- China

- /

- Electrical

- /

- SZSE:002323

3 Asian Penny Stocks With Market Caps Over US$200M

Reviewed by Simply Wall St

As global markets navigate a complex landscape of inflation data and trade negotiations, Asian stock markets have shown resilience, with notable advances in Japan and China. Despite the term 'penny stocks' evoking images of past trading eras, these smaller or newer companies continue to offer intriguing investment opportunities when backed by solid financials. This article explores three such penny stocks in Asia that stand out for their financial strength and potential for growth.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.02 | THB3.95B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$2.90 | HK$2.38B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.47 | HK$977.26M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.49 | HK$2.09B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.625 | SGD255.33M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.17 | HK$1.99B | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.87 | SGD11.33B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.96 | THB1.4B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.74 | THB9.62B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 971 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Brii Biosciences (SEHK:2137)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Brii Biosciences Limited develops therapies for infectious and central nervous system diseases in China and the United States, with a market cap of HK$1.73 billion.

Operations: The company's revenue is generated from its Biotechnology (Startups) segment, amounting to CN¥54.99 million.

Market Cap: HK$1.73B

Brii Biosciences Limited, with a market cap of HK$1.73 billion, is navigating the biotech sector with a focus on infectious and central nervous system diseases. The company recently entered into a strategic agreement with Joincare Pharmaceutical Group for BRII-693, securing an upfront payment and potential milestone payments. Despite being pre-revenue with CN¥54.99 million in revenue from its biotechnology segment, Brii Bio maintains strong financial health; its short-term assets (CN¥2.4 billion) comfortably cover both short- and long-term liabilities. However, it remains unprofitable with negative return on equity and no forecasted profitability within the next three years.

- Click here and access our complete financial health analysis report to understand the dynamics of Brii Biosciences.

- Examine Brii Biosciences' earnings growth report to understand how analysts expect it to perform.

Digital China Holdings (SEHK:861)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Digital China Holdings Limited is an investment holding company that offers big data products and solutions to government and enterprise customers in Mainland China, with a market cap of HK$5.27 billion.

Operations: The company's revenue is primarily derived from three segments: Big Data Products and Solutions (CN¥3.24 billion), Software and Operating Services (CN¥5.52 billion), and Traditional and Localization Services (CN¥7.96 billion).

Market Cap: HK$5.27B

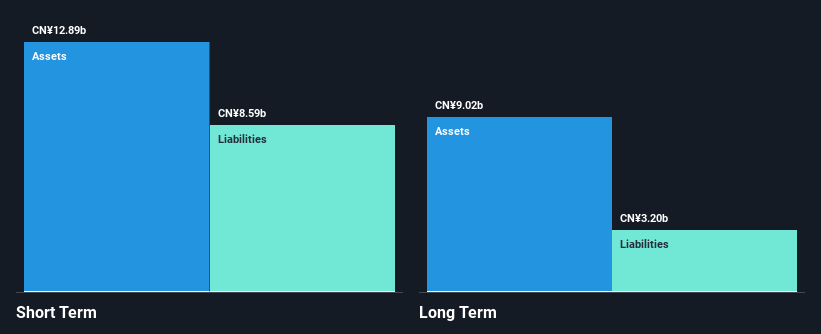

Digital China Holdings, with a market cap of HK$5.27 billion, operates primarily in big data and IT services across Mainland China. Despite being unprofitable, the company has a robust financial position with short-term assets of CN¥14.1 billion surpassing both short- and long-term liabilities. It has more cash than total debt and maintains a sufficient cash runway for over three years even if free cash flow decreases annually by 16%. The board is experienced with an average tenure of three years, while shareholders have not faced meaningful dilution recently. A final dividend was declared for 2024 at 6 Hong Kong cents per share.

- Click to explore a detailed breakdown of our findings in Digital China Holdings' financial health report.

- Learn about Digital China Holdings' historical performance here.

Shandong Yabo Technology (SZSE:002323)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shandong Yabo Technology Co., Ltd specializes in the design, research, and development of new materials for metal roof and wall enclosure systems, with a market cap of CN¥2.72 billion.

Operations: There are no specific revenue segments reported for Shandong Yabo Technology Co., Ltd.

Market Cap: CN¥2.72B

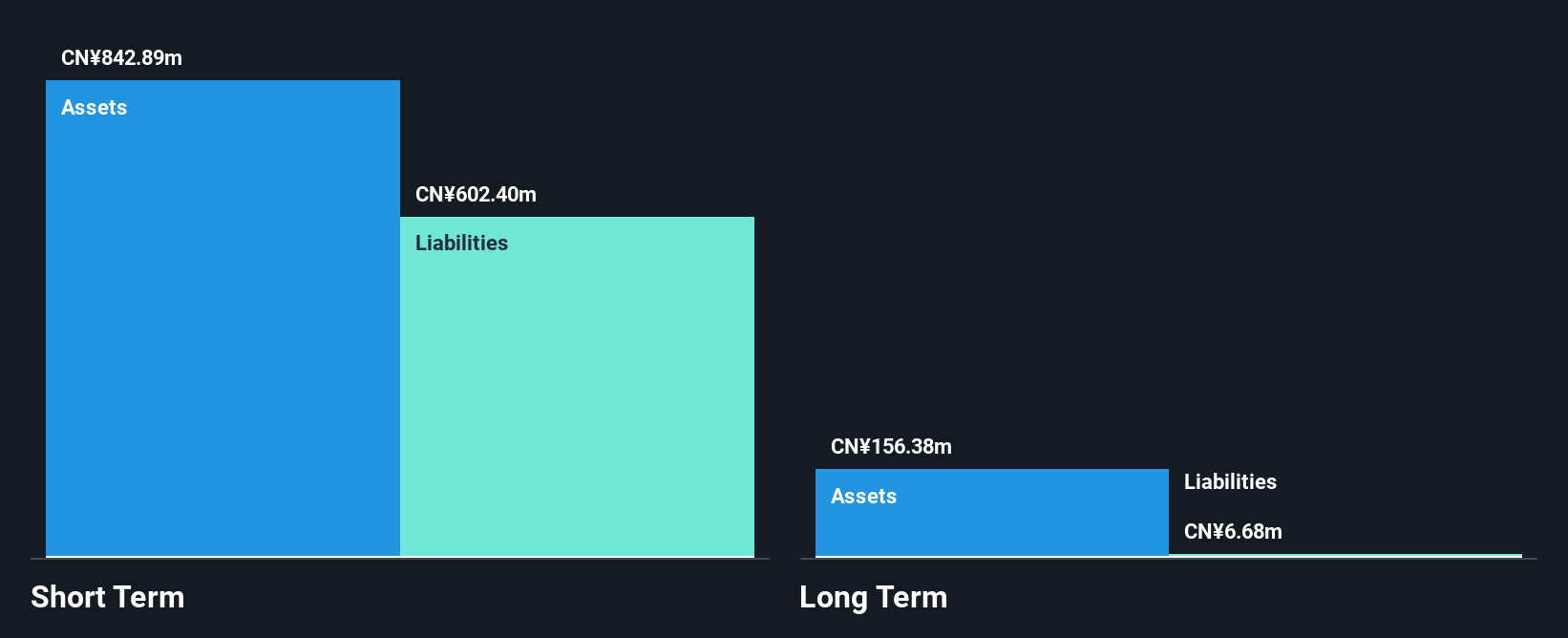

Shandong Yabo Technology, with a market cap of CN¥2.72 billion, focuses on innovative materials for metal roofing and wall systems. Despite being pre-revenue and unprofitable, the company has significantly reduced its debt-to-equity ratio from a very large value to 38.4% over five years, indicating improved financial management. Short-term assets of CN¥842.9 million comfortably cover both short- and long-term liabilities, reflecting sound liquidity. However, the cash runway is less than a year due to negative free cash flow trends. Recent executive changes may impact strategic direction following board elections at the June 2025 AGM.

- Jump into the full analysis health report here for a deeper understanding of Shandong Yabo Technology.

- Explore historical data to track Shandong Yabo Technology's performance over time in our past results report.

Where To Now?

- Unlock more gems! Our Asian Penny Stocks screener has unearthed 968 more companies for you to explore.Click here to unveil our expertly curated list of 971 Asian Penny Stocks.

- Curious About Other Options? Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002323

Shandong Yabo Technology

Engages in the design, research, and development of new materials for metal roof and wall enclosure systems.

Flawless balance sheet with weak fundamentals.

Market Insights

Community Narratives