- Philippines

- /

- Metals and Mining

- /

- PSE:NIKL

3 Global Penny Stocks With Market Caps Under US$600M

Reviewed by Simply Wall St

Global markets have shown a muted response to new U.S. tariffs, with the Nasdaq Composite Index performing relatively well among major U.S. indices, despite modest declines across the board. In such a landscape, investors often look beyond large-cap stocks to find opportunities in smaller companies that might offer growth potential and resilience amid economic fluctuations. Though the term 'penny stock' might sound like a relic of past trading days, it still points to relevant opportunities in smaller or newer companies that can provide significant returns when built on solid financials.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.17 | A$101.42M | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.40 | HK$883.33M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.44 | SGD178.33M | ✅ 4 ⚠️ 1 View Analysis > |

| MGB Berhad (KLSE:MGB) | MYR0.54 | MYR319.49M | ✅ 5 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 5 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.30 | SGD9.05B | ✅ 5 ⚠️ 0 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.435 | SEK2.33B | ✅ 4 ⚠️ 1 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ✅ 5 ⚠️ 0 View Analysis > |

| Zetrix AI Berhad (KLSE:ZETRIX) | MYR0.985 | MYR7.59B | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,819 stocks from our Global Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Nickel Asia (PSE:NIKL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nickel Asia Corporation operates in the Philippines, focusing on the mining and exploration of nickel saprolite, limonite ore, limestone, and quarry materials, with a market capitalization of ₱33.57 billion.

Operations: The company's revenue is derived from its mining operations, with ₱5.44 billion from RTN and ₱8.59 billion from TMC, alongside power generation contributions of ₱1.18 billion from EPI and ₱208.07 million from NAC, as well as services totaling ₱1.18 billion across RTN/TMC/CDTN.

Market Cap: ₱33.57B

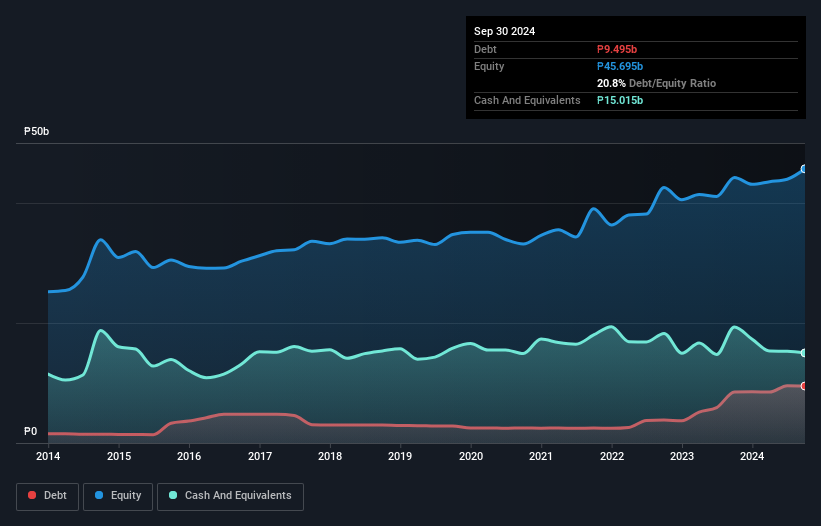

Nickel Asia Corporation, with a market cap of ₱33.57 billion, derives substantial revenue from its mining operations and power generation contributions. Despite an increase in the debt-to-equity ratio over five years, the company maintains strong interest coverage and has more cash than total debt. Short-term assets exceed both short- and long-term liabilities, providing financial stability. However, profit margins have declined recently alongside negative earnings growth over the past year. The stock trades at a significant discount to its estimated fair value but offers a dividend yield that is not well covered by free cash flows. Recent board changes include appointing Naoki Kawai as director following resignations within the leadership team.

- Get an in-depth perspective on Nickel Asia's performance by reading our balance sheet health report here.

- Examine Nickel Asia's earnings growth report to understand how analysts expect it to perform.

Sun.King Technology Group (SEHK:580)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sun.King Technology Group Limited is an investment holding company that manufactures and trades power electronic components for various sectors in China, with a market cap of HK$2.15 billion.

Operations: The company generates CN¥1.61 billion in revenue from its manufacturing and trading of power electronic components segment.

Market Cap: HK$2.15B

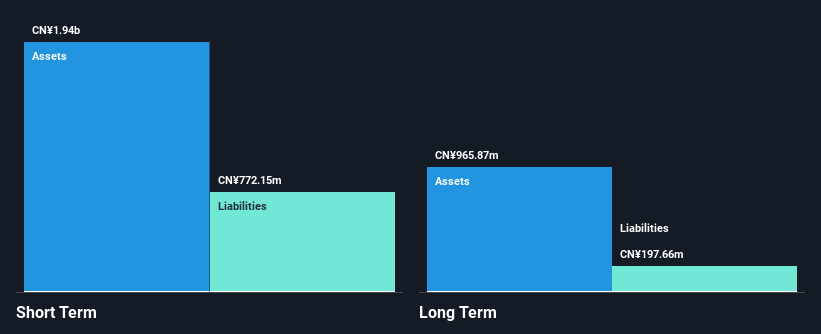

Sun.King Technology Group Limited, with a market cap of HK$2.15 billion, has shown robust revenue growth, expecting RMB 880 million for the first half of 2025 due to significant project deliveries and increased sales of insulated gate bipolar transistors. The company boasts strong financial health with short-term assets exceeding liabilities and interest well-covered by EBIT. Despite past earnings volatility, recent profit margins have improved significantly alongside accelerated earnings growth over the past year. However, challenges persist as operating cash flow remains negative. Recent board changes reflect a seasoned management team focused on strategic governance enhancements.

- Navigate through the intricacies of Sun.King Technology Group with our comprehensive balance sheet health report here.

- Learn about Sun.King Technology Group's future growth trajectory here.

Hubei Mailyard ShareLtd (SHSE:600107)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hubei Mailyard Share Co., Ltd, with a market cap of CN¥1.56 billion, is involved in the manufacture, processing, and sale of clothes, apparel, textiles, and accessories both in China and internationally.

Operations: Hubei Mailyard Share Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥1.56B

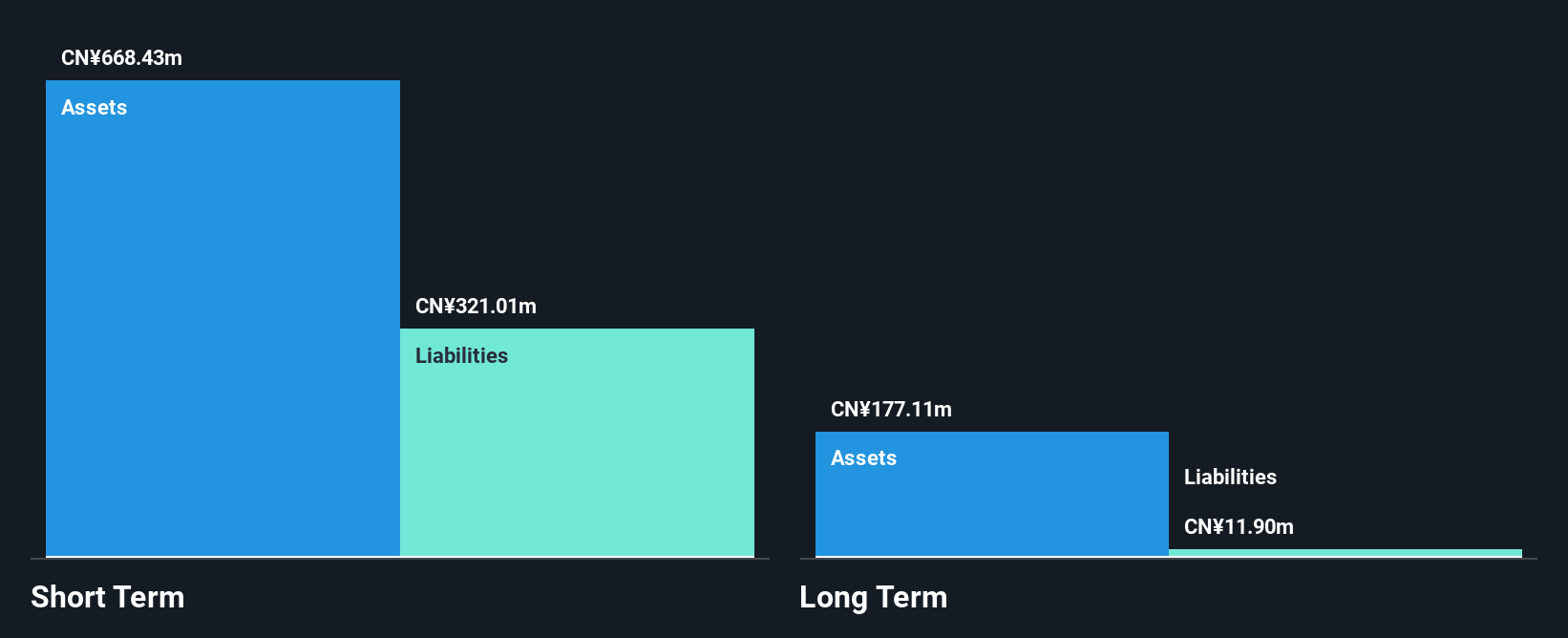

Hubei Mailyard Share Co., Ltd, with a market cap of CN¥1.56 billion, faces challenges as it remains unprofitable despite reducing its net loss from CN¥13.55 million to CN¥8.27 million year-over-year for Q1 2025. Revenue decreased significantly from CN¥129.72 million to CN¥74.23 million during the same period, reflecting operational difficulties in the competitive apparel sector. However, the company maintains financial stability with short-term assets of CN¥668.4 million surpassing both short and long-term liabilities and a reduced debt-to-equity ratio over five years, providing some cushion against volatility in its highly fluctuating share price.

- Click here to discover the nuances of Hubei Mailyard ShareLtd with our detailed analytical financial health report.

- Gain insights into Hubei Mailyard ShareLtd's past trends and performance with our report on the company's historical track record.

Make It Happen

- Navigate through the entire inventory of 3,819 Global Penny Stocks here.

- Contemplating Other Strategies? The end of cancer? These 25 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nickel Asia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:NIKL

Nickel Asia

Engages in the mining and exploration of nickel saprolite, limonite ore, limestone, and quarry materials in the Philippines.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives