3 Global Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets experience a mix of optimism and caution, with U.S. stocks climbing for the second consecutive week amid cooling labor market data, investors are keenly observing sectors like information technology that have shown resilience. In this environment, identifying undervalued stocks can be particularly appealing, as these equities may offer potential value gains when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiyo Yuden (TSE:6976) | ¥2408.50 | ¥4746.09 | 49.3% |

| Sparebank 68° Nord (OB:SB68) | NOK179.38 | NOK357.67 | 49.8% |

| Sahara International Petrochemical (SASE:2310) | SAR18.98 | SAR37.76 | 49.7% |

| Livero (TSE:9245) | ¥1692.00 | ¥3354.00 | 49.6% |

| Kanto Denka Kogyo (TSE:4047) | ¥841.00 | ¥1678.37 | 49.9% |

| Hangzhou Zhongtai Cryogenic Technology (SZSE:300435) | CN¥16.67 | CN¥33.19 | 49.8% |

| Fuji (TSE:6134) | ¥2252.00 | ¥4448.27 | 49.4% |

| Brangista (TSE:6176) | ¥591.00 | ¥1179.91 | 49.9% |

| Boditech Med (KOSDAQ:A206640) | ₩15850.00 | ₩31444.13 | 49.6% |

| Absolent Air Care Group (OM:ABSO) | SEK211.00 | SEK416.55 | 49.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

Ningbo Deye Technology Group (SHSE:605117)

Overview: Ningbo Deye Technology Group Co., Ltd. operates in the production and sales of heat exchangers, inverters, and dehumidifiers across China, the UK, the US, Germany, India, and other international markets with a market cap of CN¥53.78 billion.

Operations: Ningbo Deye Technology Group Co., Ltd. generates revenue through its production and sales of heat exchangers, inverters, and dehumidifiers across various international markets including China, the UK, the US, Germany, and India.

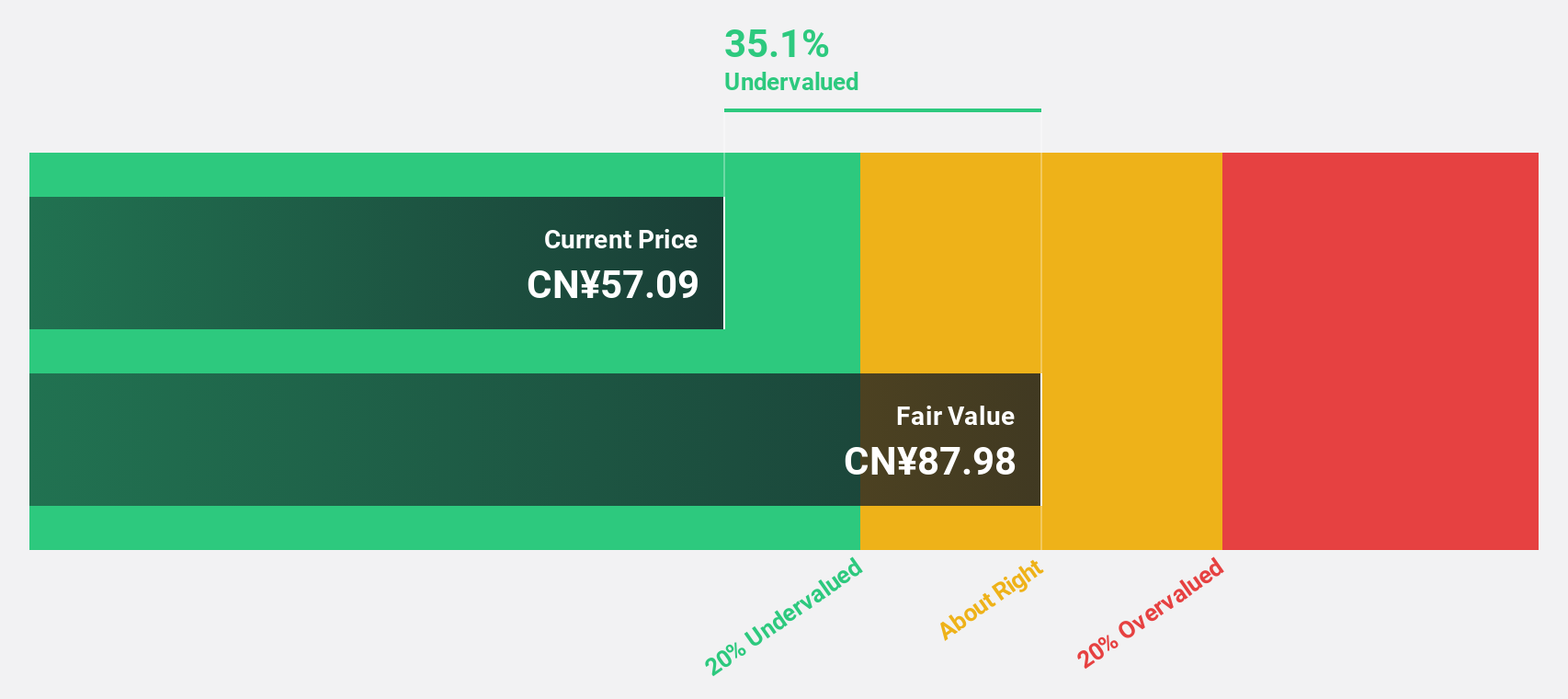

Estimated Discount To Fair Value: 31.2%

Ningbo Deye Technology Group is trading at CN¥85.02, significantly below its estimated fair value of CN¥123.66, suggesting it may be undervalued based on cash flows. The company's earnings grew substantially last year and are expected to grow significantly over the next three years, albeit slower than the market average. Recent buyback announcements totaling CNY 200 million could enhance shareholder value further by utilizing excess cash effectively for stock repurchases.

- Our earnings growth report unveils the potential for significant increases in Ningbo Deye Technology Group's future results.

- Click here to discover the nuances of Ningbo Deye Technology Group with our detailed financial health report.

Shenzhen Transsion Holdings (SHSE:688036)

Overview: Shenzhen Transsion Holdings Co., Ltd. manufactures and sells smart devices primarily in Africa and internationally, with a market capitalization of CN¥81.97 billion.

Operations: Revenue segments for SHSE:688036 include smart device sales primarily in Africa and other international markets.

Estimated Discount To Fair Value: 26.4%

Shenzhen Transsion Holdings is currently trading at CN¥76.29, which is more than 20% below its estimated fair value of CN¥103.72, highlighting potential undervaluation based on cash flows. Despite a decline in Q1 2025 earnings to CNY 490.09 million from CNY 1,626.47 million the previous year, its earnings are projected to grow significantly over the next three years. However, the dividend yield of 3.93% lacks coverage by free cash flows, posing sustainability concerns.

- Our expertly prepared growth report on Shenzhen Transsion Holdings implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Shenzhen Transsion Holdings' balance sheet by reading our health report here.

Wuxi Lead Intelligent EquipmentLTD (SZSE:300450)

Overview: Wuxi Lead Intelligent Equipment Co., Ltd. develops, manufactures, and sells intelligent equipment in China with a market cap of CN¥31.10 billion.

Operations: Wuxi Lead Intelligent Equipment Co., Ltd. generates revenue through the development, manufacturing, and sale of intelligent equipment in China.

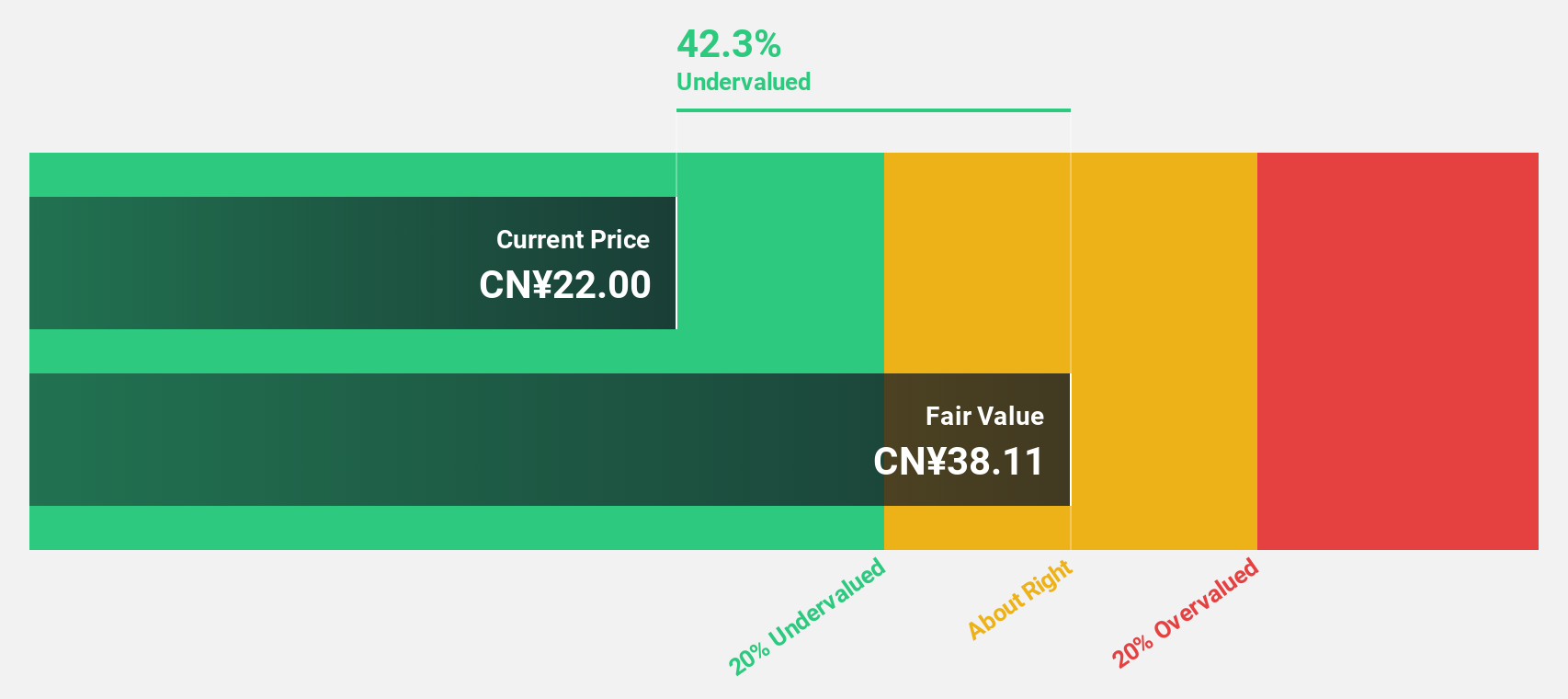

Estimated Discount To Fair Value: 42.3%

Wuxi Lead Intelligent Equipment is trading at CN¥21.65, significantly below its estimated fair value of CN¥37.53, indicating potential undervaluation based on cash flows. Despite a drop in net income to CNY 365.25 million for Q1 2025 from CNY 564.5 million the previous year, earnings are forecasted to grow substantially at over 54% annually for the next three years, outpacing market averages and suggesting strong future prospects despite current margin challenges.

- The growth report we've compiled suggests that Wuxi Lead Intelligent EquipmentLTD's future prospects could be on the up.

- Dive into the specifics of Wuxi Lead Intelligent EquipmentLTD here with our thorough financial health report.

Next Steps

- Take a closer look at our Undervalued Global Stocks Based On Cash Flows list of 508 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Lead Intelligent EquipmentLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300450

Wuxi Lead Intelligent EquipmentLTD

Develops, manufactures, and sells intelligent equipment in China.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives