- United States

- /

- Biotech

- /

- NasdaqCM:DMAC

3 Promising Penny Stocks With Market Caps Under $200M

Reviewed by Simply Wall St

Major indexes in the United States are experiencing mixed performances, with tech stocks rallying and bank stocks sliding following recent inflation data. In this context, penny stocks remain a compelling area of interest for investors looking for potential growth opportunities. Although the term 'penny stocks' may seem outdated, these smaller or newer companies can offer significant value when backed by strong financials. Let's explore several such penny stocks that stand out for their robust financial health and potential for long-term success.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.46 | $509.94M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.9662 | $169.86M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.28 | $228.14M | ✅ 3 ⚠️ 0 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $100.41M | ✅ 3 ⚠️ 1 View Analysis > |

| Safe Bulkers (SB) | $4.08 | $420.49M | ✅ 2 ⚠️ 3 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.83 | $6.16M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.68 | $109.38M | ✅ 3 ⚠️ 2 View Analysis > |

| North European Oil Royalty Trust (NRT) | $4.83 | $44.48M | ✅ 2 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.33 | $28.06M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 420 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

DiaMedica Therapeutics (DMAC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: DiaMedica Therapeutics Inc. is a clinical stage biopharmaceutical company dedicated to enhancing the lives of individuals with severe ischemic diseases, with a market cap of $155.67 million.

Operations: Currently, DiaMedica Therapeutics Inc. does not report any revenue segments.

Market Cap: $155.67M

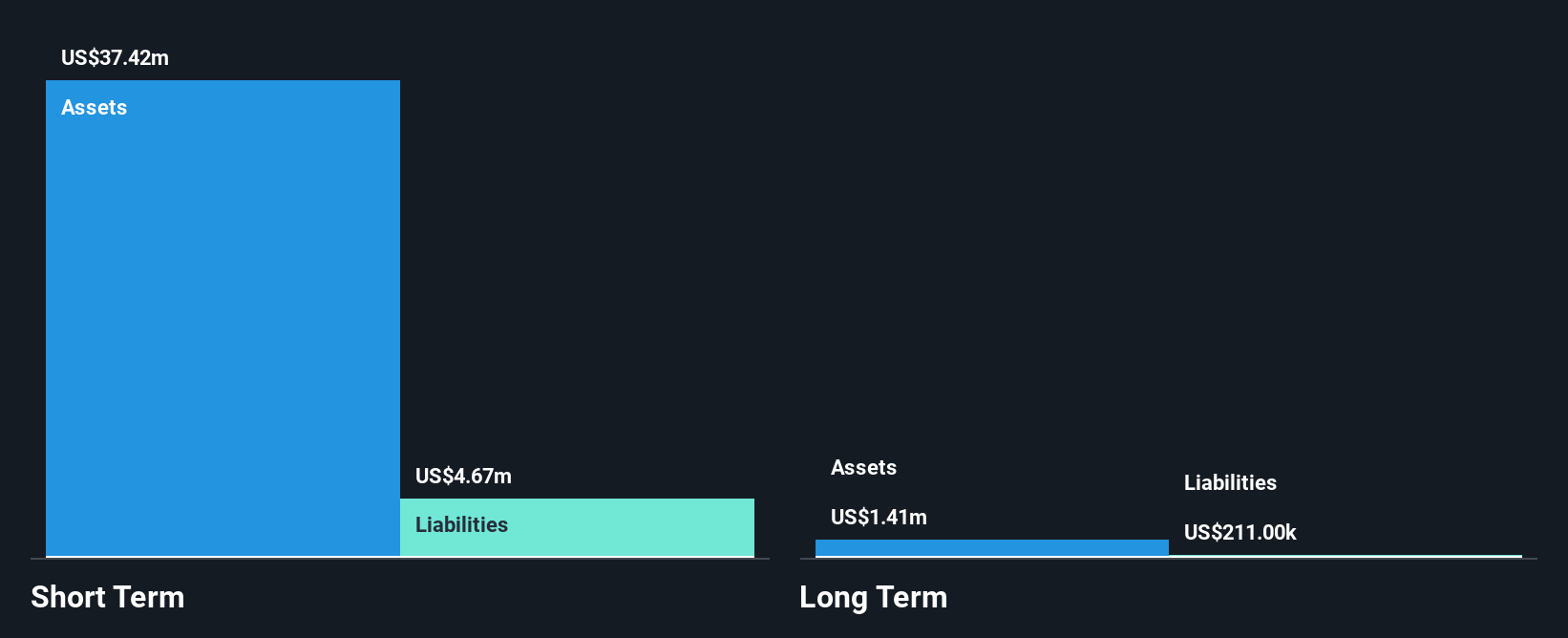

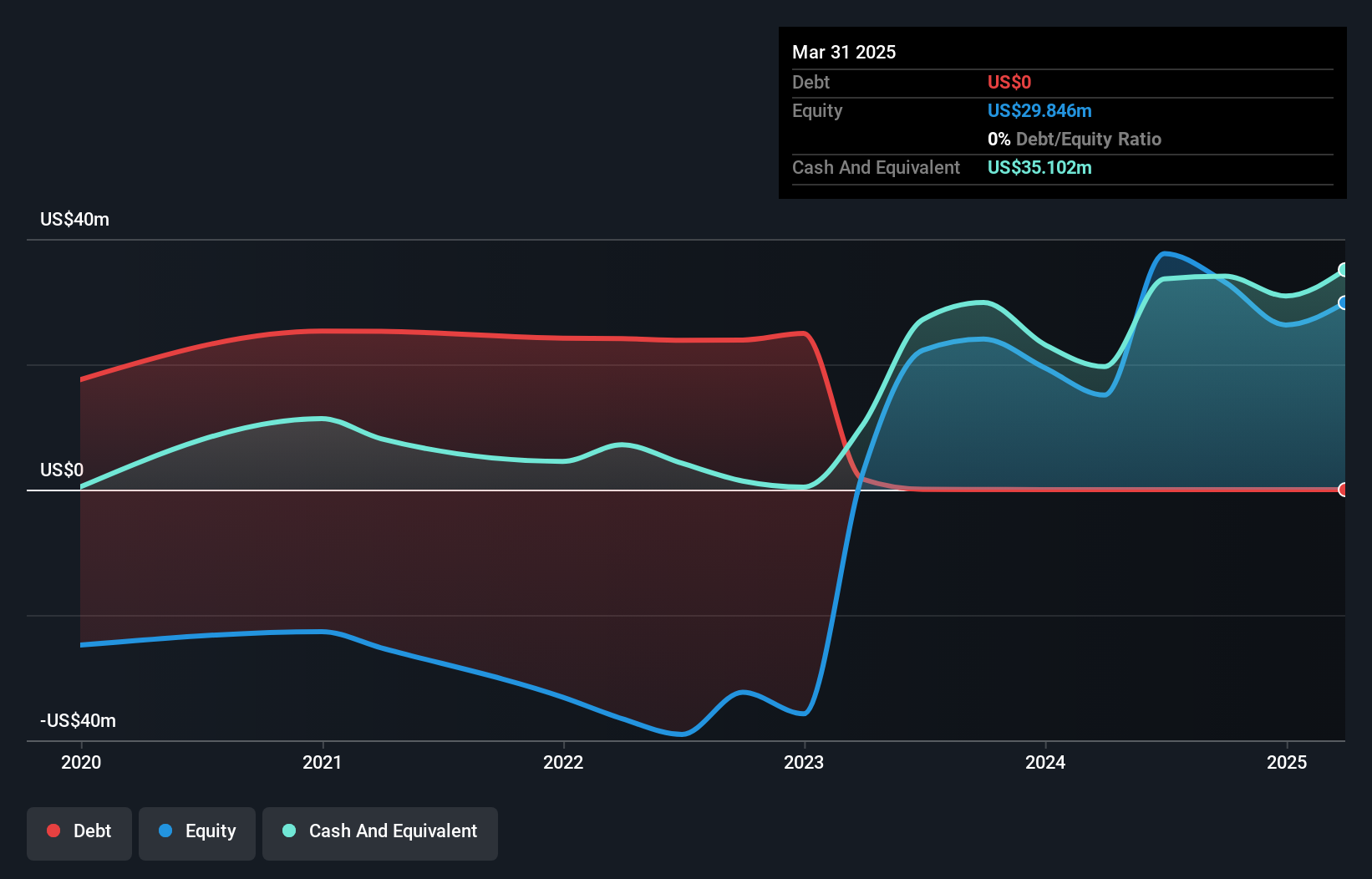

DiaMedica Therapeutics Inc., a clinical-stage biopharmaceutical company, is currently pre-revenue with increasing losses, reporting a net loss of US$7.71 million for Q1 2025. Despite its unprofitability and negative return on equity, the company maintains a strong financial position with short-term assets of US$37.4 million exceeding liabilities and being debt-free. Recent additions to various Russell indices could enhance visibility among investors. However, DiaMedica's cash runway may be less than a year if current cash flow trends continue to decline at historical rates. The management team is relatively new yet considered experienced by industry standards.

- Click here to discover the nuances of DiaMedica Therapeutics with our detailed analytical financial health report.

- Assess DiaMedica Therapeutics' future earnings estimates with our detailed growth reports.

Genelux (GNLX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Genelux Corporation is a clinical-stage biopharmaceutical company specializing in oncolytic viral immunotherapies for challenging solid tumors, with a market cap of approximately $127.94 million.

Operations: Genelux Corporation has not reported any specific revenue segments.

Market Cap: $127.94M

Genelux Corporation, a clinical-stage biopharmaceutical company, is pre-revenue with a net loss of US$7.49 million in Q1 2025. Despite its unprofitability and negative return on equity, the company has no debt and short-term assets of US$35.9 million exceed liabilities. However, it faces potential cash flow challenges with less than a year of runway if trends persist. Recent leadership changes include Eric Groen's appointment as General Counsel to bolster business development efforts. The stock remains highly volatile and trades significantly below estimated fair value, reflecting investor caution amidst its financial uncertainties and growth prospects in viral immunotherapies.

- Unlock comprehensive insights into our analysis of Genelux stock in this financial health report.

- Examine Genelux's earnings growth report to understand how analysts expect it to perform.

Pliant Therapeutics (PLRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pliant Therapeutics, Inc. is a biopharmaceutical company focused on discovering, developing, and commercializing novel therapies for fibrosis and related diseases, with a market cap of $86.55 million.

Operations: Pliant Therapeutics, Inc. has not reported any revenue segments.

Market Cap: $86.55M

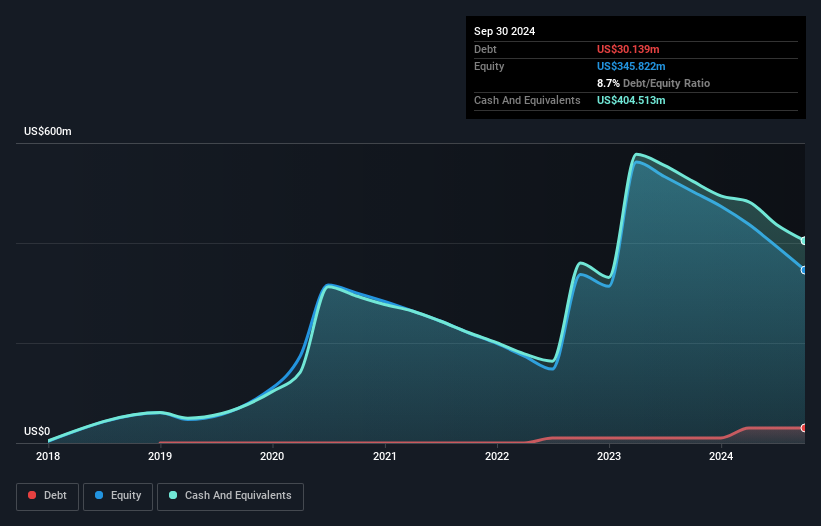

Pliant Therapeutics, Inc. is a pre-revenue biopharmaceutical company with significant cash reserves of US$311.2 million, comfortably covering both short and long-term liabilities. Despite being unprofitable and experiencing increased losses over the past five years, it maintains a seasoned management team and board of directors. Recent setbacks include discontinuation of its bexotegrast program for idiopathic pulmonary fibrosis following unfavorable trial results, leading to strategic restructuring and workforce reduction by 45%. The stock's removal from multiple Russell indices indicates potential investor caution; however, its addition to the Russell Microcap Value Benchmark Index suggests continued interest in its microcap potential.

- Dive into the specifics of Pliant Therapeutics here with our thorough balance sheet health report.

- Understand Pliant Therapeutics' earnings outlook by examining our growth report.

Next Steps

- Investigate our full lineup of 420 US Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? Uncover 14 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DMAC

DiaMedica Therapeutics

A clinical stage biopharmaceutical company, focuses on improving the lives of people suffering from severe ischemic diseases.

Excellent balance sheet low.

Market Insights

Community Narratives