- Germany

- /

- Trade Distributors

- /

- XTRA:BNR

3 European Dividend Stocks Yielding Up To 6.6%

Reviewed by Simply Wall St

As European markets experience a lift, with the STOXX Europe 600 Index climbing 0.90% amid easing inflation and supportive monetary policy from the European Central Bank, investors are increasingly eyeing dividend stocks for their potential to provide steady income streams. In such an environment, selecting dividend stocks that offer robust yields while maintaining financial stability can be a prudent strategy for those looking to capitalize on Europe's evolving economic landscape.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.39% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.93% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.00% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.93% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.68% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.54% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.21% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.20% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.70% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.33% | ★★★★★★ |

Click here to see the full list of 228 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

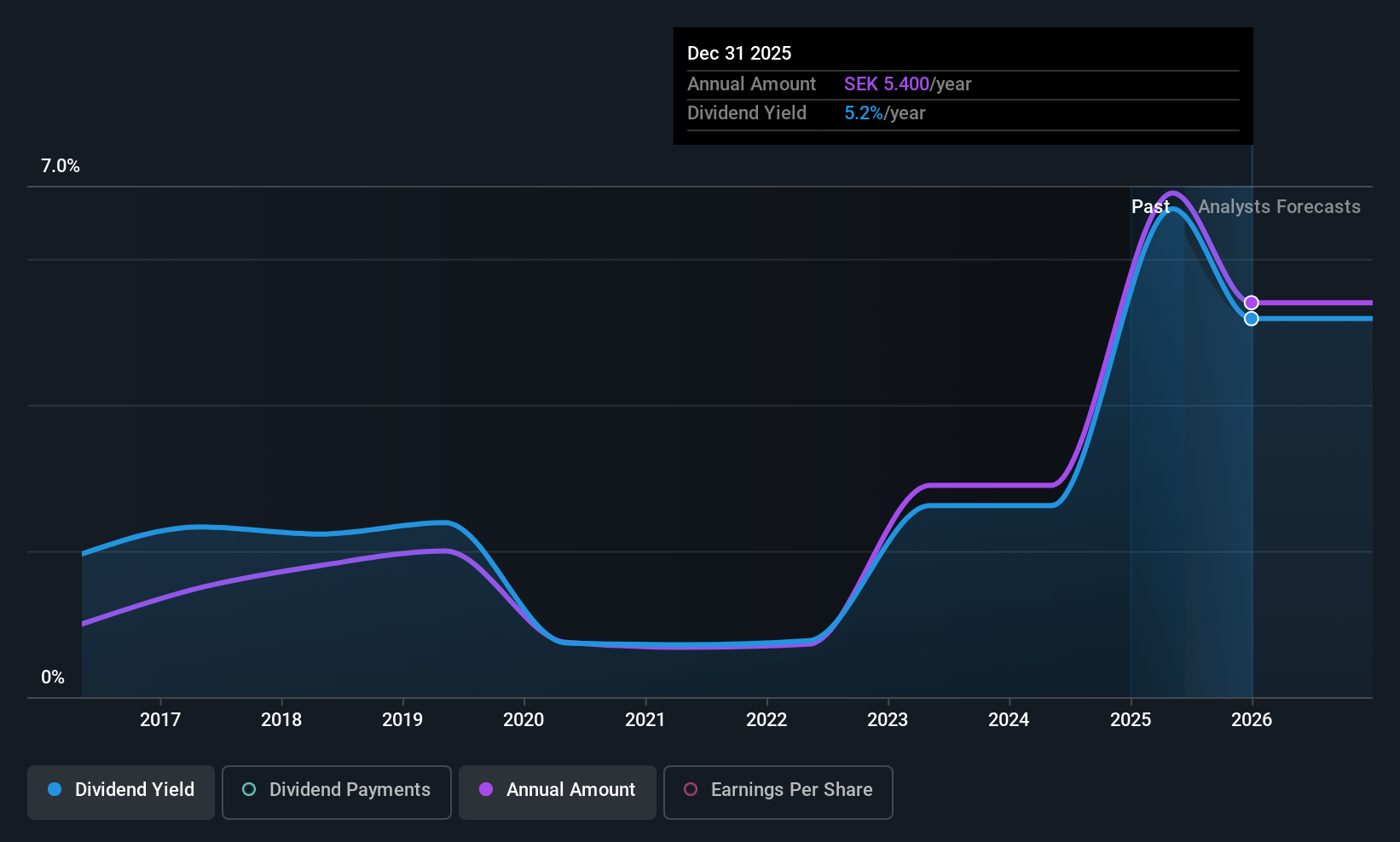

BioGaia (OM:BIOG B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BioGaia AB (publ) is a healthcare company that provides probiotic products globally, with a market cap of SEK10.45 billion.

Operations: BioGaia AB generates revenue from its key segments, with Pediatrics contributing SEK1.07 billion and Adult Health adding SEK341.06 million.

Dividend Yield: 6.7%

BioGaia recently announced a special dividend of SEK 4.95 per share and an increased regular dividend of SEK 1.95 per share, reflecting its commitment to returning value to shareholders despite earnings challenges. The company reported a decline in net income for Q1 2025 compared to the previous year, highlighting potential concerns over sustainability as dividends are not fully covered by free cash flows. While BioGaia's dividend yield is among the top in Sweden, historical volatility raises reliability questions.

- Click here and access our complete dividend analysis report to understand the dynamics of BioGaia.

- According our valuation report, there's an indication that BioGaia's share price might be on the expensive side.

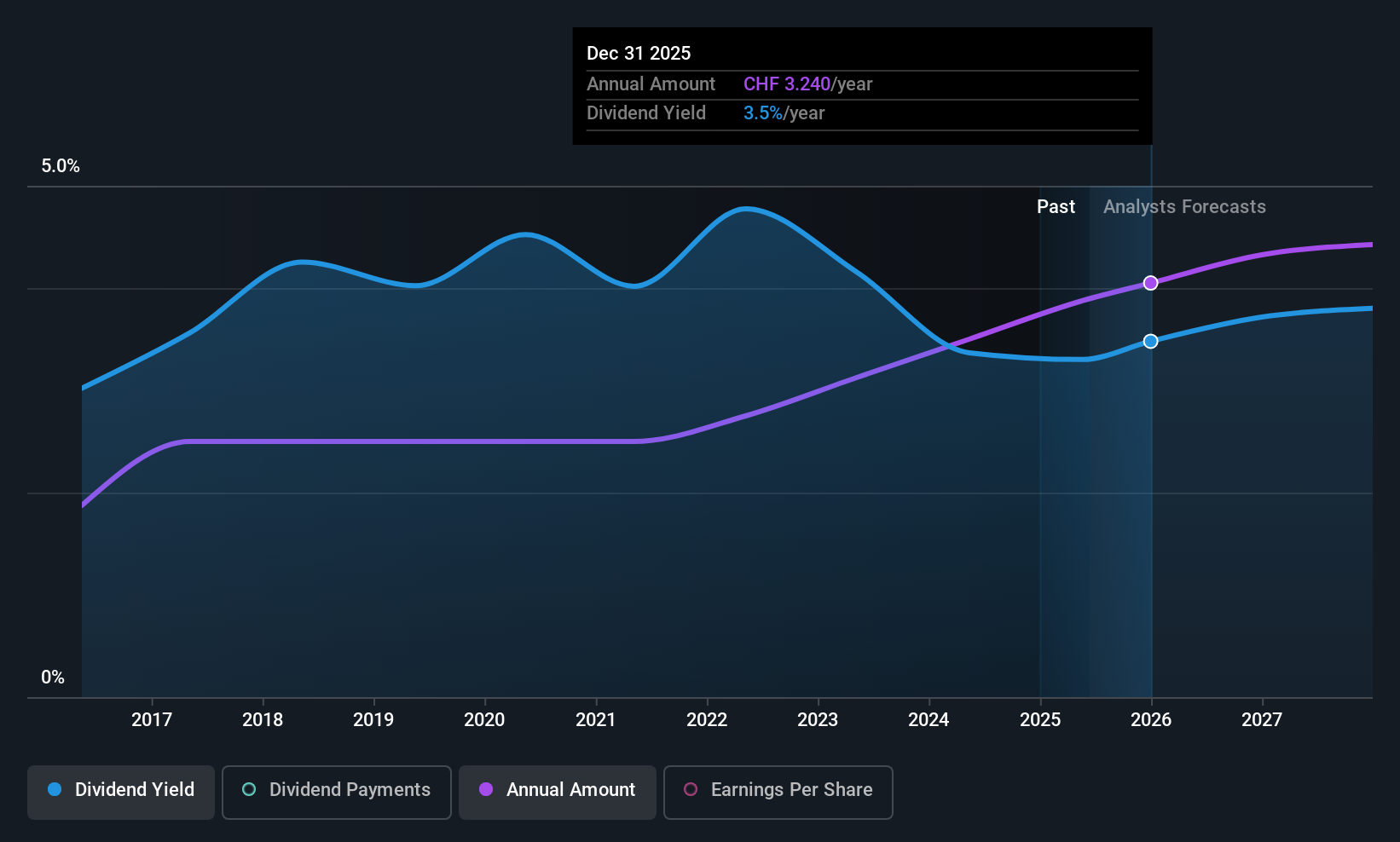

Holcim (SWX:HOLN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Holcim AG, with a market cap of CHF52.15 billion, operates globally through its subsidiaries to provide building materials and solutions.

Operations: Holcim AG generates revenue through its diverse segments, including Cement (CHF13.16 billion), Aggregates (CHF4.34 billion), Ready-Mix Concrete (CHF5.60 billion), and Solutions & Products (CHF5.94 billion).

Dividend Yield: 3.3%

Holcim's recent 11% dividend increase to CHF 3.10 per share reflects its commitment to shareholder returns, supported by a payout ratio of 59.2%, ensuring dividends are covered by earnings and cash flows. Although its yield of 3.28% is below the Swiss market's top tier, Holcim has maintained stable and growing dividends over the past decade. The company's strategic investments, like the EUR 400 million OLYMPUS project in Greece, underscore its focus on sustainable growth and innovation in low-carbon building solutions.

- Delve into the full analysis dividend report here for a deeper understanding of Holcim.

- Our expertly prepared valuation report Holcim implies its share price may be lower than expected.

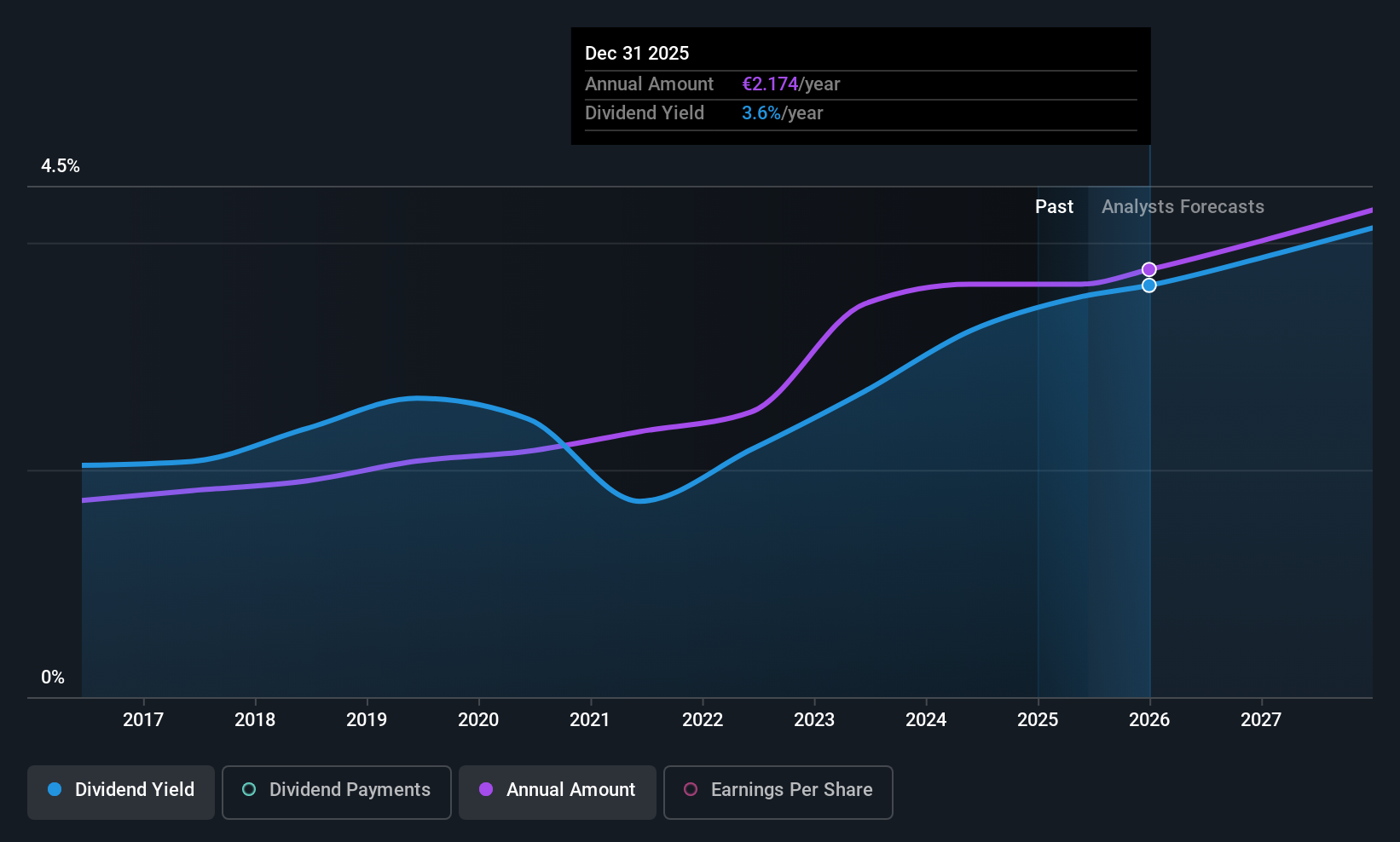

Brenntag (XTRA:BNR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Brenntag SE is a global company involved in the distribution of chemicals and ingredients across multiple countries, including Germany, the United States, and China, with a market cap of approximately €8.81 billion.

Operations: Brenntag SE's revenue segments include Brenntag Essentials with contributions from North America (€5.14 billion), EMEA (€3.79 billion), APAC (€1.02 billion), Latin America (€839.80 million), and Transregional (€322.30 million); and Brenntag Specialties comprising Life Science (€3.46 billion) and Material Science (€1.68 billion).

Dividend Yield: 3.4%

Brenntag's dividend of €2.10 per share, payable on May 27, 2025, is supported by a payout ratio of 57.3%, ensuring coverage by earnings and cash flows. Although its yield of 3.44% lags behind Germany's top dividend payers, Brenntag has delivered stable and growing dividends over the past decade. Despite high debt levels, the company's dividends remain sustainable due to reliable earnings growth and a cash payout ratio of 53.2%.

- Click here to discover the nuances of Brenntag with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Brenntag shares in the market.

Turning Ideas Into Actions

- Explore the 228 names from our Top European Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brenntag might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BNR

Brenntag

Engages in the distribution of chemicals and ingredients in Germany, the United States, the United Kingdom, China, Canada, Italy, Poland, France, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives