3 Asian Stocks Estimated To Be Trading At Discounts Of Up To 41.5%

Reviewed by Simply Wall St

As geopolitical tensions and trade-related concerns continue to shape global markets, Asian indices have shown mixed performances, with some regions experiencing deflationary pressures while others navigate trade negotiations. In this environment, identifying undervalued stocks becomes crucial for investors seeking opportunities amid volatility; such stocks may offer potential value when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiyo Yuden (TSE:6976) | ¥2356.50 | ¥4700.51 | 49.9% |

| Shenzhen Techwinsemi Technology (SZSE:001309) | CN¥127.36 | CN¥252.41 | 49.5% |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥21.78 | CN¥43.41 | 49.8% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥42.92 | CN¥85.28 | 49.7% |

| Polaris Holdings (TSE:3010) | ¥217.00 | ¥428.50 | 49.4% |

| PixArt Imaging (TPEX:3227) | NT$221.00 | NT$436.29 | 49.3% |

| Pansoft (SZSE:300996) | CN¥14.19 | CN¥27.97 | 49.3% |

| Good Will Instrument (TWSE:2423) | NT$44.00 | NT$87.14 | 49.5% |

| Food & Life Companies (TSE:3563) | ¥6534.00 | ¥12865.95 | 49.2% |

| Dive (TSE:151A) | ¥921.00 | ¥1829.36 | 49.7% |

Let's explore several standout options from the results in the screener.

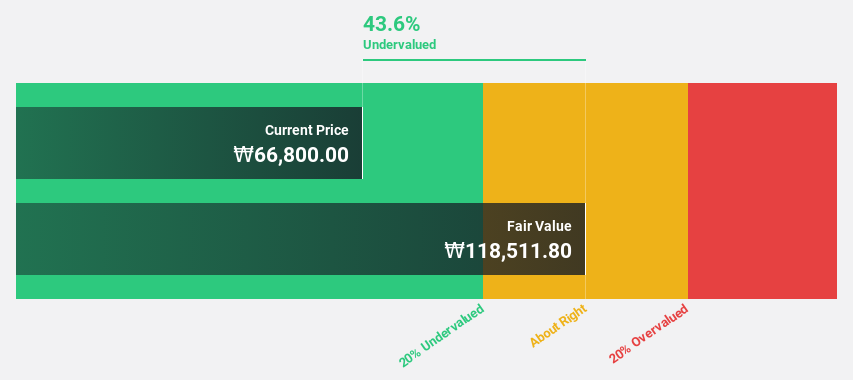

Sanil Electric (KOSE:A062040)

Overview: Sanil Electric Co., Ltd. manufactures and sells transformers in Korea and internationally, with a market cap of ₩2.23 billion.

Operations: Sanil Electric generates revenue of ₩362.18 million from its electric equipment segment.

Estimated Discount To Fair Value: 41.5%

Sanil Electric is trading at ₩73,200, significantly below its estimated fair value of ₩125.11K, suggesting it may be undervalued. The company’s revenue and earnings are expected to grow at 21.7% and 22.73% per year respectively, outpacing the Korean market averages. Despite high non-cash earnings, Sanil's strong growth prospects and a forecasted return on equity of 26.8% in three years highlight its potential as an undervalued investment based on cash flows in Asia.

- Our comprehensive growth report raises the possibility that Sanil Electric is poised for substantial financial growth.

- Take a closer look at Sanil Electric's balance sheet health here in our report.

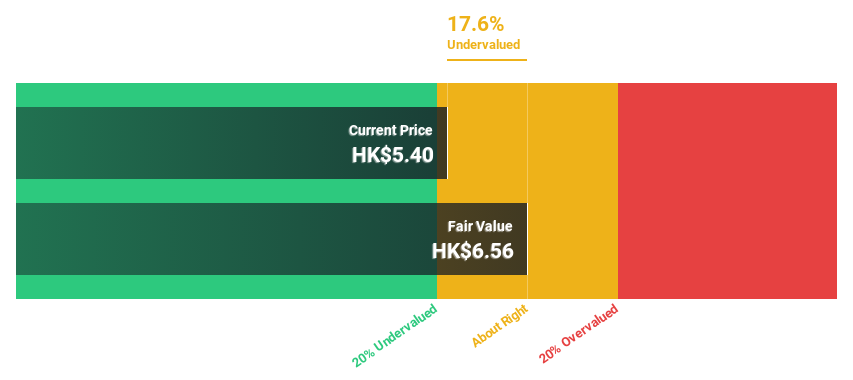

Chinasoft International (SEHK:354)

Overview: Chinasoft International Limited, along with its subsidiaries, offers IT solutions, IT outsourcing, and training services across several countries including China and the United States, with a market cap of HK$12.33 billion.

Operations: The company's revenue segments consist of CN¥14.77 billion from the Technology Professional Services Group and CN¥2.18 billion from the Internet Information Technology Services Group.

Estimated Discount To Fair Value: 19.9%

Chinasoft International, trading at HK$4.95, is valued 19.9% below its estimated fair value of HK$6.18, indicating potential undervaluation based on cash flows. Despite a forecasted low return on equity of 7.5% in three years, its earnings are expected to grow significantly at 20.5% annually, surpassing the Hong Kong market's growth rate. Recent strategic initiatives and product launches in AI and IoT sectors could enhance revenue streams and support future growth prospects.

- According our earnings growth report, there's an indication that Chinasoft International might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Chinasoft International.

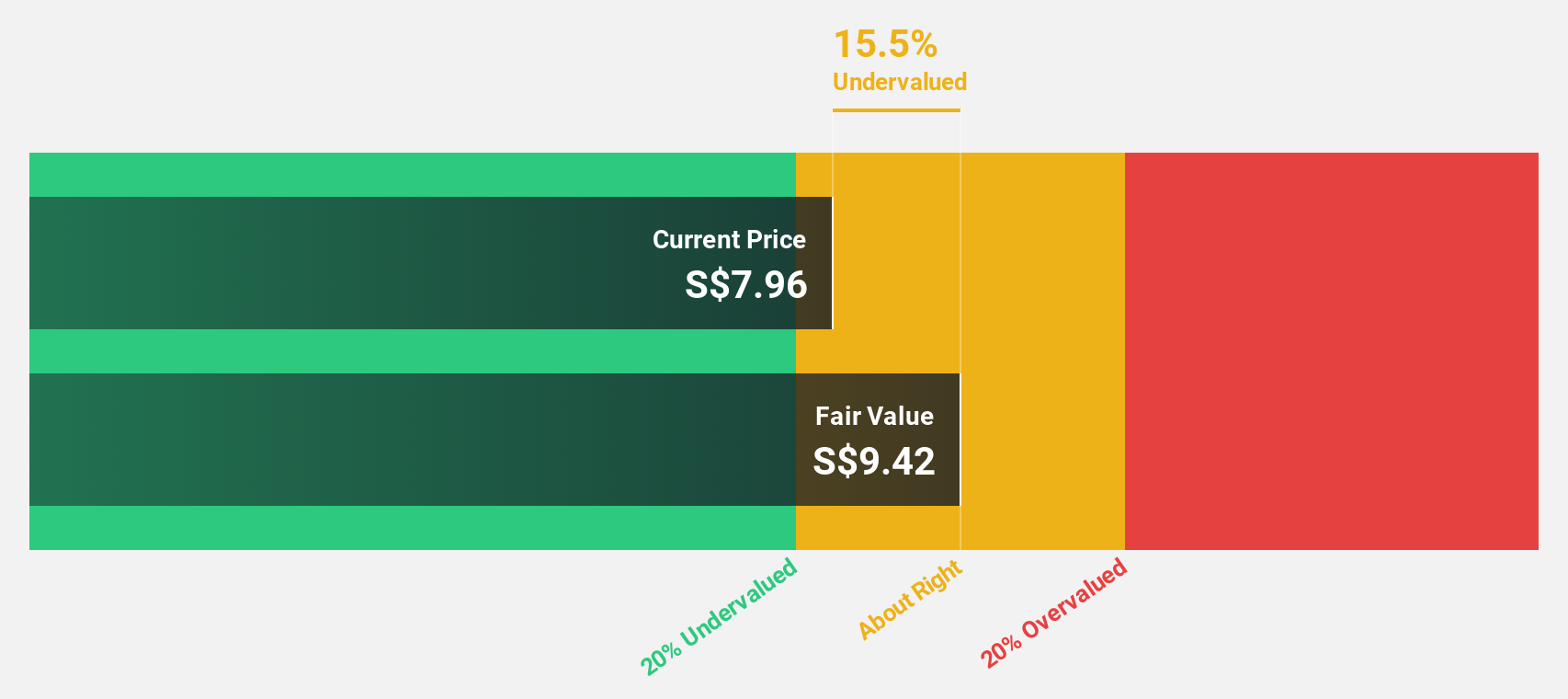

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global technology, defence, and engineering company with a market cap of SGD24.82 billion.

Operations: The company's revenue is derived from three main segments: Commercial Aerospace at SGD4.44 billion, Urban Solutions & Satcom at SGD2.01 billion, and Defence & Public Security at SGD4.97 billion.

Estimated Discount To Fair Value: 16%

Singapore Technologies Engineering is trading at S$7.95, 16% below its estimated fair value of S$9.46, suggesting undervaluation based on cash flows. The company secured S$4.4 billion in new contracts across various segments in Q1 2025, supporting revenue growth forecasts of 7.5% annually—higher than the Singapore market average. Despite a high debt level, earnings are projected to grow at 12.48% per year, outpacing the market's growth rate of 7.1%.

- Insights from our recent growth report point to a promising forecast for Singapore Technologies Engineering's business outlook.

- Navigate through the intricacies of Singapore Technologies Engineering with our comprehensive financial health report here.

Taking Advantage

- Gain an insight into the universe of 292 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:354

Chinasoft International

Engages in development and provision of information technology (IT) solutions, IT outsourcing, and training services in the People’s Republic of China, the United States, Malaysia, Japan, Singapore, India, and Saudi Arabia.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives