- China

- /

- Commercial Services

- /

- SZSE:002266

3 Penny Stocks In Global With Market Caps Larger Than US$600M

Reviewed by Simply Wall St

Global markets have recently faced turbulence, with U.S. stock indexes posting losses due to renewed tariffs and trade policy uncertainty, while the Federal Reserve's steady interest rates and accelerating inflation continue to shape economic sentiment. Amid these broader market challenges, investors often look towards alternative opportunities that might be overlooked by mainstream attention. Penny stocks, though sometimes considered outdated in terminology, remain a relevant investment area for those seeking potential growth in smaller or newer companies. In this article, we explore three penny stocks that stand out for their financial strength and resilience amidst current global economic conditions.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.15 | A$110.86M | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.45 | HK$908.57M | ✅ 4 ⚠️ 1 View Analysis > |

| GTN (ASX:GTN) | A$0.395 | A$72.45M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.48 | HK$2.02B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €308.19M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.54 | SGD218.86M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.84 | SGD11.18B | ✅ 5 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.205 | £191.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.96 | €32.37M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,812 stocks from our Global Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Anton Oilfield Services Group (SEHK:3337)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anton Oilfield Services Group is an investment holding company that provides integrated oilfield technology services in China, Iraq, and internationally, with a market cap of HK$4.17 billion.

Operations: The company's revenue is primarily derived from Oilfield Technical Services (CN¥2.13 billion), followed by Oilfield Management Services (CN¥1.85 billion), Inspection Services (CN¥421.04 million), and Drilling Rig Services (CN¥358.89 million).

Market Cap: HK$4.17B

Anton Oilfield Services Group, with a market cap of HK$4.17 billion, demonstrates robust financial health, as its debt is well covered by operating cash flow and it holds more cash than total debt. Recent earnings growth of 23.5% outpaced the industry average, supported by high-quality earnings and improved profit margins. The company's strategic focus on natural gas utilization amid global energy transitions presents significant opportunities for growth. Additionally, Anton secured a contract in Sarawak to develop oil and gas facilities over eight years, enhancing its integrated resource utilization capabilities while maintaining stable weekly volatility at 7%.

- Click here to discover the nuances of Anton Oilfield Services Group with our detailed analytical financial health report.

- Gain insights into Anton Oilfield Services Group's future direction by reviewing our growth report.

Boustead Singapore (SGX:F9D)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boustead Singapore Limited is an investment holding company that offers energy engineering, real estate, geospatial, and healthcare technology solutions across various global markets with a market cap of SGD806.26 million.

Operations: The company's revenue is primarily derived from its Geospatial segment at SGD221.35 million, followed by Energy Engineering at SGD158.89 million, Real Estate Solutions at SGD134.35 million, and Healthcare at SGD12.14 million.

Market Cap: SGD806.26M

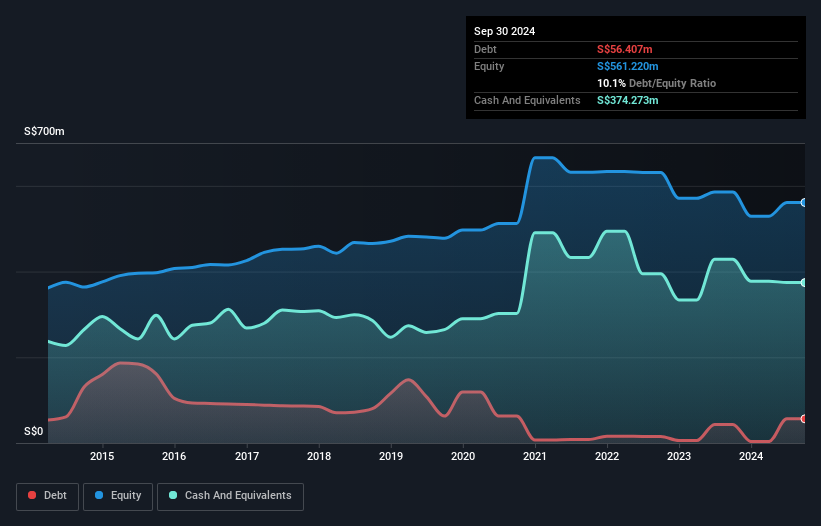

Boustead Singapore Limited, with a market cap of SGD806.26 million, shows financial resilience as its debt is well covered by operating cash flow and it holds more cash than total debt. The company reported earnings growth of 48.1% over the past year, surpassing the industry average and benefiting from improved profit margins, despite a significant one-off gain impacting results. While dividends have been proposed at 7.5 cents per share for 2025, indicating shareholder returns focus, Boustead's board has undergone recent changes with new appointments that may influence strategic direction amidst stable weekly volatility at 5%.

- Get an in-depth perspective on Boustead Singapore's performance by reading our balance sheet health report here.

- Gain insights into Boustead Singapore's historical outcomes by reviewing our past performance report.

Zhefu Holding Group (SZSE:002266)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhefu Holding Group Co., Ltd. focuses on the research, development, manufacture, installation, and servicing of hydropower equipment both in China and globally, with a market cap of CN¥18.54 billion.

Operations: Currently, there are no specific revenue segments reported for Zhefu Holding Group Co., Ltd.

Market Cap: CN¥18.54B

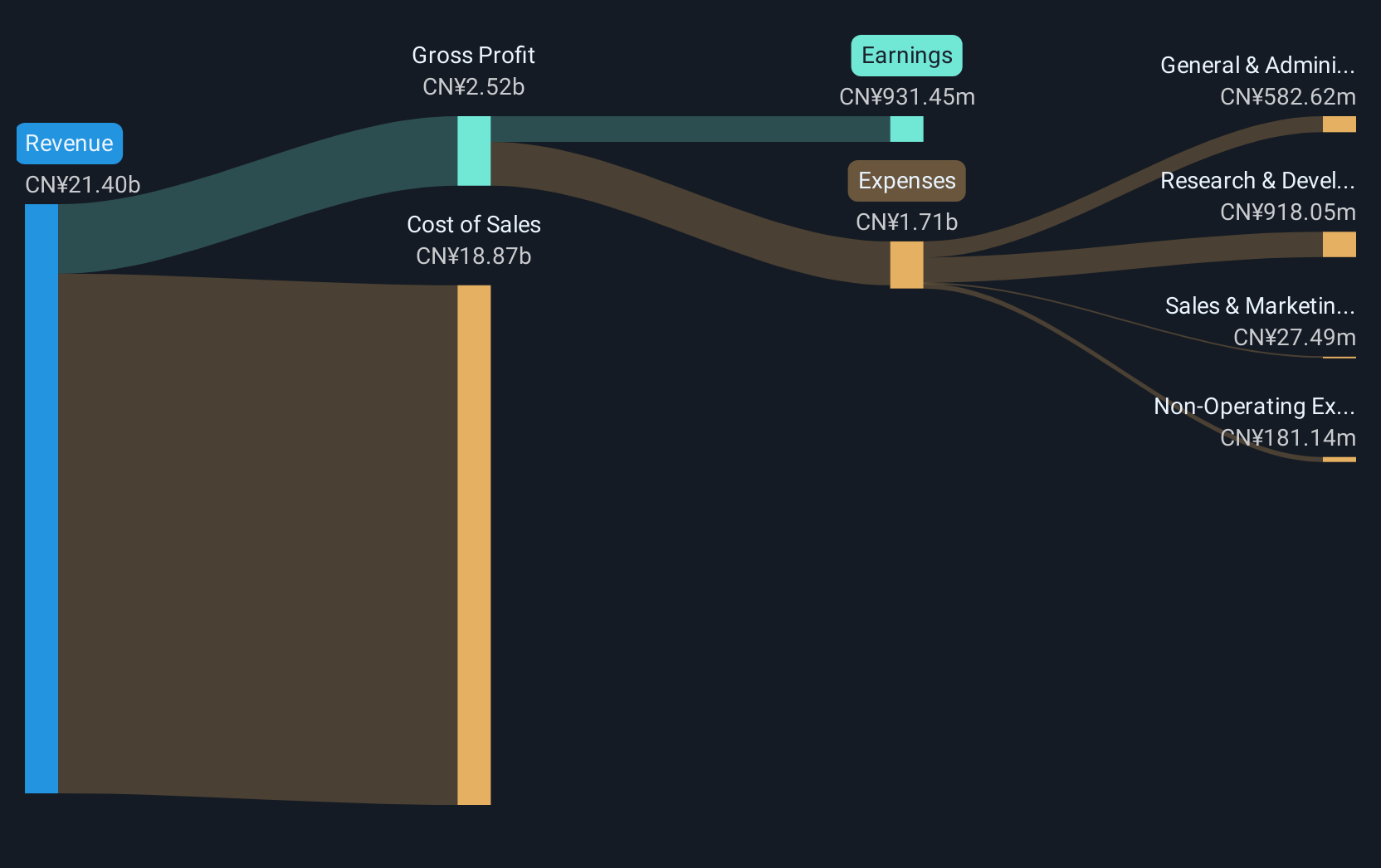

Zhefu Holding Group, with a market cap of CN¥18.54 billion, demonstrates financial stability through its strong balance sheet, where short-term assets of CN¥16.9 billion surpass both short and long-term liabilities. The company offers value with a price-to-earnings ratio of 20.3x, below the industry average, and maintains stable weekly volatility at 6%. Despite earnings growth of 10.6% over the past year exceeding industry averages, profit margins have slightly declined to 4.4%. The board's experience and well-covered interest payments further enhance its investment appeal amidst an unstable dividend history recently affirmed at CNY 0.50 per share for shareholders.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhefu Holding Group.

- Understand Zhefu Holding Group's earnings outlook by examining our growth report.

Key Takeaways

- Gain an insight into the universe of 3,812 Global Penny Stocks by clicking here.

- Curious About Other Options? The end of cancer? These 26 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhefu Holding Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002266

Zhefu Holding Group

Through its subsidiaries, primarily engages in the research and development, manufacture, installation, and service of hydropower equipment in China and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives