- United States

- /

- Biotech

- /

- NasdaqGM:BNR

3 Promising Penny Stocks With Market Caps Over $40M

Reviewed by Simply Wall St

The U.S. stock market has been navigating a period of volatility, with major indices such as the Dow Jones Industrial Average and the S&P 500 experiencing fluctuations amid geopolitical tensions and economic policy discussions. Despite these broader market challenges, penny stocks remain an intriguing area for investors, representing smaller or newer companies that can offer potential value when backed by strong financials. In this context, we explore three penny stocks that exhibit financial robustness and growth potential, highlighting their promise in delivering opportunities for investors seeking to uncover hidden gems in the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.43 | $528.03M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.38 | $253.92M | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (MAPS) | $0.9129 | $162.49M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.36 | $232.21M | ✅ 3 ⚠️ 0 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $100.94M | ✅ 3 ⚠️ 1 View Analysis > |

| Safe Bulkers (SB) | $4.01 | $417.42M | ✅ 2 ⚠️ 3 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.81645 | $6.03M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.58 | $104.9M | ✅ 3 ⚠️ 2 View Analysis > |

| North European Oil Royalty Trust (NRT) | $4.84 | $44.39M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 426 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Burning Rock Biotech (BNR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Burning Rock Biotech Limited focuses on developing and selling cancer therapy selection tests in China, with a market cap of $49.85 million.

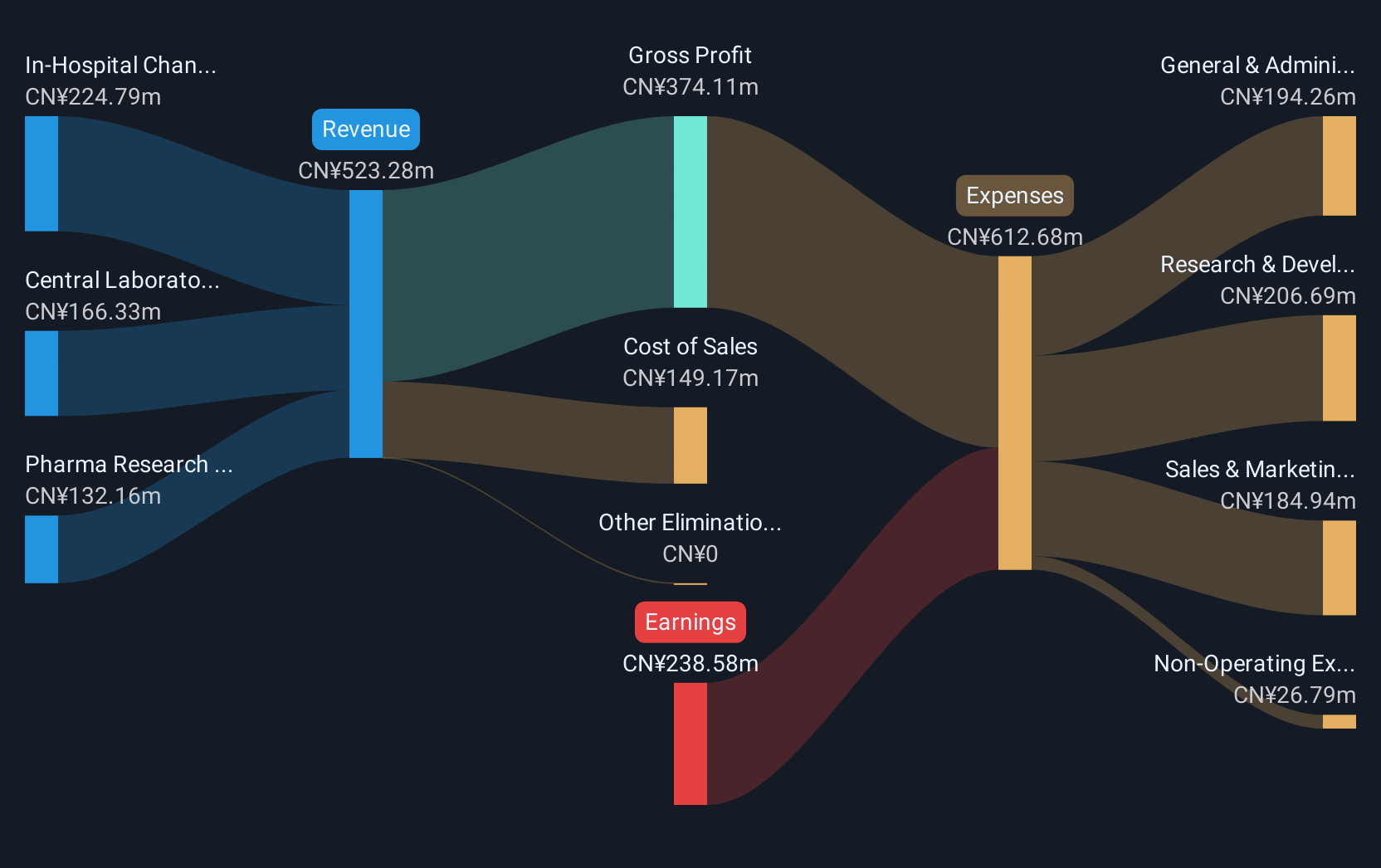

Operations: Burning Rock Biotech generates revenue through its In-Hospital Channel (CN¥224.79 million), Central Laboratory Channel (CN¥166.33 million), and Pharma Research and Development Channel (CN¥132.16 million).

Market Cap: $49.85M

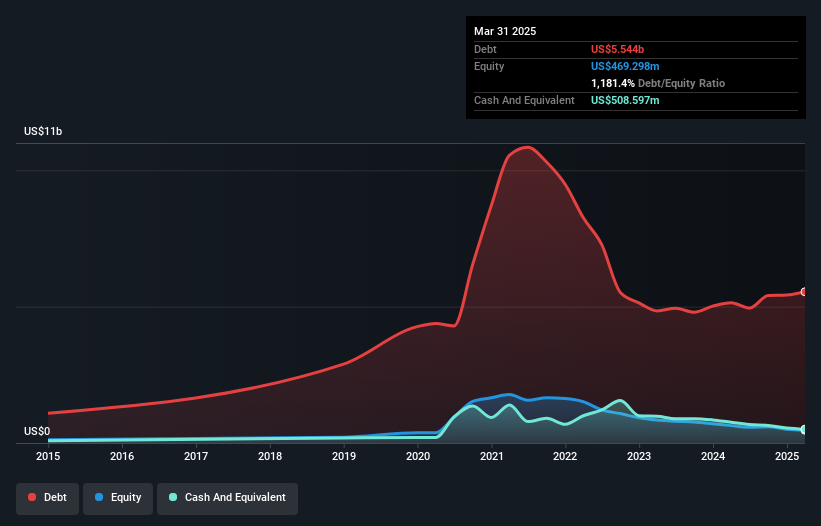

Burning Rock Biotech, with a market cap of US$49.85 million, reported first-quarter sales of CN¥133.08 million, up from CN¥125.62 million a year earlier, while reducing its net loss significantly to CN¥13.5 million from CN¥121.55 million. Despite being unprofitable, it has shown progress in reducing losses over five years and benefits from an experienced management team with an average tenure of 9.3 years. The company is debt-free and possesses sufficient cash runway for over three years based on current free cash flow levels, although its share price remains highly volatile compared to other U.S.-listed stocks.

- Dive into the specifics of Burning Rock Biotech here with our thorough balance sheet health report.

- Gain insights into Burning Rock Biotech's historical outcomes by reviewing our past performance report.

loanDepot (LDI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: loanDepot, Inc. operates in the United States by originating, financing, selling, and servicing residential mortgage loans with a market cap of approximately $501.46 million.

Operations: The company generates revenue primarily from the originating, financing, and selling of mortgage loans, amounting to $1.09 billion.

Market Cap: $501.46M

loanDepot, Inc., with a market cap of US$501.46 million, recently joined multiple Russell indexes, potentially increasing its visibility among investors. Despite a high net debt to equity ratio and ongoing unprofitability with a negative return on equity, the company has not diluted shareholders significantly over the past year. Its short-term assets of US$4.5 billion cover both short- and long-term liabilities, providing some financial stability amidst challenges. Earnings are forecasted to grow substantially at 112.47% annually, yet its current losses have increased by 43.4% per year over five years, reflecting ongoing financial hurdles despite good relative value compared to peers.

- Take a closer look at loanDepot's potential here in our financial health report.

- Learn about loanDepot's future growth trajectory here.

NameSilo Technologies (URLO.F)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NameSilo Technologies Corp. operates through its subsidiaries to offer domain name registration services across the United States, various regions in Asia, Australasia, and internationally, with a market cap of $77.37 million.

Operations: The company generates revenue primarily from Domain Registration and Related Services, amounting to CA$58.30 million.

Market Cap: $77.37M

NameSilo Technologies, with a market cap of CA$77.37 million, has shown revenue growth, reporting CA$15.87 million for Q1 2025 compared to CA$12.8 million a year prior. Despite this, the company faces financial challenges as its short-term assets of CA$32.6 million do not cover liabilities of CA$45.9 million, and it remains unprofitable with negative return on equity at 38.43%. However, it has reduced its debt-to-equity ratio significantly over five years and holds more cash than total debt, offering some financial resilience despite auditor concerns about its ability to continue as a going concern.

- Get an in-depth perspective on NameSilo Technologies' performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into NameSilo Technologies' track record.

Turning Ideas Into Actions

- Navigate through the entire inventory of 426 US Penny Stocks here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burning Rock Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BNR

Burning Rock Biotech

Develops and sells cancer therapy selection tests in the People's Republic of China and the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives