- United States

- /

- Electrical

- /

- NYSE:SES

3 Promising Penny Stocks With Market Caps At Least $300M

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 2.9%, and over the past 12 months, it is up 14%. Though often considered a relic of past trading days, penny stocks remain relevant as they can offer a blend of affordability and growth potential when backed by strong financials. This article will explore three such stocks that stand out for their financial strength and potential in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.33 | $481.01M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8688 | $146.11M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.18 | $222.03M | ✅ 3 ⚠️ 0 View Analysis > |

| Talkspace (TALK) | $2.77 | $463.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $95.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Safe Bulkers (SB) | $3.69 | $377.52M | ✅ 3 ⚠️ 3 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Flexible Solutions International (FSI) | $4.95 | $62.61M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.8399 | $6.1M | ✅ 2 ⚠️ 3 View Analysis > |

| TETRA Technologies (TTI) | $3.53 | $469.75M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 441 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Cytek Biosciences (CTKB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cytek Biosciences, Inc. is a cell analysis solutions company offering tools for biomedical research and clinical applications, with a market cap of approximately $449.64 million.

Operations: Cytek Biosciences generates its revenue primarily from the Scientific & Technical Instruments segment, which accounted for $197.05 million.

Market Cap: $449.64M

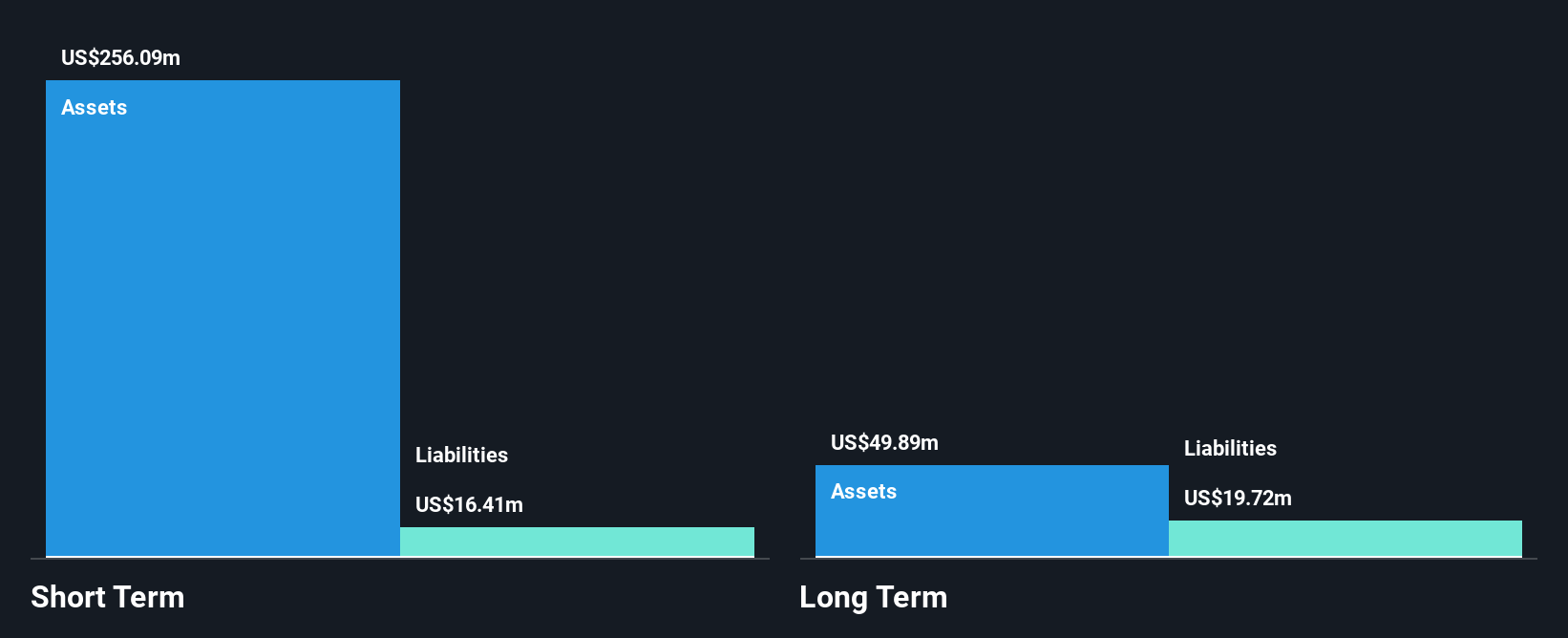

Cytek Biosciences, with a market cap of approximately US$449.64 million, is navigating the penny stock landscape by leveraging its innovative cell analysis solutions. Despite being unprofitable and experiencing a net loss increase to US$11.4 million in Q1 2025, the company maintains a strong cash position with assets significantly exceeding liabilities and positive free cash flow supporting over three years of operations. Recent advancements include the launch of the Cytek Aurora Evo system, enhancing its product line's capabilities and potentially boosting adoption rates in research settings. Additionally, Cytek's inclusion in indices like Russell 2000 highlights growing market recognition.

- Dive into the specifics of Cytek Biosciences here with our thorough balance sheet health report.

- Gain insights into Cytek Biosciences' future direction by reviewing our growth report.

Savara (SVRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Savara Inc. is a clinical-stage biopharmaceutical company that concentrates on rare respiratory diseases, with a market cap of $465.63 million.

Operations: Savara Inc. has not reported any revenue segments as it is a clinical-stage biopharmaceutical company focused on rare respiratory diseases.

Market Cap: $465.63M

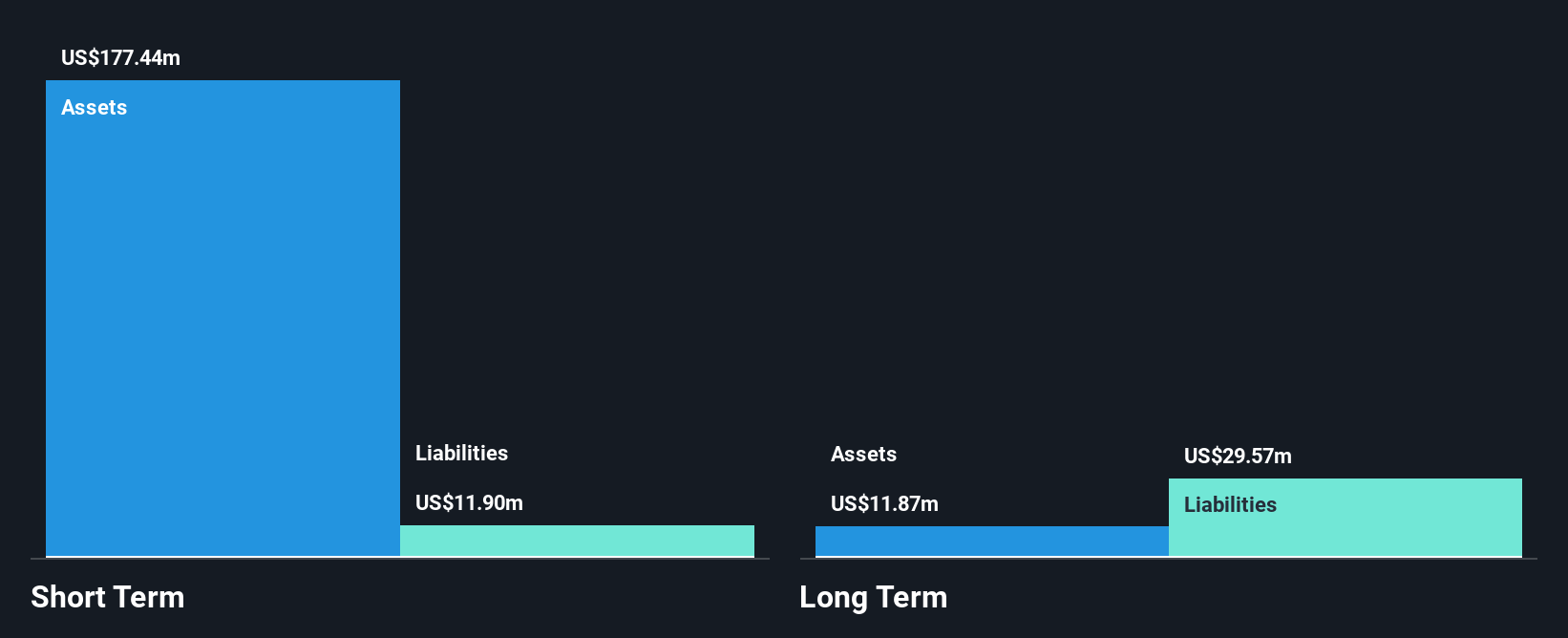

Savara Inc., with a market cap of US$465.63 million, is a pre-revenue biopharmaceutical company focused on rare respiratory diseases. Despite being unprofitable, Savara's short-term assets significantly exceed its liabilities, and it has more cash than debt, providing financial stability. However, the company's stock was recently removed from several Russell indices, which might impact investor sentiment. The FDA issued a Refusal to File letter for its MOLBREEVI therapy application due to incomplete data but did not express safety concerns. Savara plans to address these issues swiftly and retains multiple regulatory designations for MOLBREEVI's development.

- Jump into the full analysis health report here for a deeper understanding of Savara.

- Examine Savara's earnings growth report to understand how analysts expect it to perform.

SES AI (SES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SES AI Corporation develops and produces AI-enhanced lithium metal and lithium-ion rechargeable battery technologies for various applications, including electric vehicles and drones, with a market cap of approximately $325.55 million.

Operations: SES AI Corporation has not reported any revenue segments.

Market Cap: $325.55M

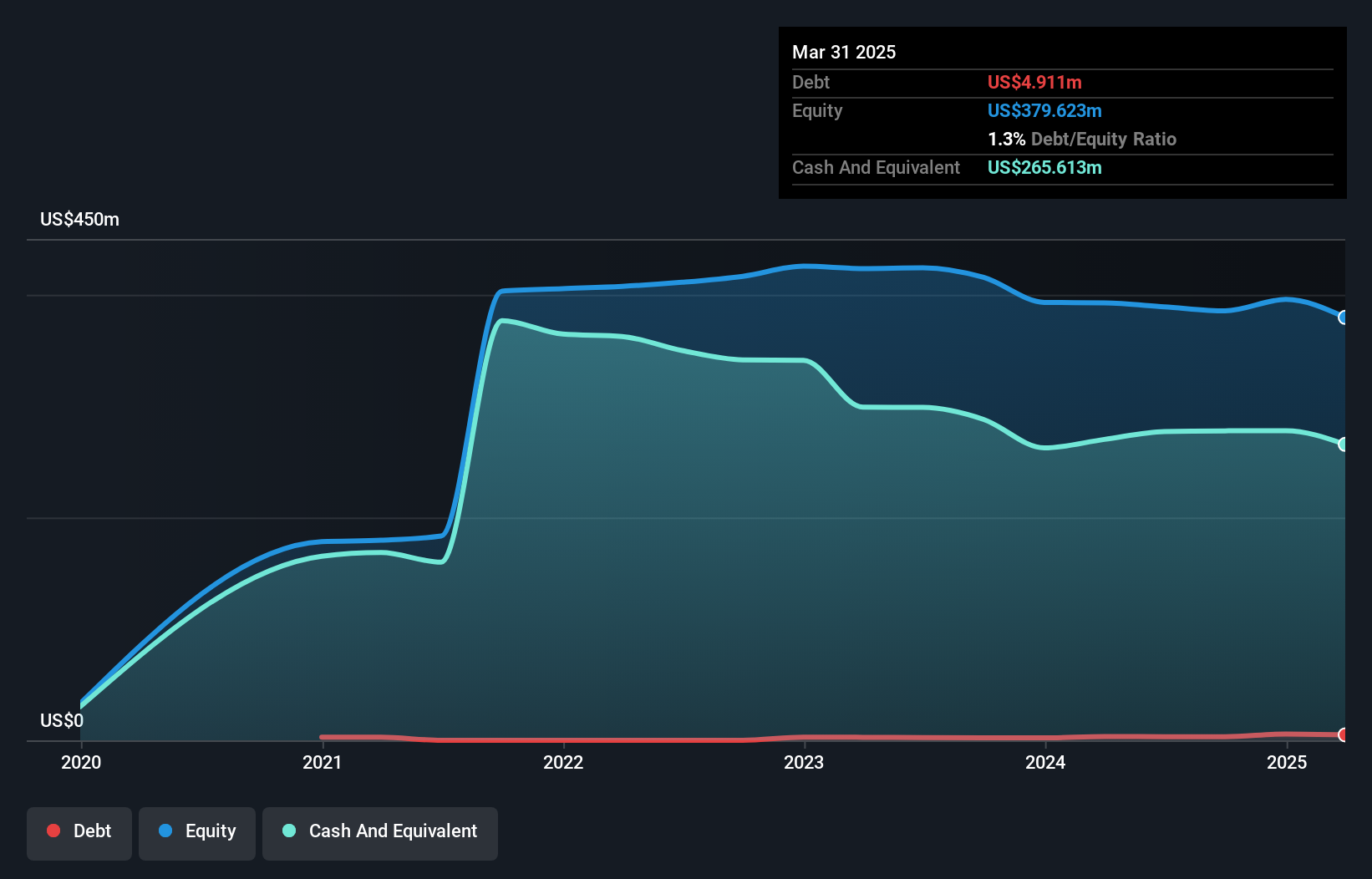

SES AI Corporation, with a market cap of approximately US$325.55 million, is an emerging company in the battery technology sector. Despite being unprofitable and experiencing increased losses over the past five years, SES boasts a seasoned management team and board. The company's recent unveiling of its Molecular Universe MU-0 platform showcases its commitment to innovation in battery material discovery using AI technology. With sufficient cash runway for over a year and no debt burden, SES has financial resilience to support its strategic initiatives. Additionally, it announced a US$30 million share repurchase program funded by existing cash reserves.

- Take a closer look at SES AI's potential here in our financial health report.

- Review our growth performance report to gain insights into SES AI's future.

Turning Ideas Into Actions

- Jump into our full catalog of 441 US Penny Stocks here.

- Want To Explore Some Alternatives? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SES

SES AI

Engages in the development and production of AI enhanced lithium metal and lithium ion rechargeable battery technologies for electric vehicles, urban air mobility, drones, robotics, battery energy storage systems, and other applications in the United States and the Asia Pacific region.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives