- South Korea

- /

- Auto Components

- /

- KOSE:A036530

3 Global Dividend Stocks Yielding Up To 5.3%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by record highs in major U.S. indices and mixed economic signals from regions like Europe and Japan, investors are increasingly drawn to dividend stocks as a means of securing steady income amidst the volatility. In such an environment, selecting dividend stocks with yields up to 5.3% can provide not just potential income but also a measure of stability, making them appealing options for those looking to balance growth with consistent returns.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.48% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.10% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.32% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.38% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.24% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.29% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.05% | ★★★★★★ |

| Daicel (TSE:4202) | 4.79% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.05% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.63% | ★★★★★★ |

Click here to see the full list of 1514 stocks from our Top Global Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

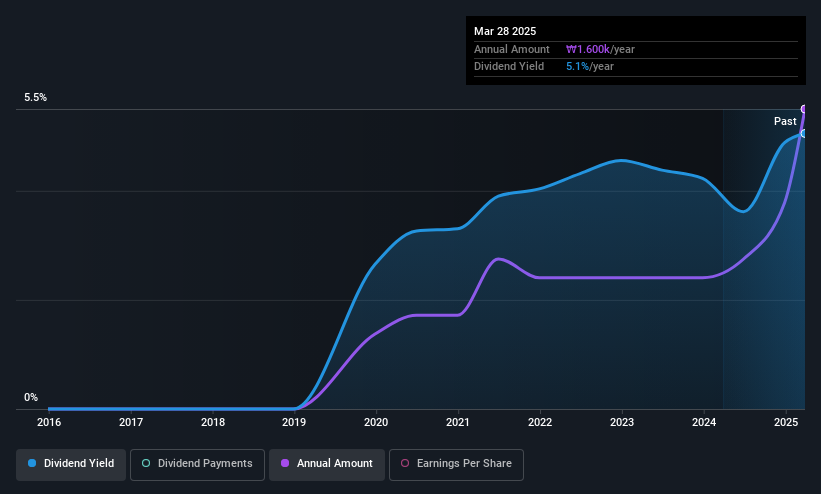

SNT Holdings (KOSE:A036530)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SNT Holdings CO., LTD operates in the auto parts and industrial facilities sectors, with a market cap of ₩874.81 billion.

Operations: SNT Holdings CO., LTD generates revenue primarily from its Vehicle Parts segment, contributing ₩1.39 billion, and its Industrial Equipment segment, contributing ₩347.89 million.

Dividend Yield: 3.4%

SNT Holdings' dividend payments are well supported by both earnings and cash flows, with a low payout ratio of 21.1% and a cash payout ratio of 21.5%. Despite its dividends being in the top 25% in the KR market, they have been unreliable over its six-year history due to volatility. Recent private placements for KRW 20 billion could impact future financial flexibility but currently do not affect its ability to maintain dividends.

- Get an in-depth perspective on SNT Holdings' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of SNT Holdings shares in the market.

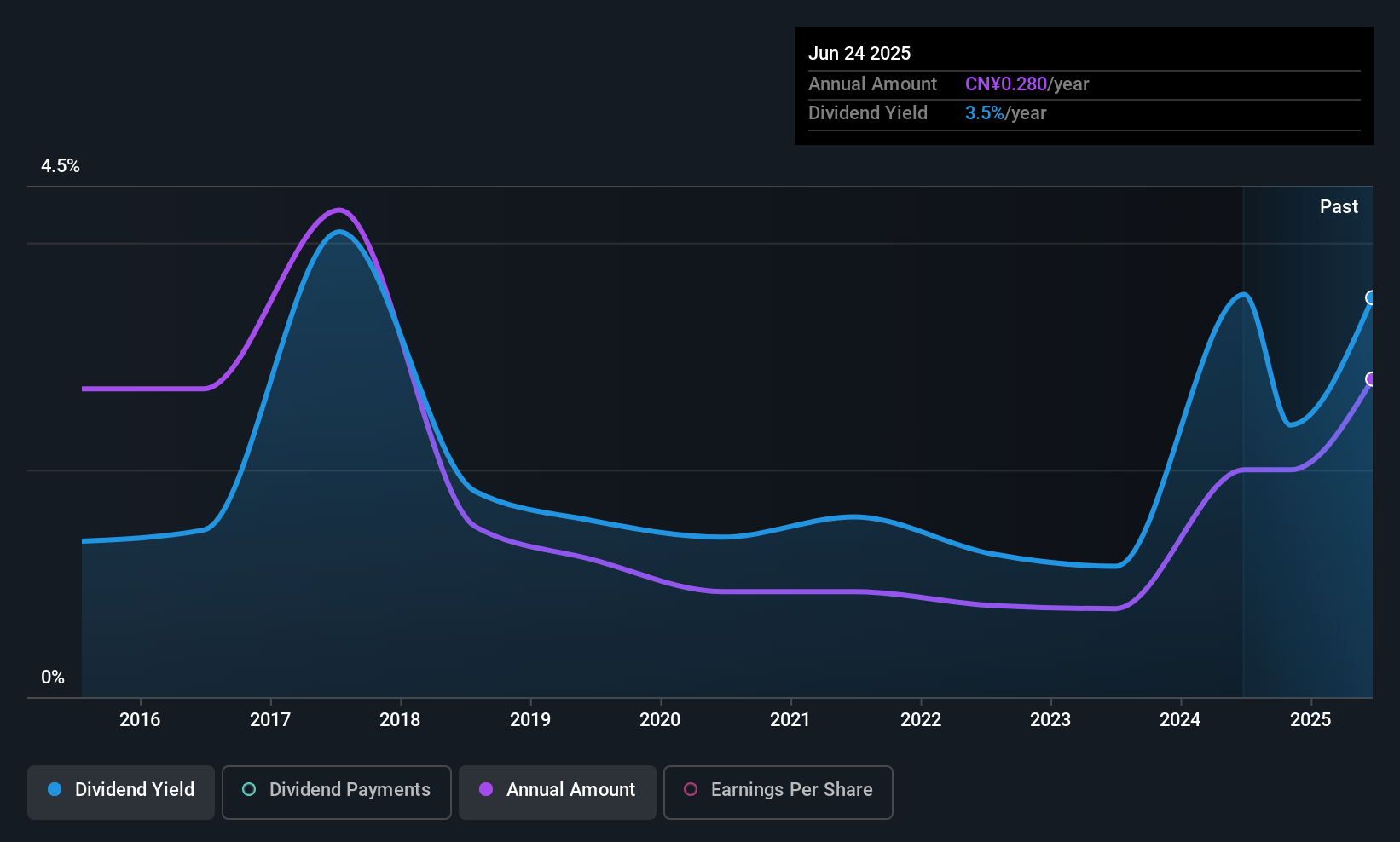

Dlg Exhibitions & Events (SHSE:600826)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dlg Exhibitions & Events Corporation Limited, along with its subsidiaries, offers conference and exhibition services in China and has a market cap of CN¥5.92 billion.

Operations: Dlg Exhibitions & Events Corporation Limited generates revenue primarily from its trading segment, amounting to CN¥1.70 billion.

Dividend Yield: 3.1%

Dlg Exhibitions & Events offers a dividend yield of 3.11%, placing it in the top 25% of CN market payers. However, its dividends have been volatile and are not well covered by cash flows, with a high cash payout ratio of 137.6%. Although earnings cover the dividend with a reasonable payout ratio of 70.5%, recent financial results show increased net losses, raising concerns about future dividend sustainability despite past growth in payouts.

- Take a closer look at Dlg Exhibitions & Events' potential here in our dividend report.

- The analysis detailed in our Dlg Exhibitions & Events valuation report hints at an inflated share price compared to its estimated value.

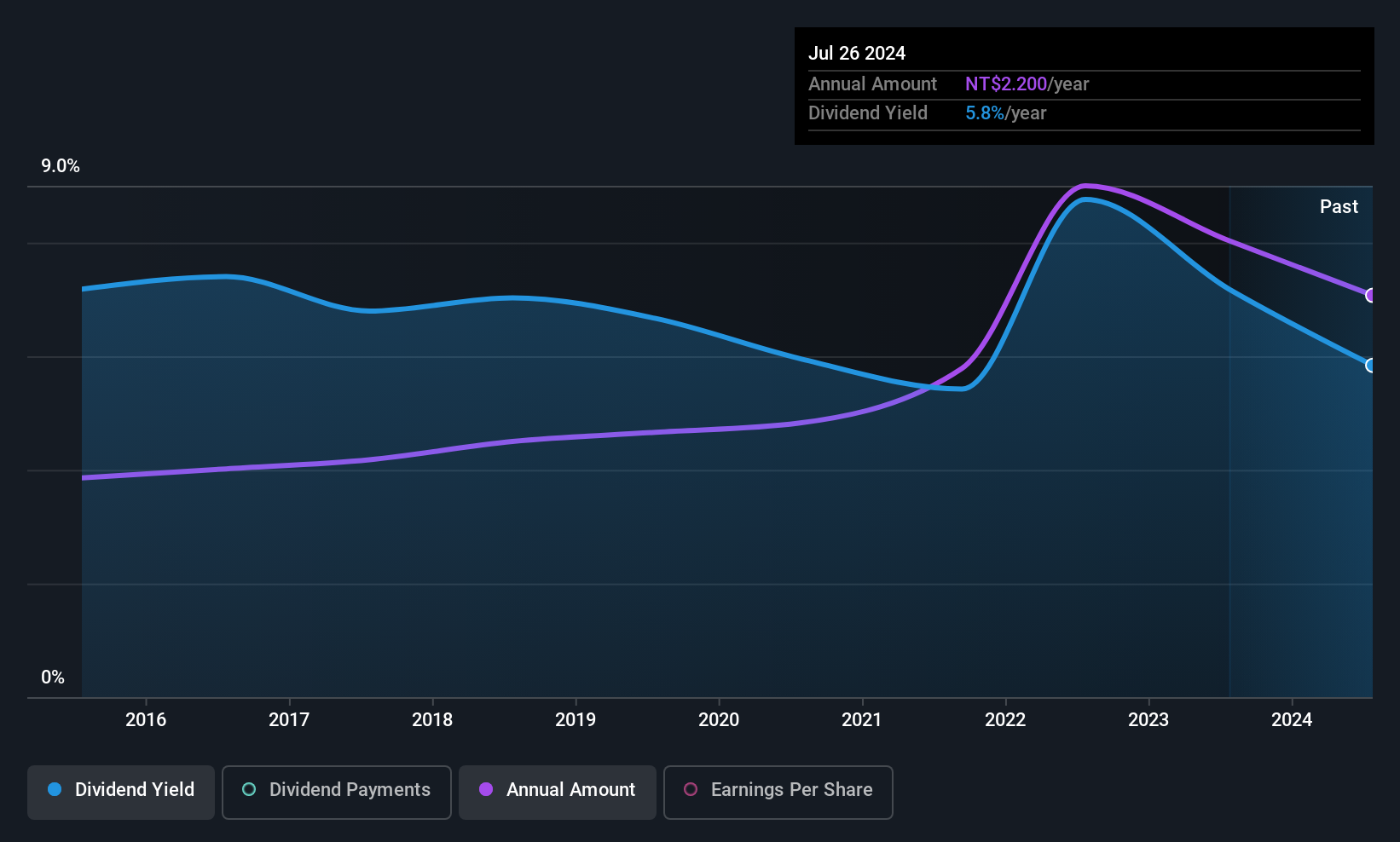

Unitech Computer (TWSE:2414)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Unitech Computer Co., Ltd. operates in the information technology product channel business across Asia, America, Europe, and Oceania with a market cap of NT$7.07 billion.

Operations: Unitech Computer Co., Ltd. generates revenue primarily from its Information Access Business Segment, which accounts for NT$22.72 billion, and its Automatic Identification of Data Collection Product Sector, contributing NT$2.48 billion.

Dividend Yield: 5.3%

Unitech Computer offers a 5.31% dividend yield, slightly below the top 25% in the TW market. While dividends have been reliable and stable over the past decade, they are not well covered by free cash flow due to a high cash payout ratio of 1064.6%. The current payout ratio of 85.6% suggests earnings cover dividends, but sustainability concerns persist despite recent earnings growth and increased net income from TWD 91.38 million to TWD 131.96 million year-over-year.

- Delve into the full analysis dividend report here for a deeper understanding of Unitech Computer.

- Our comprehensive valuation report raises the possibility that Unitech Computer is priced higher than what may be justified by its financials.

Summing It All Up

- Discover the full array of 1514 Top Global Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A036530

SNT Holdings

SNT Holdings Co., Ltd engages in manufacturing and selling automobile parts and industrial facilities businesses.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion