- United States

- /

- Medical Equipment

- /

- NasdaqCM:VANI

3 Penny Stocks With Market Caps Over $30M To Consider

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, but it has risen by 10% over the past 12 months with earnings forecasted to grow by 15% annually. In light of these conditions, identifying stocks that combine value and growth potential is crucial for investors looking to capitalize on under-the-radar opportunities. Penny stocks, although a somewhat outdated term, continue to attract attention when they are supported by strong financials and fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.43 | $528.03M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.38 | $253.92M | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (MAPS) | $0.9129 | $162.49M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.36 | $232.21M | ✅ 3 ⚠️ 0 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $100.94M | ✅ 3 ⚠️ 1 View Analysis > |

| Safe Bulkers (SB) | $4.01 | $417.42M | ✅ 2 ⚠️ 3 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.81645 | $6.03M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.58 | $104.9M | ✅ 3 ⚠️ 2 View Analysis > |

| North European Oil Royalty Trust (NRT) | $4.84 | $44.39M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 425 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Vivani Medical (VANI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vivani Medical, Inc. is a clinical-stage biopharmaceutical company focused on developing miniaturized and subdermal drug implants for treating chronic diseases, with a market cap of $88.27 million.

Operations: Vivani Medical, Inc. has not reported any revenue segments.

Market Cap: $88.27M

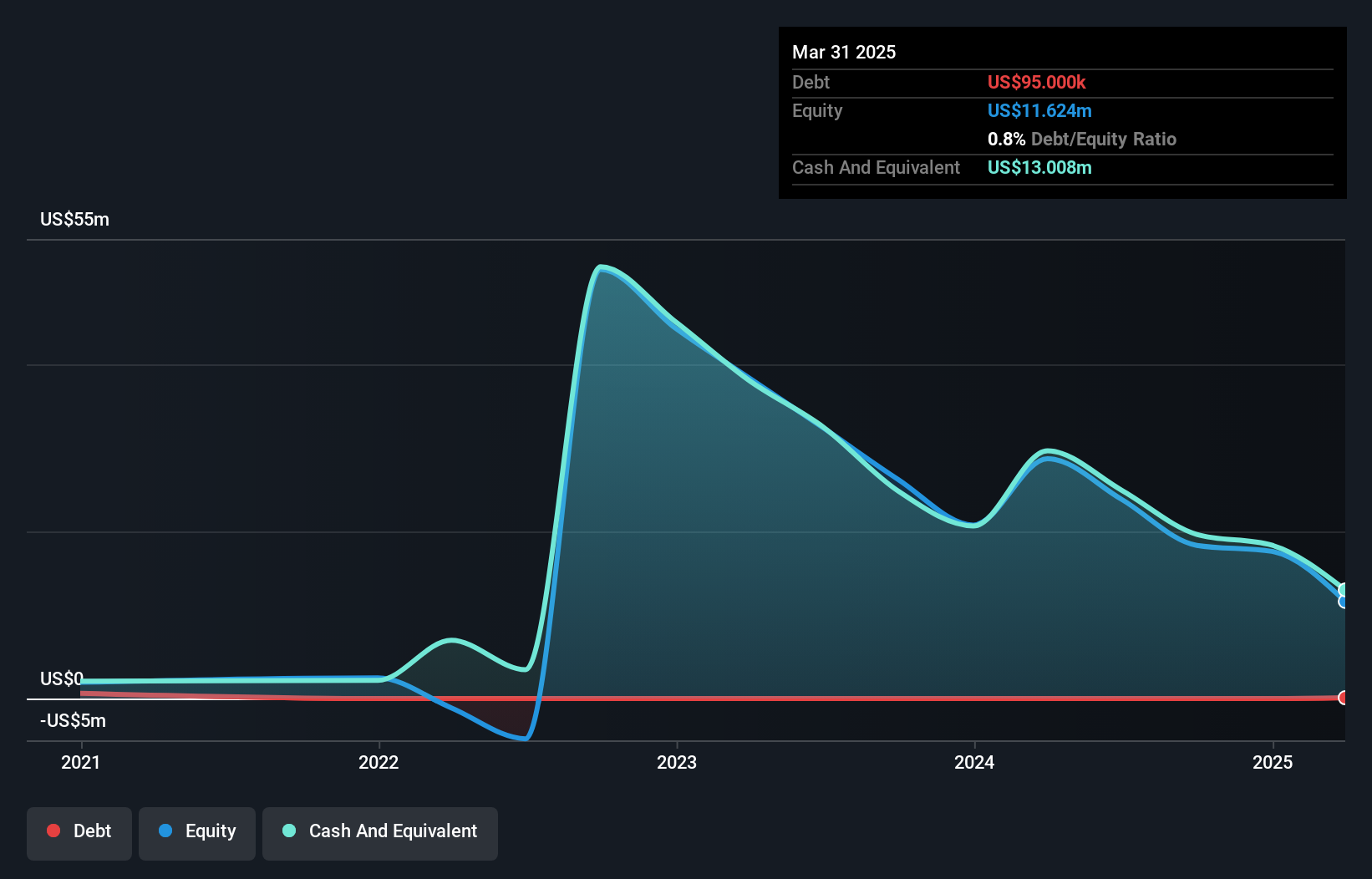

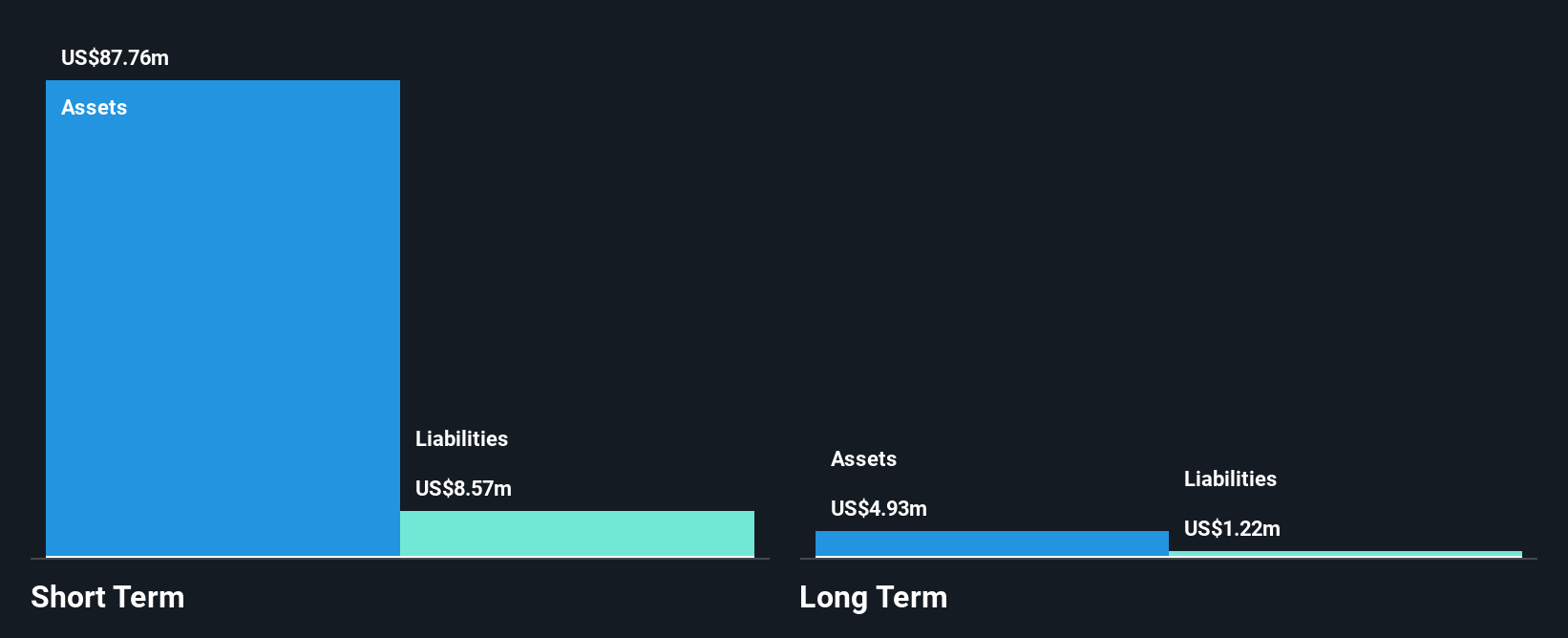

Vivani Medical, Inc., a clinical-stage biopharmaceutical company with a market cap of US$88.27 million, is pre-revenue and unprofitable. The company recently appointed Anthony Baldor as CFO, bringing extensive financial expertise to the team. Despite a negative return on equity and increased losses over five years, Vivani's short-term assets exceed its short-term liabilities by US$8.7 million. However, long-term liabilities remain uncovered by these assets. A recent private placement raised nearly US$3 million to bolster its cash runway beyond the current seven months forecasted based on free cash flow estimates as of March 2025.

- Jump into the full analysis health report here for a deeper understanding of Vivani Medical.

- Review our growth performance report to gain insights into Vivani Medical's future.

Connect Biopharma Holdings (CNTB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Connect Biopharma Holdings Limited is a clinical-stage biopharmaceutical company focused on developing therapies for inflammatory diseases in the United States, with a market cap of $78.34 million.

Operations: Connect Biopharma Holdings Limited has not reported any revenue segments.

Market Cap: $78.34M

Connect Biopharma Holdings Limited, with a market cap of US$78.34 million, is pre-revenue and currently unprofitable. The company has made strides in its pipeline with rademikibart, an investigational antibody targeting inflammatory diseases. Recent collaborations in China could yield up to $110 million in milestone payments and royalties if successful. Despite a volatile share price and forecasted earnings decline, Connect's short-term assets significantly exceed liabilities, providing financial stability. The management team is relatively new but supported by an experienced board. Connect remains debt-free with a cash runway sufficient for over a year at current burn rates.

- Unlock comprehensive insights into our analysis of Connect Biopharma Holdings stock in this financial health report.

- Assess Connect Biopharma Holdings' future earnings estimates with our detailed growth reports.

SideChannel (SDCH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SideChannel, Inc. focuses on identifying, developing, and deploying cybersecurity solutions in North America with a market cap of $32.37 million.

Operations: The company's revenue is primarily generated from the research, development, and commercialization of its technology, amounting to $7.54 million.

Market Cap: $32.37M

SideChannel, Inc., with a market cap of US$32.37 million, focuses on cybersecurity solutions and has shown progress in reducing its losses over the past five years by 3.5% annually. The company remains unprofitable but maintains a positive free cash flow, ensuring a cash runway exceeding three years if current conditions persist. Recent earnings reveal sales of US$1.89 million for Q2 2025, with net losses narrowing to US$0.054 million from US$0.253 million year-over-year. Despite high share price volatility and an inexperienced board, SideChannel is debt-free and covers short-term liabilities with assets totaling US$2.7 million against liabilities of US$1.5 million.

- Take a closer look at SideChannel's potential here in our financial health report.

- Examine SideChannel's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Unlock more gems! Our US Penny Stocks screener has unearthed 422 more companies for you to explore.Click here to unveil our expertly curated list of 425 US Penny Stocks.

- Searching for a Fresh Perspective? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VANI

Vivani Medical

A clinical-stage biopharmaceutical company, engages in the development of miniaturized and subdermal drug implants that treat chronic diseases.

Adequate balance sheet low.

Market Insights

Community Narratives