- Philippines

- /

- Hospitality

- /

- PSE:PLUS

3 Global Dividend Stocks With Up To 3.9% Yield

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals, with inflation heating up in the U.S. and solid corporate earnings bolstering some indices to record highs, investors are increasingly focused on finding stable returns amid uncertainty. In such an environment, dividend stocks can offer a compelling opportunity for income generation, providing not only potential yield but also a measure of stability against market volatility.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.21% | ★★★★★★ |

| NCD (TSE:4783) | 4.21% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.25% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.14% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.44% | ★★★★★★ |

| Daicel (TSE:4202) | 4.58% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.93% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.58% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.46% | ★★★★★★ |

Click here to see the full list of 1484 stocks from our Top Global Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

DigiPlus Interactive (PSE:PLUS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DigiPlus Interactive Corp., with a market cap of ₱109.37 billion, operates as a digital entertainment company in the Philippines through its subsidiaries.

Operations: DigiPlus Interactive Corp. generates revenue through its Casino Group (₱503.77 million), Retail Group (₱83.81 billion), and Network and License Group (₱414.68 million).

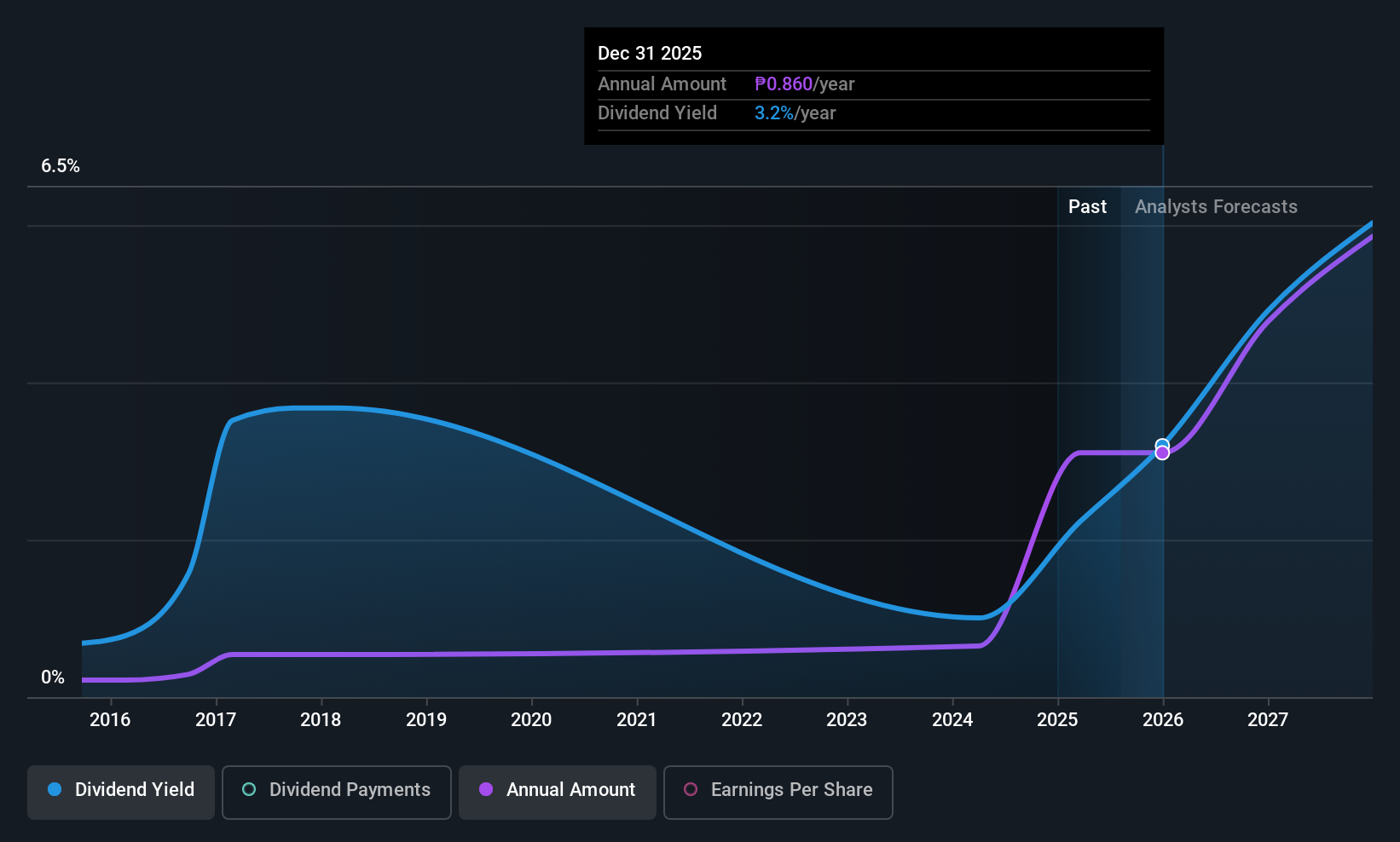

Dividend Yield: 3.2%

DigiPlus Interactive's dividend payments are well covered by earnings and cash flows, with payout ratios of 25.6% and 22%, respectively. However, the dividends have been volatile over the past decade, lacking reliability despite recent growth. The stock trades at a good value compared to peers but has a lower dividend yield of 3.16% relative to top payers in the Philippines market. Recent strategic moves include a PHP 6 billion share buyback program funded by internal cash flows, signaling confidence in future growth prospects amidst expansion into Brazil's lucrative gaming market.

- Click here and access our complete dividend analysis report to understand the dynamics of DigiPlus Interactive.

- Our valuation report here indicates DigiPlus Interactive may be undervalued.

Jinduicheng Molybdenum (SHSE:601958)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jinduicheng Molybdenum Co., Ltd. is involved in the research, development, production, and sale of molybdenum series products and trades molybdenum-related products globally, with a market cap of CN¥38.36 billion.

Operations: Jinduicheng Molybdenum Co., Ltd. generates revenue primarily through its global operations in the research, development, production, and sale of molybdenum series products and trading of molybdenum-related goods.

Dividend Yield: 3.1%

Jinduicheng Molybdenum's dividend payments are well covered by both earnings and cash flows, with payout ratios of 42.8% and 42%, respectively, indicating sustainability despite a history of volatility over the past decade. The stock trades at a good value compared to peers, offering a competitive dividend yield of 3.06%, which is in the top quartile of China's market. Recent earnings showed growth with net income reaching CNY 677.95 million for Q1 2025.

- Dive into the specifics of Jinduicheng Molybdenum here with our thorough dividend report.

- The valuation report we've compiled suggests that Jinduicheng Molybdenum's current price could be quite moderate.

Mitsui Matsushima Holdings (TSE:1518)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsui Matsushima Holdings Co., Ltd. operates in the consumer goods, industrial products, and energy sectors both in Japan and internationally, with a market cap of ¥62.81 billion.

Operations: Mitsui Matsushima Holdings Co., Ltd. generates revenue from its consumer goods segment at ¥26.79 billion and industrial products segment at ¥29.64 billion, alongside a smaller contribution from finance and others amounting to ¥4.21 billion.

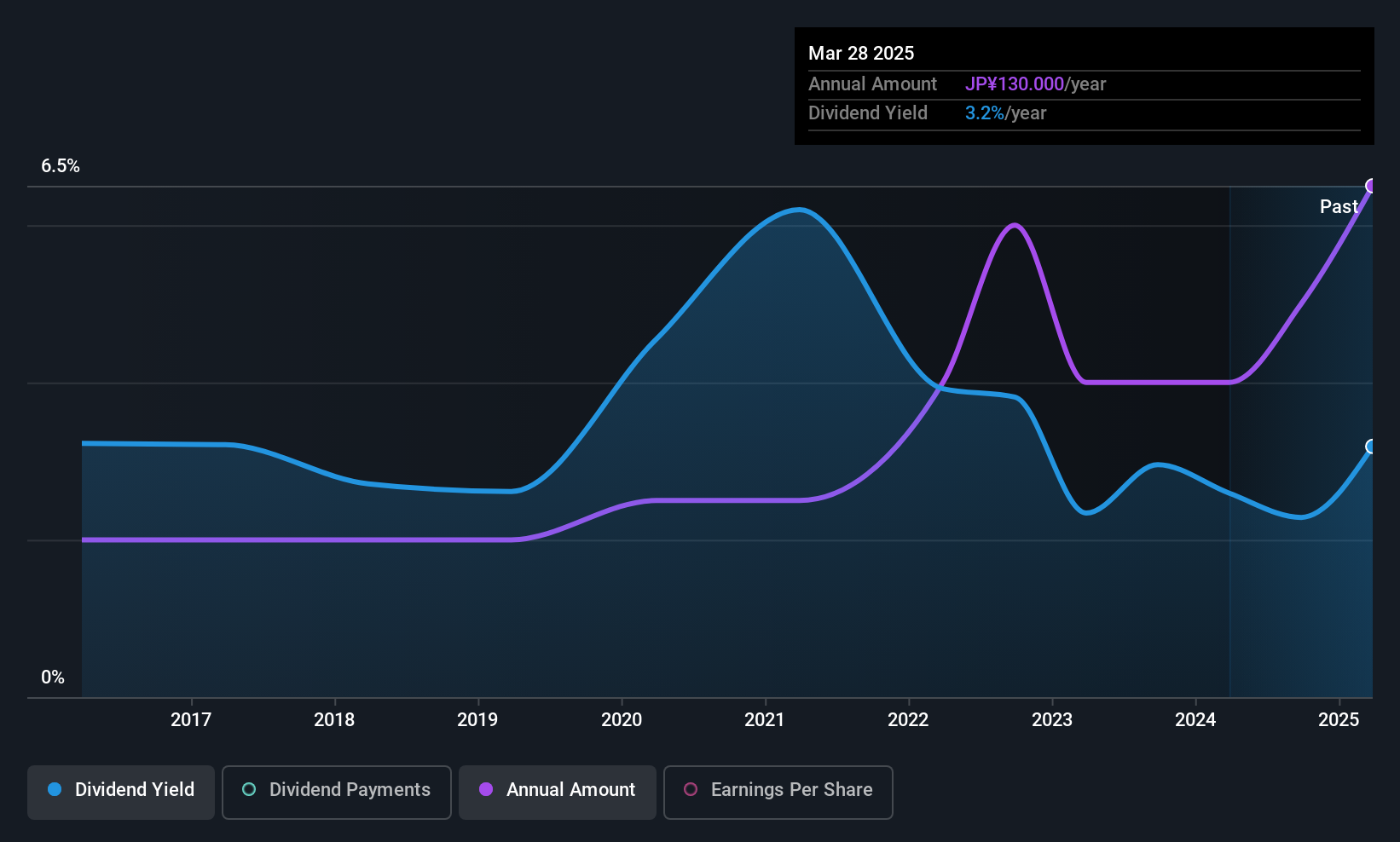

Dividend Yield: 4%

Mitsui Matsushima Holdings has increased its dividend to ¥80.00 per share, with plans for further increases despite a history of volatility. The company recently expanded its buyback plan, authorizing the repurchase of up to 4 million shares. Its dividends are supported by earnings and cash flows, with payout ratios at 17.3% and 80.6%, respectively. The stock's price-to-earnings ratio of 7.5x suggests it is undervalued compared to the broader Japanese market average of 13.7x.

- Get an in-depth perspective on Mitsui Matsushima Holdings' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Mitsui Matsushima Holdings is priced higher than what may be justified by its financials.

Taking Advantage

- Access the full spectrum of 1484 Top Global Dividend Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:PLUS

DigiPlus Interactive

Through its subsidiaries, operates as a digital entertainment company in the Philippines.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives