Amidst renewed uncertainty about U.S. trade policy and escalating geopolitical tensions in the Middle East, European markets have faced downward pressure, with the pan-European STOXX Europe 600 Index ending 1.57% lower. In this environment of volatility, dividend stocks can offer a measure of stability by providing consistent income streams, making them an attractive consideration for investors seeking to navigate these challenging market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.48% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.00% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.91% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.64% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.96% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.86% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.34% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.22% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.92% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.51% | ★★★★★★ |

Click here to see the full list of 232 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

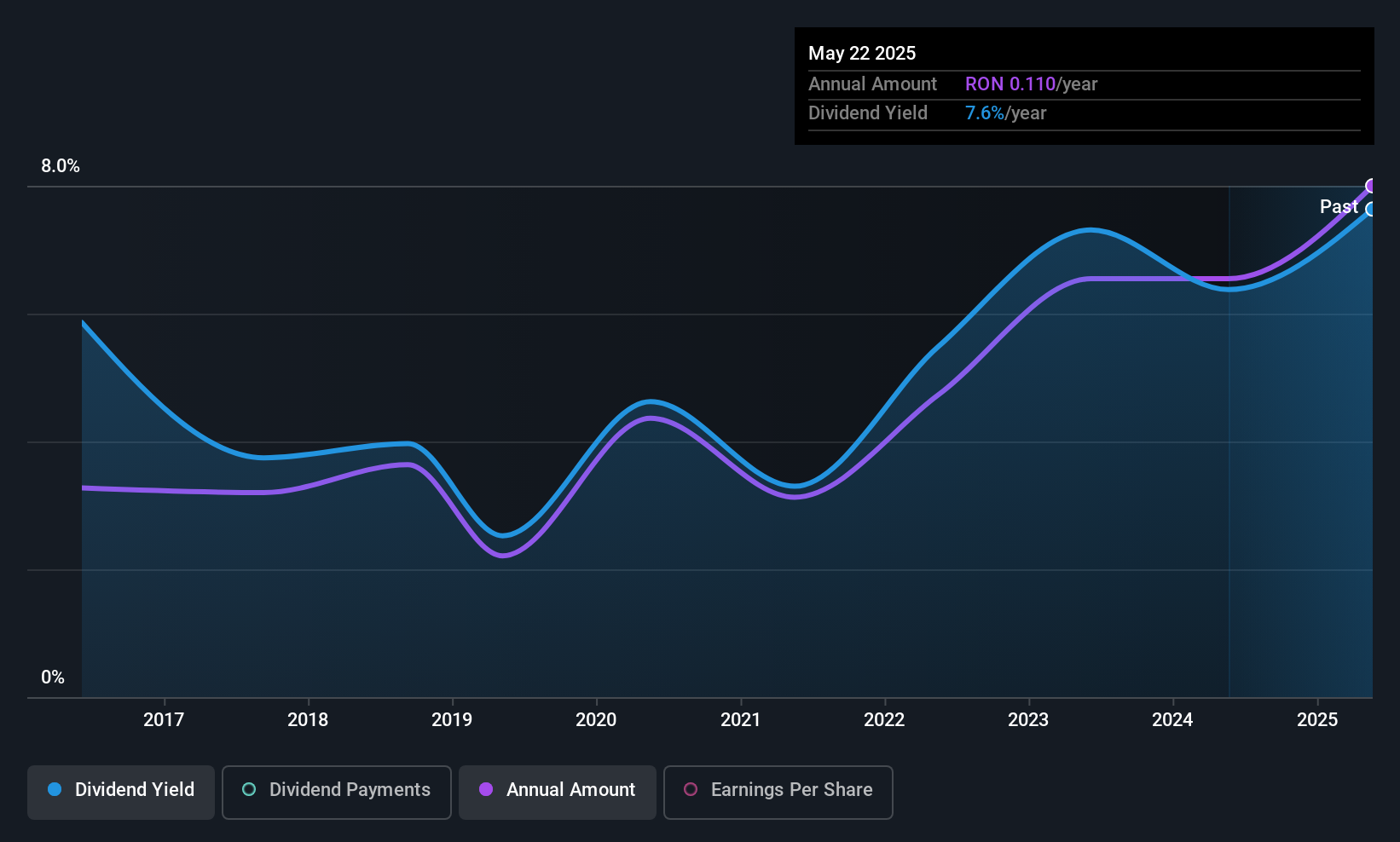

Evergent Investments (BVB:EVER)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evergent Investments SA is a publicly owned investment manager with a market capitalization of RON1.31 billion.

Operations: Evergent Investments generates revenue primarily from Financial Investment Services (RON173.36 million), with additional contributions from the Manufacture of Agricultural Machinery and Equipment (RON24.42 million), Cultivation of Fruit-Bearing Trees like Blueberries (RON5.99 million), and Real Estate Development in Apartments (RON0.69 million).

Dividend Yield: 7.4%

Evergent Investments offers a dividend yield of 7.36%, ranking in the top 25% of Romanian market payers, but its sustainability is questionable due to high cash payout ratios and recent net losses (RON 6.32 million for Q1 2025). While dividends have grown over the past decade, they remain volatile and unreliable. The company's low price-to-earnings ratio (5.4x) suggests potential value, yet dividend coverage by earnings is more secure than by free cash flows.

- Click here and access our complete dividend analysis report to understand the dynamics of Evergent Investments.

- Our valuation report here indicates Evergent Investments may be overvalued.

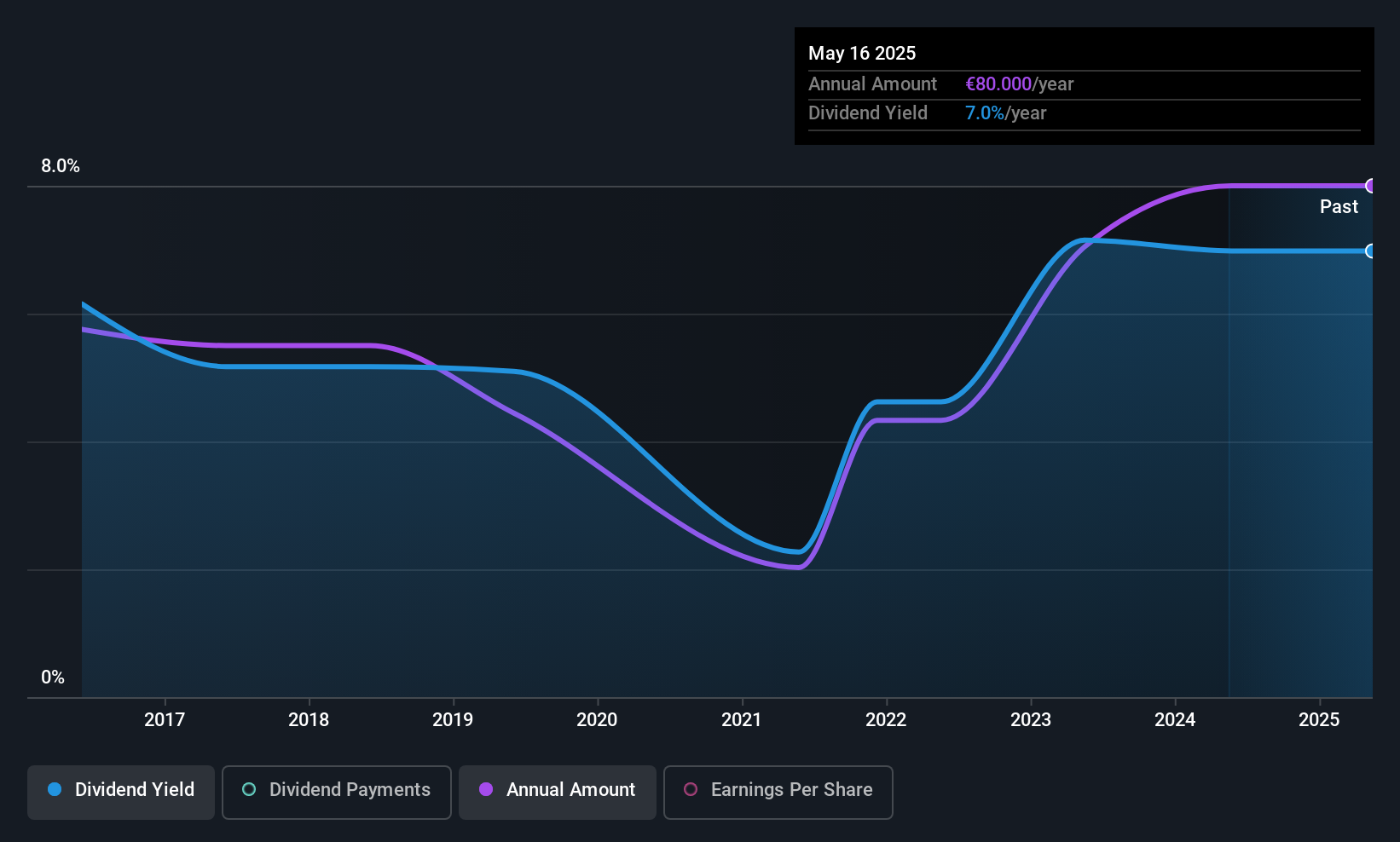

CFM Indosuez Wealth Management (ENXTPA:MLCFM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CFM Indosuez Wealth Management SA, along with its subsidiaries, provides banking and financial solutions in Monaco and internationally, with a market cap of €721.98 million.

Operations: CFM Indosuez Wealth Management SA generates its revenue primarily from its Wealth Management segment, amounting to €196.43 million.

Dividend Yield: 6.2%

CFM Indosuez Wealth Management's dividend yield of 6.19% places it among the top 25% in France, yet its reliability is undermined by a volatile payment history. The recent annual dividend decrease to €78 per share highlights this instability. While dividends have grown over the past decade, their sustainability remains uncertain despite a reasonable payout ratio of 73.6%. The company's price-to-earnings ratio of 12.2x suggests it might offer value compared to the broader French market.

- Delve into the full analysis dividend report here for a deeper understanding of CFM Indosuez Wealth Management.

- The valuation report we've compiled suggests that CFM Indosuez Wealth Management's current price could be inflated.

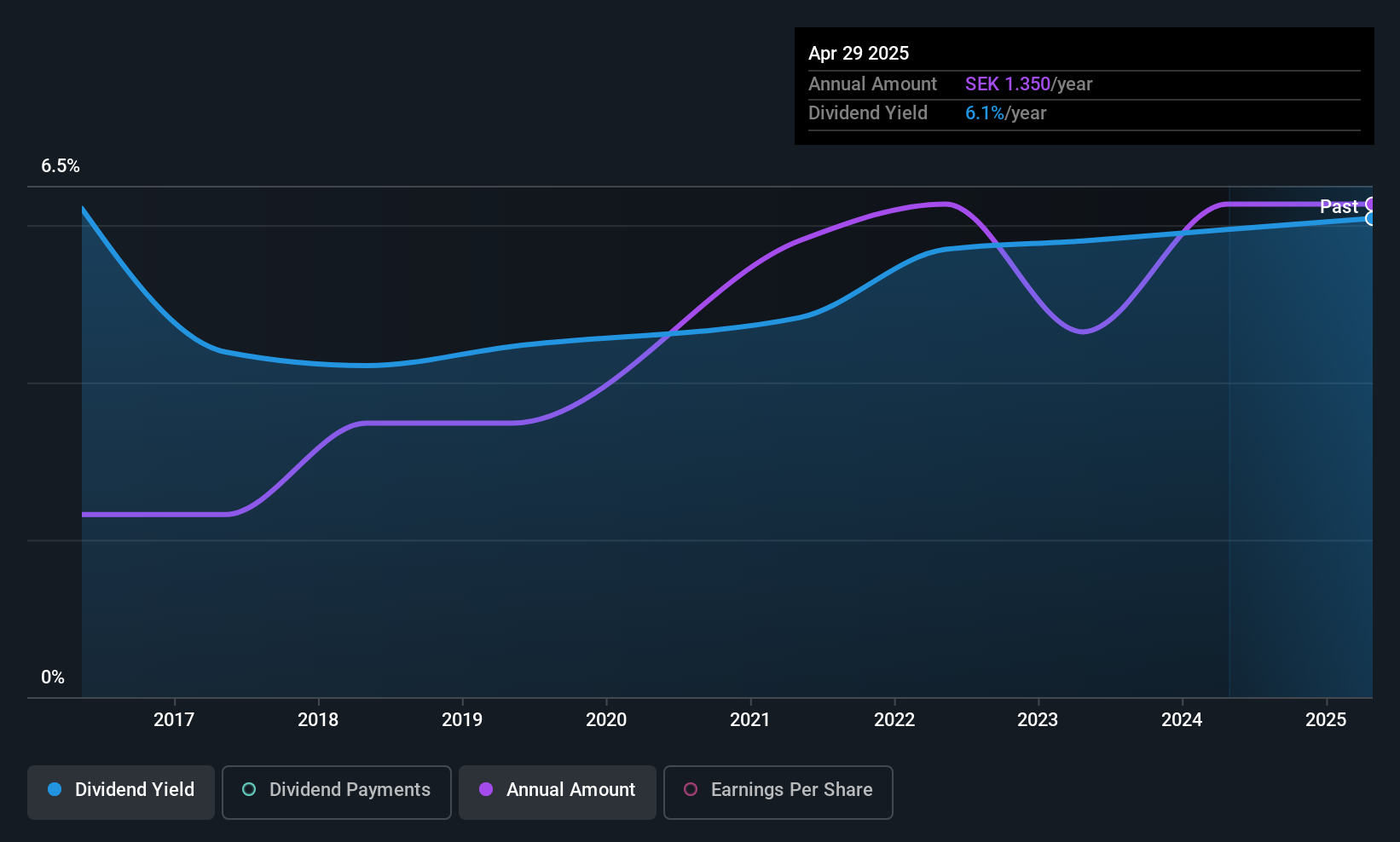

Softronic (OM:SOF B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Softronic AB (publ) offers IT and management services in Sweden, with a market capitalization of approximately SEK1.19 billion.

Operations: Softronic AB (publ) generates revenue primarily from its Computer Services segment, amounting to SEK847.54 million.

Dividend Yield: 5.9%

Softronic's dividend yield of 5.95% ranks it in the top 25% of Swedish dividend payers, supported by a payout ratio of 88.6% and a cash payout ratio of 58.2%, indicating coverage by earnings and cash flows. Despite a decade-long growth in dividends, their reliability is questionable due to past volatility with drops exceeding 20%. Trading at nearly two-thirds below estimated fair value may present an attractive opportunity for investors seeking value.

- Unlock comprehensive insights into our analysis of Softronic stock in this dividend report.

- The analysis detailed in our Softronic valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Navigate through the entire inventory of 232 Top European Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SOF B

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives