- France

- /

- Oil and Gas

- /

- ENXTPA:MAU

3 European Dividend Stocks Yielding Up To 6.4%

Reviewed by Simply Wall St

As European markets navigate a period of mixed performance, with the pan-European STOXX Europe 600 Index experiencing a slight decline amid waning expectations for further ECB rate cuts, investors are increasingly focused on strategies that can provide steady income. In this context, dividend stocks stand out as attractive options for those seeking reliable returns in an environment where economic growth is modest and inflation remains near target levels.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.51% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.84% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.39% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.92% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.98% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.77% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.23% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 11.33% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.62% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.71% | ★★★★★★ |

Click here to see the full list of 227 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

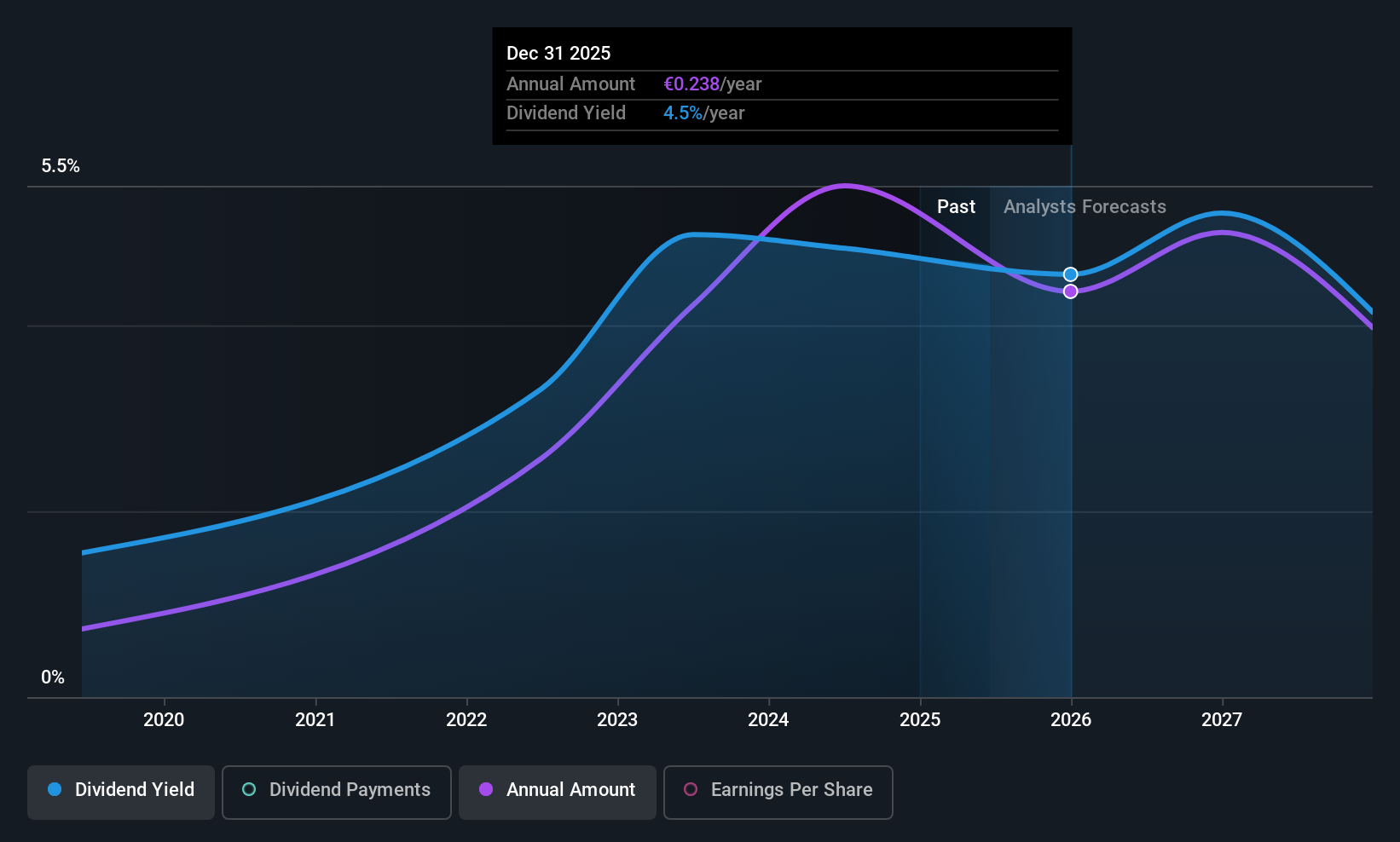

Etablissements Maurel & Prom (ENXTPA:MAU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Etablissements Maurel & Prom S.A. is involved in the exploration and production of oil, gas, and hydrocarbons across Gabon, Tanzania, Angola, and Venezuela with a market cap of €973.76 million.

Operations: Etablissements Maurel & Prom S.A. generates its revenue primarily from production, contributing $554.05 million, and drilling activities, which add $22.23 million to its financial performance.

Dividend Yield: 6.5%

Etablissements Maurel & Prom offers an attractive dividend yield of 6.48%, placing it in the top 25% of French market payers, supported by a low payout ratio of 28.9%. However, its dividend history is unstable, having been paid for less than a decade with volatility over time. Recent sales figures show a decline to $489 million for the first nine months of 2025 from $559 million the previous year, indicating potential challenges ahead.

- Navigate through the intricacies of Etablissements Maurel & Prom with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Etablissements Maurel & Prom shares in the market.

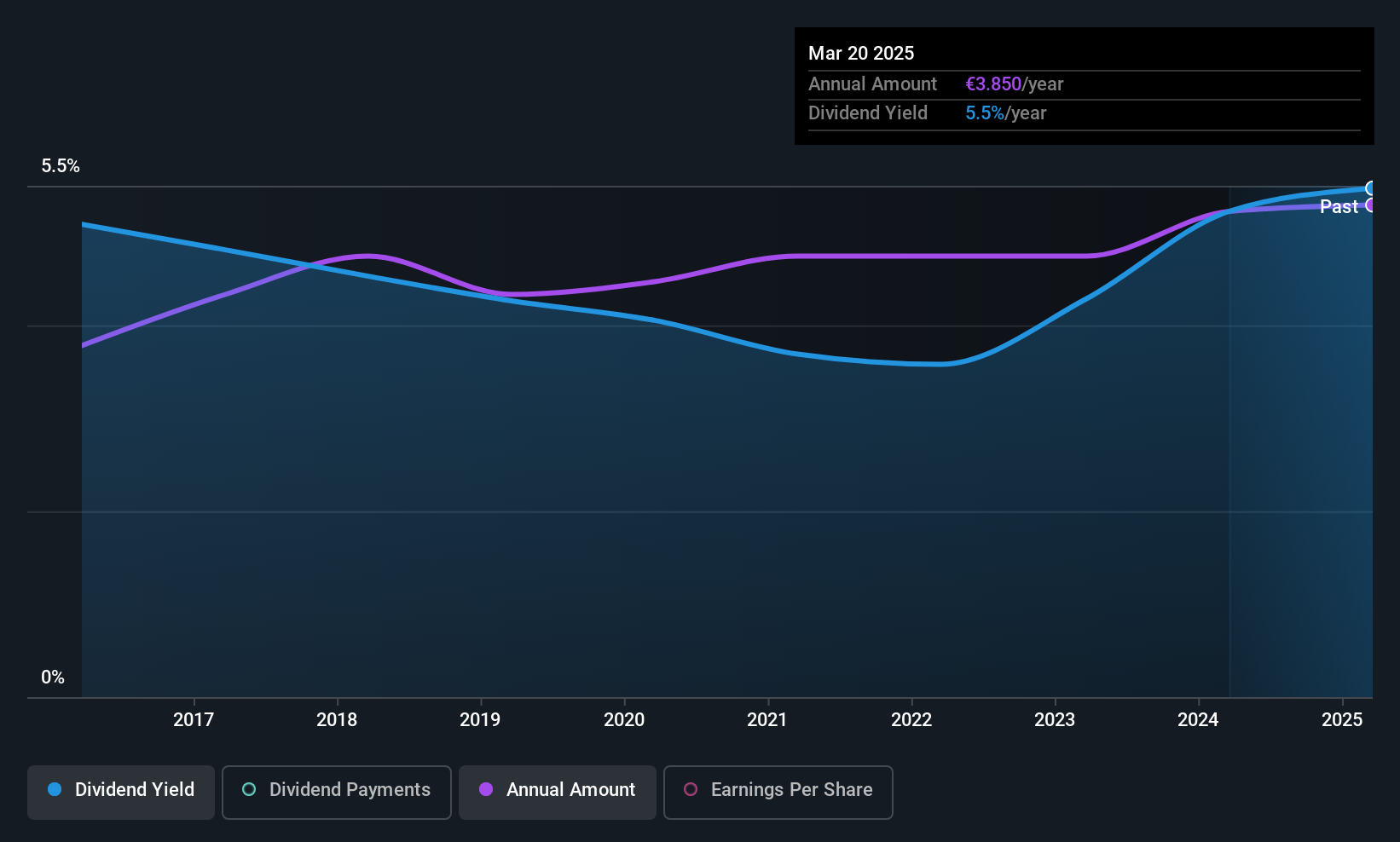

Burgenland Holding (WBAG:BHD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Burgenland Holding Aktiengesellschaft, with a market cap of €225 million, operates through its investment in Burgenland Energie AG to engage in the generation and sale of electricity in Austria.

Operations: Burgenland Holding Aktiengesellschaft derives its revenue primarily from its investment in Burgenland Energie AG, focusing on electricity generation and sales within Austria.

Dividend Yield: 5.1%

Burgenland Holding provides a reliable dividend yield of 5.13%, ranking in the top 25% of Austrian market payers, but its high payout ratio of 94.9% raises concerns about sustainability. Dividends have been stable and growing over the past decade, yet earnings coverage is insufficiently supported by free cash flow data. The stock trades at a discount to its estimated fair value, though shares are highly illiquid and revenue remains under USD$1 million (€0).

- Click here to discover the nuances of Burgenland Holding with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Burgenland Holding is priced lower than what may be justified by its financials.

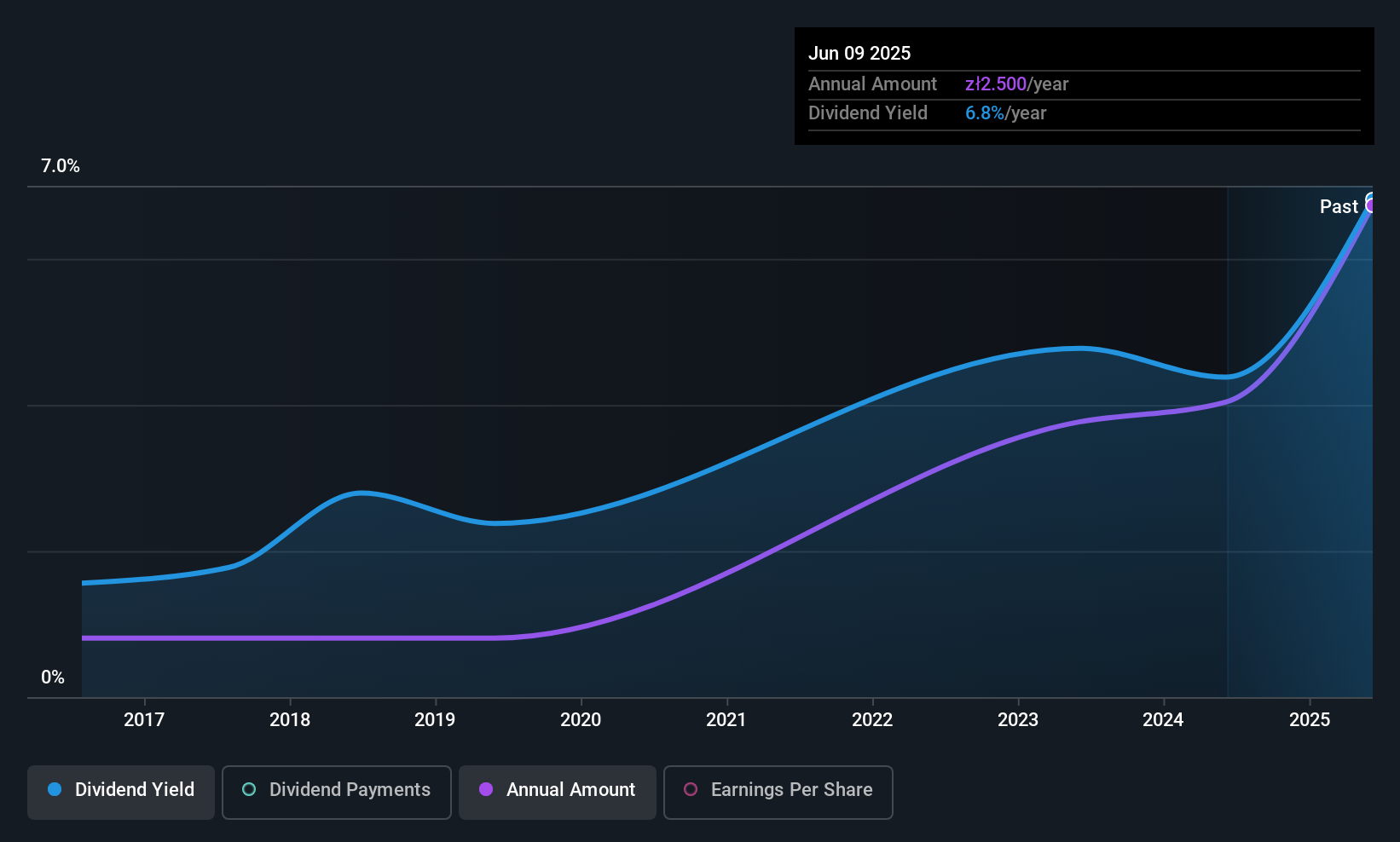

Selena FM (WSE:SEL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Selena FM S.A. operates through its subsidiaries to manufacture and distribute construction chemicals and general construction accessories across the European Union, Eastern Europe, Asia, North America, and South America, with a market cap of PLN850.42 million.

Operations: Selena FM S.A.'s revenue segments are comprised of PLN100.63 million from America, PLN868.32 million from the Parent Company, PLN440.68 million from Western Europe, PLN687.58 million from Production in Poland, PLN310.12 million from Distribution in Poland, and PLN511.32 million from Eastern Europe and Asia.

Dividend Yield: 6.4%

Selena FM's dividend yield of 6.36% falls short compared to the top Polish market payers, yet it trades below estimated fair value. Despite a payout ratio of 63.7%, dividends are covered by earnings and cash flows, but have been volatile over the past decade with significant drops exceeding 20%. Recent earnings show a slight decline in revenue and net income for both Q2 and the first half of 2025, reflecting potential challenges in maintaining stable dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Selena FM.

- According our valuation report, there's an indication that Selena FM's share price might be on the cheaper side.

Seize The Opportunity

- Navigate through the entire inventory of 227 Top European Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Etablissements Maurel & Prom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MAU

Etablissements Maurel & Prom

Engages in exploration and production of oil and gas, and hydrocarbons in Gabon, Tanzania, Angola, and Venezuela.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives