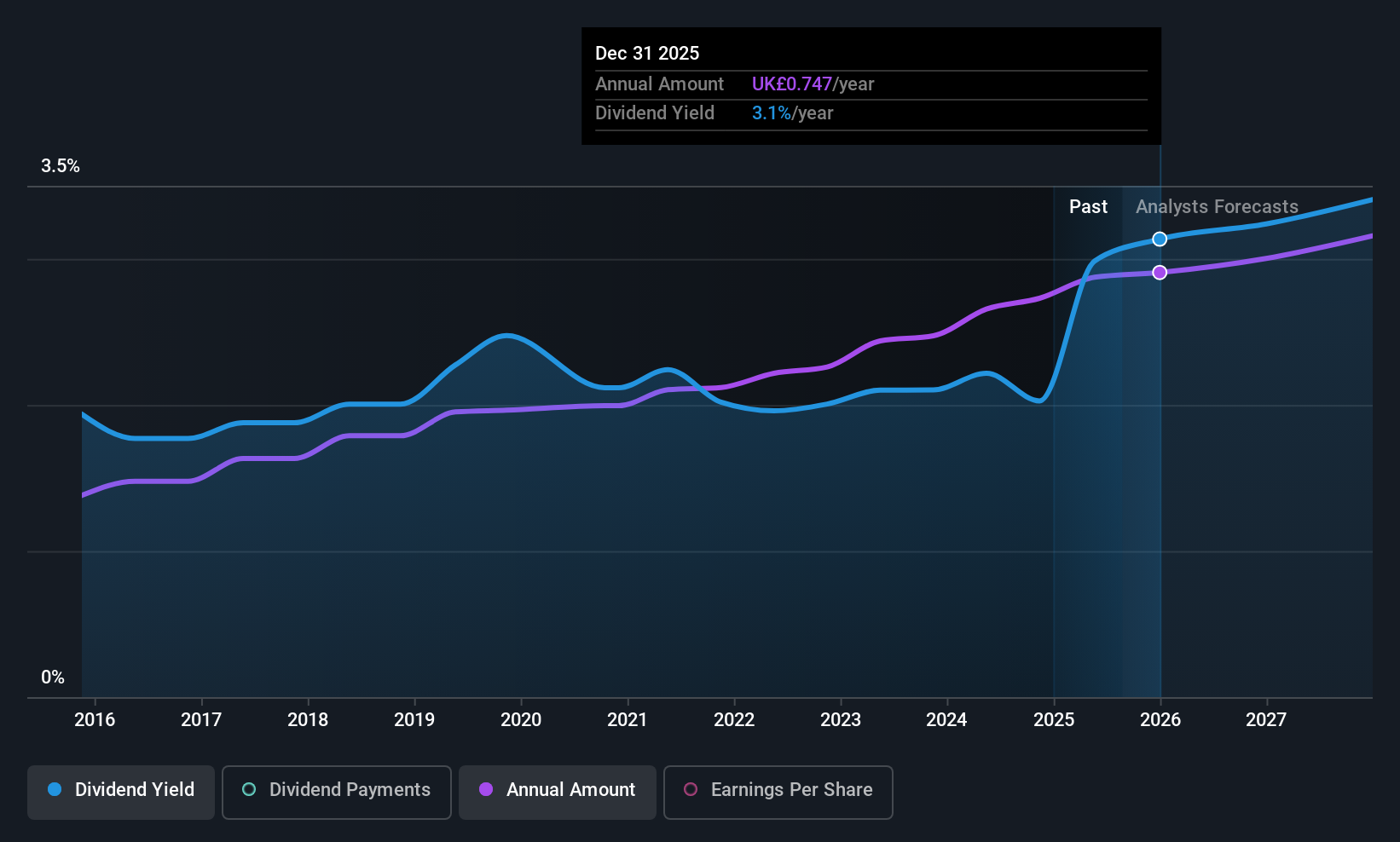

Dividend Yield: 3.1%

Bunzl's dividend payments have been volatile over the past decade, though they have grown. The company's dividends are well covered by earnings (payout ratio: 49.4%) and cash flows (cash payout ratio: 28.3%), indicating sustainability despite an unstable track record. Bunzl trades at a good value relative to peers and is priced below its estimated fair value. Recent guidance suggests modest revenue growth driven by acquisitions, with operating margins expected to remain stable at around 7%.

- Click here to discover the nuances of Bunzl with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Bunzl's current price could be quite moderate.

Pollen Street Group (LSE:POLN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pollen Street Group, headquartered in London and founded in 2015, operates as a financial services-focused investment firm with a market cap of £504.38 million.

Operations: Pollen Street Group generates its revenue primarily from two segments: the Asset Manager segment, contributing £66.80 million, and the Investment Company segment, adding £60.38 million.

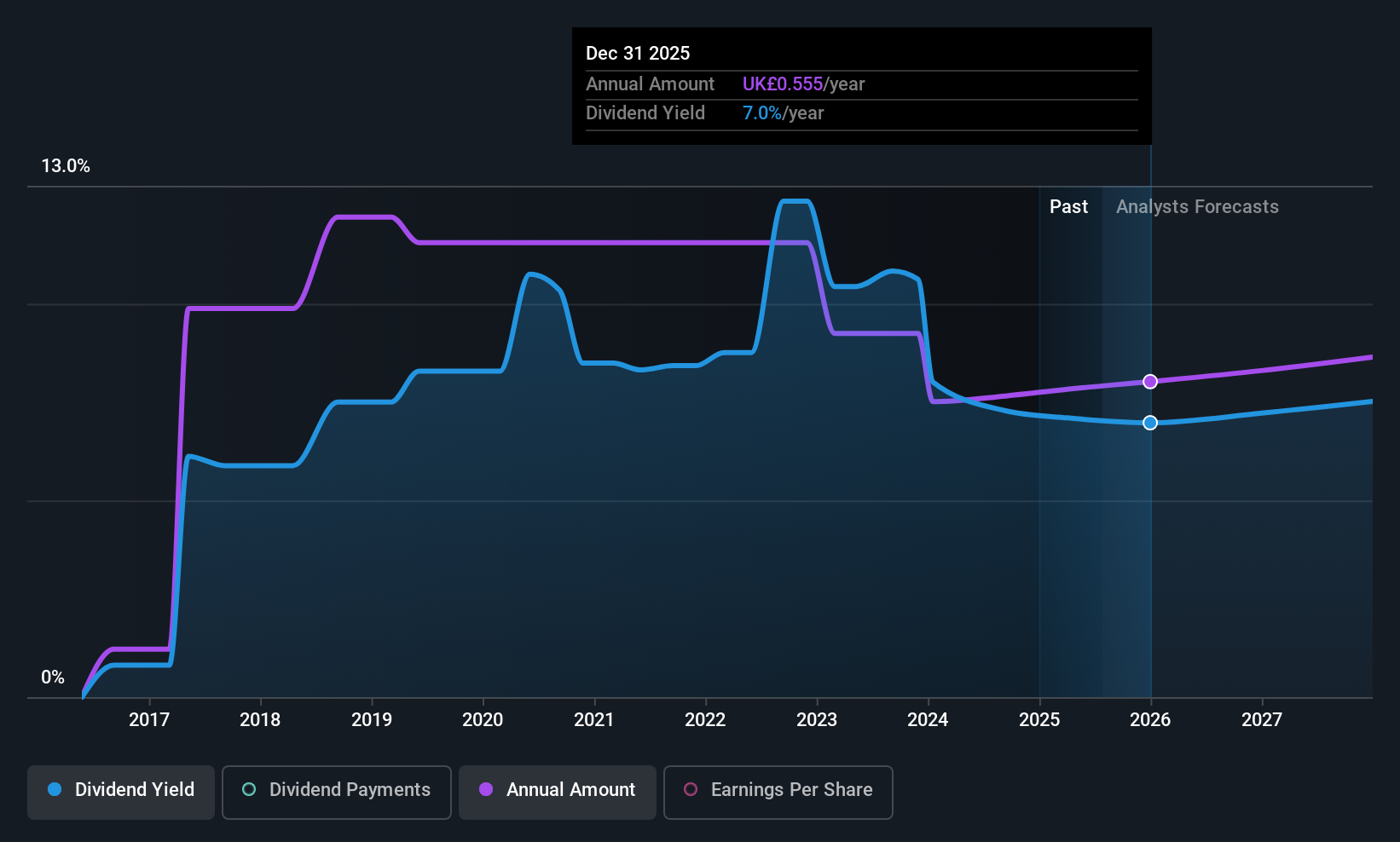

Dividend Yield: 6.5%

Pollen Street Group's dividend yield of 6.47% places it among the top UK payers, though its payments have been volatile over nine years. Dividends are covered by earnings (payout ratio: 68.1%) and cash flows (cash payout ratio: 38.6%), suggesting sustainability despite an unstable track record. The stock trades at a favorable price-to-earnings ratio of 10.2x compared to the market average of 16x, but recent insider selling may warrant caution for investors seeking stability.

- Click to explore a detailed breakdown of our findings in Pollen Street Group's dividend report.

- The analysis detailed in our Pollen Street Group valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Take a closer look at our Top UK Dividend Stocks list of 56 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SOM

Somero Enterprises

Designs, assembles, remanufactures, sells, and distributes concrete leveling, contouring, and placing equipment.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives