- United Kingdom

- /

- Capital Markets

- /

- LSE:BRK

3 Leading UK Dividend Stocks To Consider

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices experience downward pressure, largely due to disappointing trade data from China, investors are increasingly seeking stability amidst global economic uncertainties. In such a climate, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive option for those looking to navigate the current market challenges.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 7.15% | ★★★★★★ |

| Treatt (LSE:TET) | 3.14% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 6.78% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.76% | ★★★★★☆ |

| Man Group (LSE:EMG) | 7.43% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.26% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.84% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.67% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.69% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.03% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top UK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

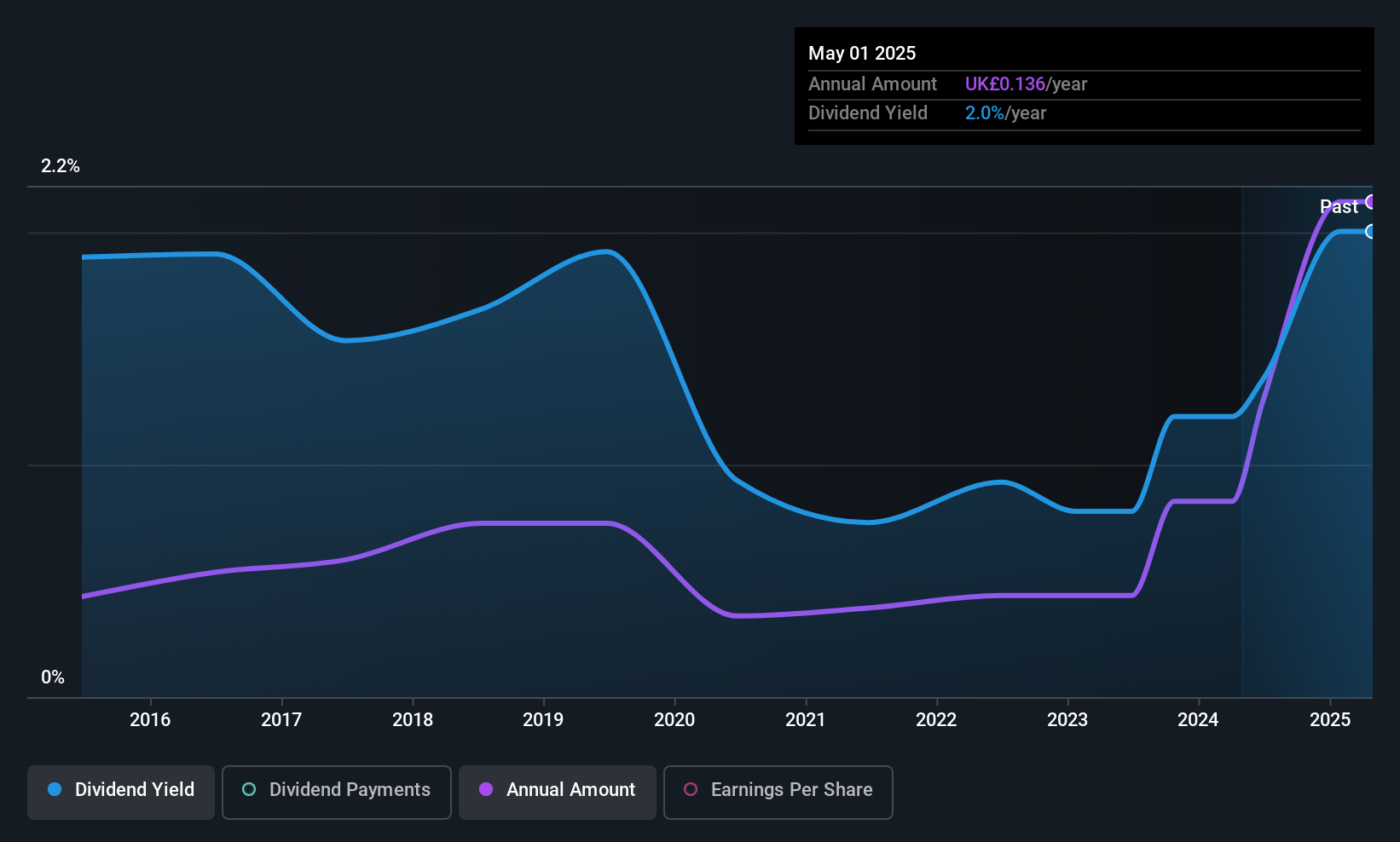

B.P. Marsh & Partners (AIM:BPM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: B.P. Marsh & Partners PLC invests in early-stage financial services intermediary businesses both in the United Kingdom and internationally, with a market cap of £252.86 million.

Operations: B.P. Marsh & Partners PLC generates revenue of £115.24 million from its consultancy services and trading investments within the financial services sector.

Dividend Yield: 3.2%

B.P. Marsh & Partners has proposed a dividend of 6.78 pence per share, reflecting its commitment to returning value to shareholders despite a historically volatile dividend record. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 5% and 24%, respectively. Recent strong earnings growth and strategic share buybacks further support its financial stability, though the dividend yield remains below the UK top tier average.

- Get an in-depth perspective on B.P. Marsh & Partners' performance by reading our dividend report here.

- Upon reviewing our latest valuation report, B.P. Marsh & Partners' share price might be too pessimistic.

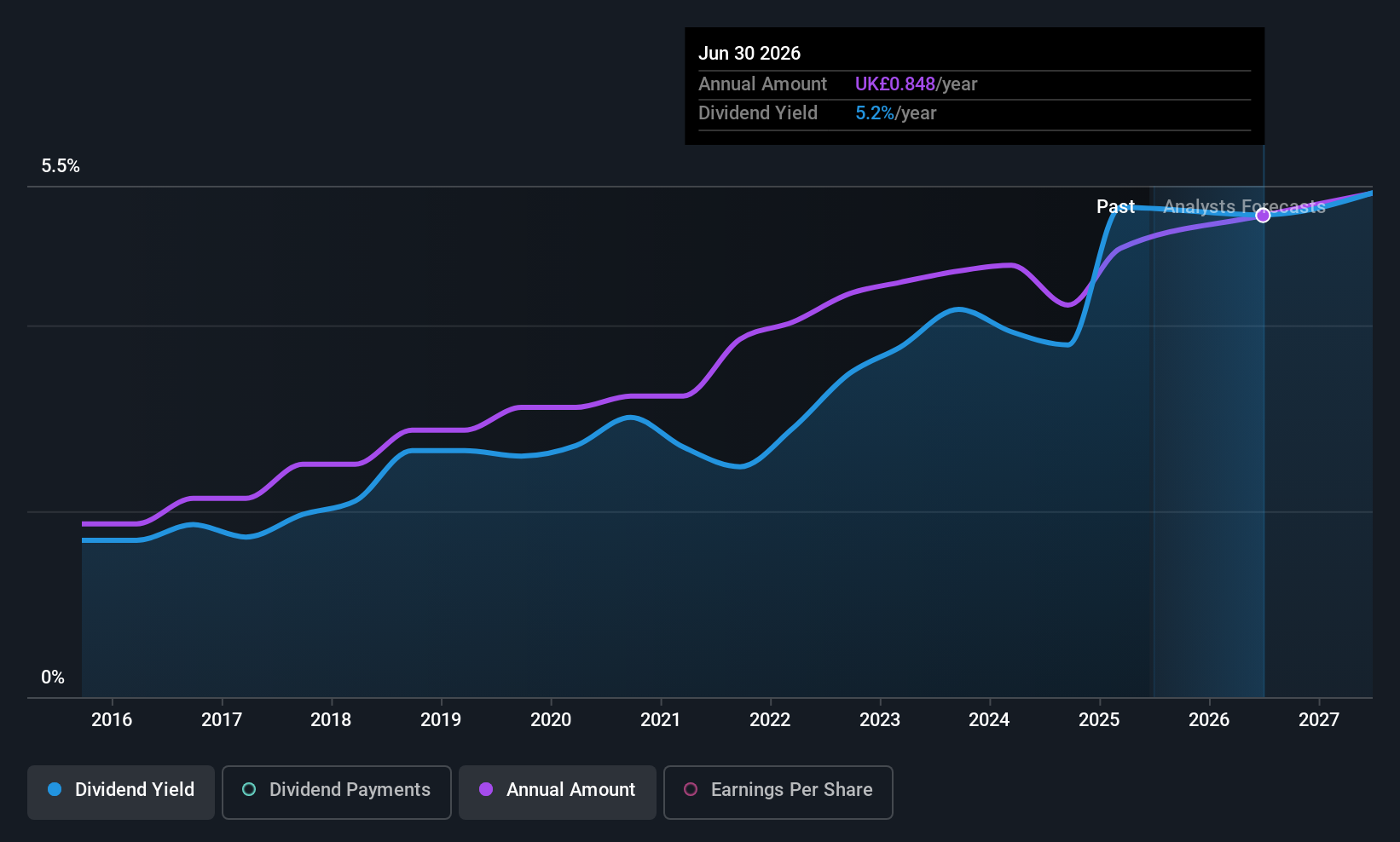

Brooks Macdonald Group (LSE:BRK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Brooks Macdonald Group plc offers investment and wealth management services to private clients, pension funds, professional intermediaries, and trustees in the United Kingdom and the Channel Islands, with a market cap of £261.59 million.

Operations: Brooks Macdonald Group plc generates its revenue by delivering a variety of financial services, including investment and wealth management, to clients such as private individuals, pension funds, professional intermediaries, and trustees across the UK and the Channel Islands.

Dividend Yield: 4.7%

Brooks Macdonald Group's dividend yield of 4.73% is lower than the top UK payers, and though dividends have grown steadily over the past decade, they are not well covered by earnings due to a high payout ratio of 187.5%. However, cash flows adequately cover the dividends with a cash payout ratio of 50%. Despite recent profit margin declines and financial impacts from one-off items, BRK trades slightly below its estimated fair value.

- Dive into the specifics of Brooks Macdonald Group here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Brooks Macdonald Group is trading beyond its estimated value.

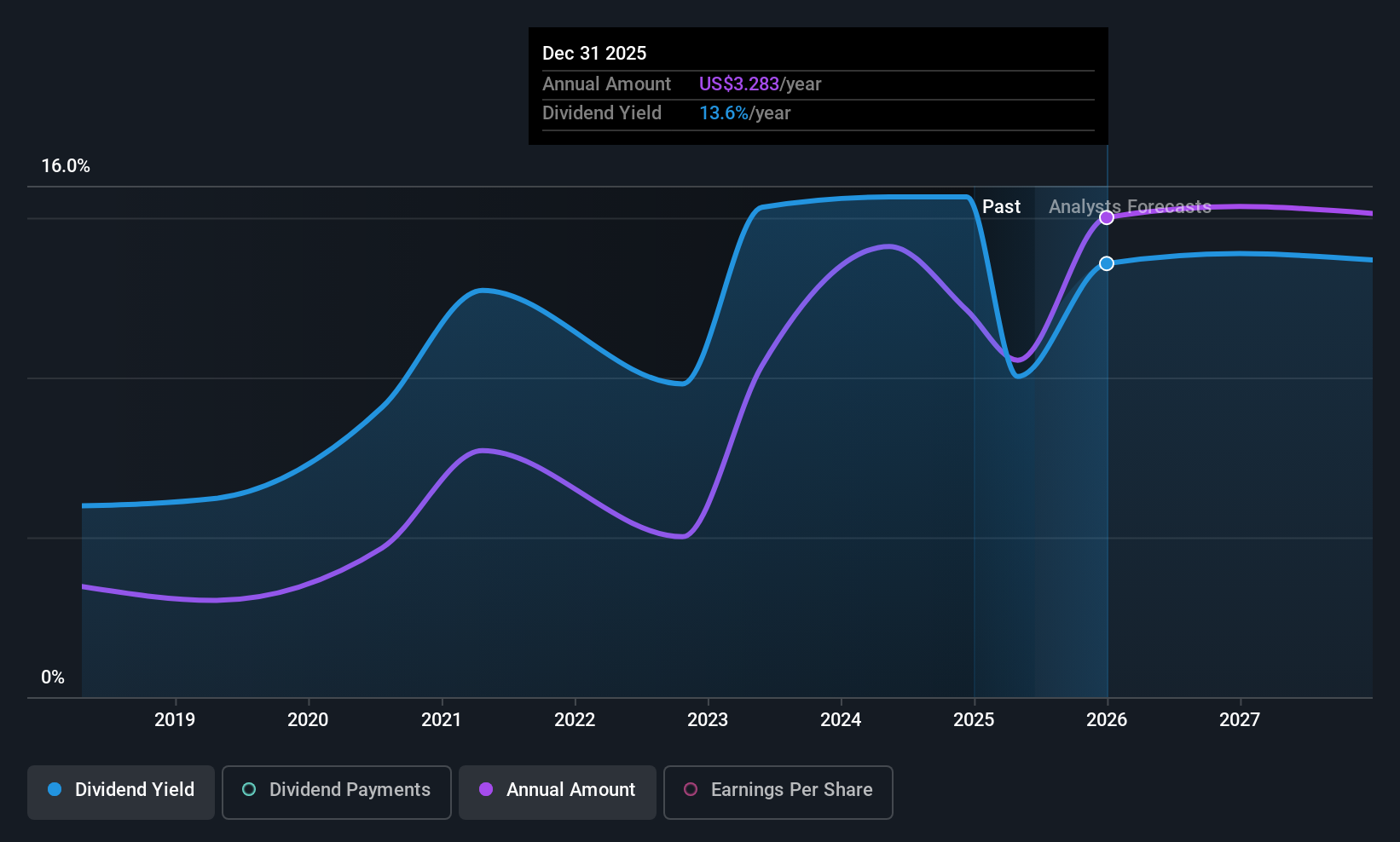

Halyk Bank of Kazakhstan (LSE:HSBK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Halyk Bank of Kazakhstan Joint Stock Company, along with its subsidiaries, offers corporate and retail banking services mainly in Kazakhstan, Kyrgyzstan, Georgia, and Uzbekistan, with a market cap of $6.34 billion.

Operations: Halyk Bank of Kazakhstan's revenue segments include Retail Banking with ₸207.87 billion, Corporate Banking at ₸822.96 billion, Investment Banking generating ₸254.72 billion, and Small and Medium Enterprises (SME) Banking contributing ₸189.80 billion.

Dividend Yield: 9.9%

Halyk Bank of Kazakhstan's dividend yield is among the top 25% in the UK market, supported by a low payout ratio of 31.7%, indicating strong earnings coverage. However, its dividend history has been volatile and unreliable over the past decade. Despite trading at a significant discount to its estimated fair value and recent robust earnings growth, concerns arise from a high level of bad loans at 6.8%.

- Unlock comprehensive insights into our analysis of Halyk Bank of Kazakhstan stock in this dividend report.

- In light of our recent valuation report, it seems possible that Halyk Bank of Kazakhstan is trading behind its estimated value.

Turning Ideas Into Actions

- Reveal the 60 hidden gems among our Top UK Dividend Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brooks Macdonald Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BRK

Brooks Macdonald Group

Through its subsidiaries, provides wealth management and financial planning services to private individuals, trusts, charities, and pension funds in the United Kingdom.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives