- China

- /

- Electronic Equipment and Components

- /

- SZSE:002388

3 Asian Penny Stocks With At Least US$300M Market Cap

Reviewed by Simply Wall St

As global markets navigate a complex landscape, with U.S.-China trade tensions and economic indicators in flux, investors are increasingly looking toward alternative opportunities. Penny stocks, often representing smaller or newer companies, continue to capture interest despite being considered an outdated term. These stocks can offer unique growth prospects at lower price points, especially when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.099 | SGD42.08M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.14 | HK$719.28M | ✅ 4 ⚠️ 2 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.89 | HK$3.27B | ✅ 5 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.06 | HK$1.72B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.44 | SGD178.33M | ✅ 3 ⚠️ 3 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.17 | HK$1.95B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.29 | SGD9.01B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.179 | SGD35.66M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.13 | SGD858.72M | ✅ 3 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.39 | HK$50.29B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,153 stocks from our Asian Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Sunyes Manufacturing (Zhejiang) Holding (SZSE:002388)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sunyes Manufacturing (Zhejiang) Holding Co., Ltd. operates in the manufacturing sector and has a market cap of approximately CN¥2.19 billion.

Operations: Sunyes Manufacturing (Zhejiang) Holding Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.19B

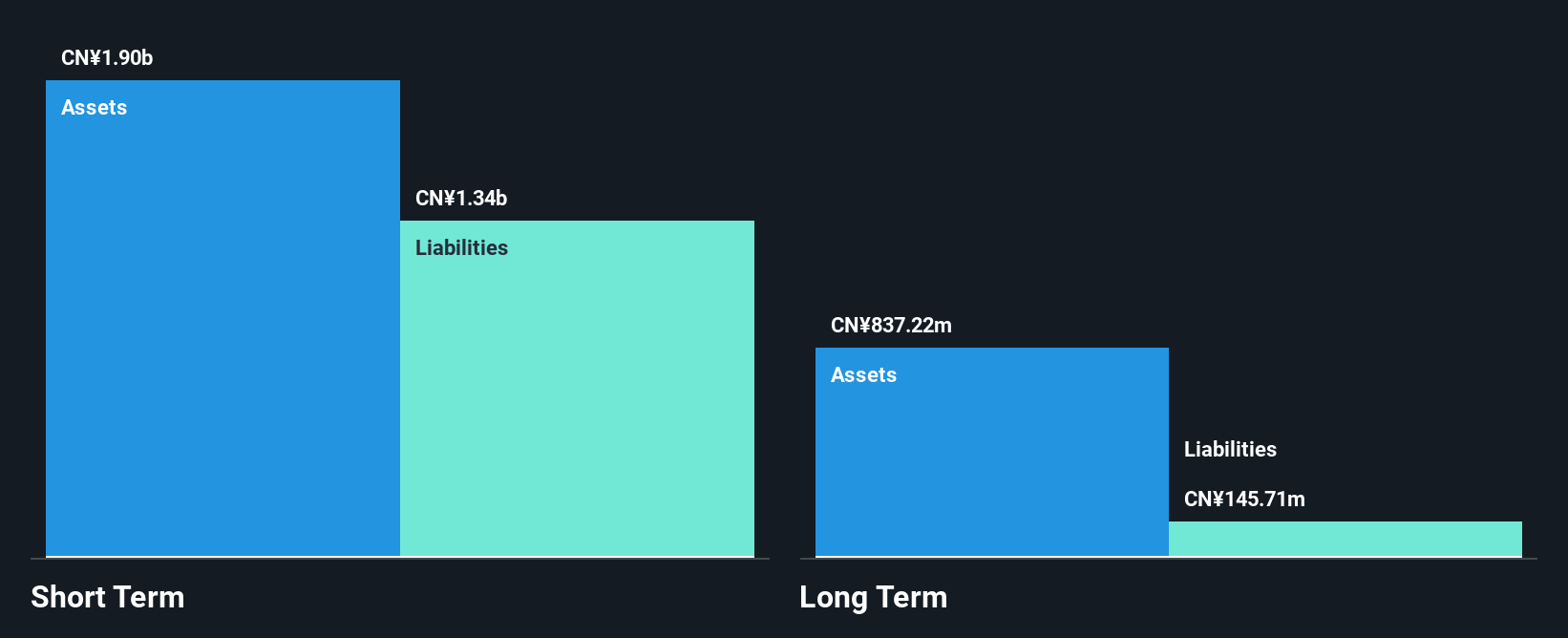

Sunyes Manufacturing (Zhejiang) Holding Co., Ltd. has shown financial resilience despite being unprofitable, with a stable weekly volatility and satisfactory net debt to equity ratio of 34.4%. The company reported a slight improvement in its financials, with annual revenue reaching CN¥2.20 billion and a reduced net loss of CN¥236.12 million for 2024 compared to the previous year. Short-term assets cover both short- and long-term liabilities, indicating sound liquidity management. Recent amendments to the company's articles of association were approved at their AGM, reflecting potential strategic adjustments moving forward.

- Dive into the specifics of Sunyes Manufacturing (Zhejiang) Holding here with our thorough balance sheet health report.

- Learn about Sunyes Manufacturing (Zhejiang) Holding's historical performance here.

New JCM GroupLtd (SZSE:300157)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: New JCM Group Co., Ltd, along with its subsidiaries, operates in the equipment manufacturing sector both in China and internationally, with a market capitalization of CN¥2.83 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥2.83B

New JCM Group Co., Ltd has navigated financial challenges, showing a significant reduction in losses over the past five years despite being unprofitable. The company's short-term assets of CN¥1.1 billion exceed long-term liabilities but fall short of covering its CN¥1.6 billion short-term liabilities, indicating potential liquidity concerns. However, the firm maintains a satisfactory net debt to equity ratio of 23.4% and has not diluted shareholders meaningfully in the past year. Recent changes to its registered capital and articles of association suggest strategic shifts that could impact future operations and financial structure.

- Unlock comprehensive insights into our analysis of New JCM GroupLtd stock in this financial health report.

- Gain insights into New JCM GroupLtd's past trends and performance with our report on the company's historical track record.

Hainan Shennong Seed Industry Technology (SZSE:300189)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hainan Shennong Seed Industry Technology Co., Ltd. operates in the agricultural sector, focusing on seed development and production, with a market cap of CN¥4.44 billion.

Operations: Hainan Shennong Seed Industry Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.44B

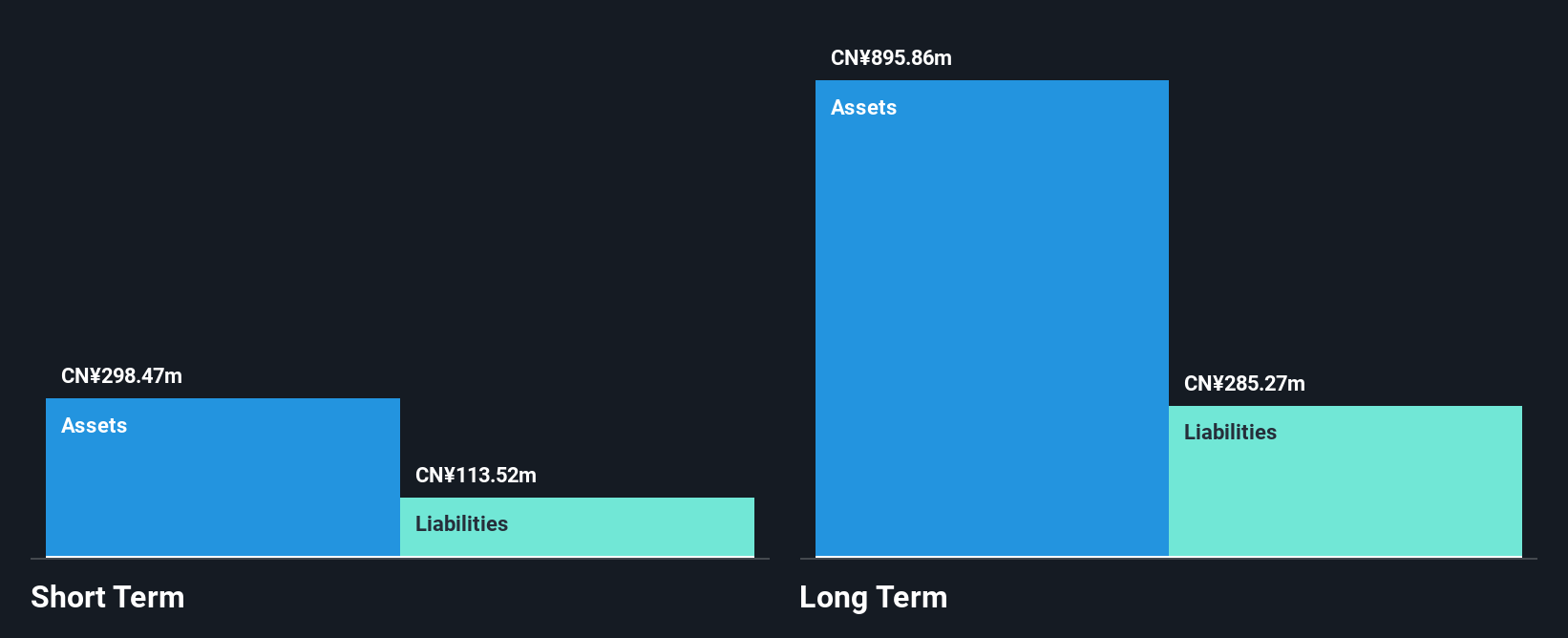

Hainan Shennong Seed Industry Technology has demonstrated a reduction in losses over the past five years, though it remains unprofitable. The company's short-term assets of CN¥270.4 million comfortably cover its long-term liabilities of CN¥267.1 million and short-term liabilities of CN¥99.8 million, reflecting a stable financial position despite its high debt to equity ratio increase to 28.5% over five years. Recent earnings show decreased revenue and increased net loss year-over-year, with net loss for Q1 2025 at CN¥0.98 million compared to CN¥8.25 million in the prior year, indicating some improvement in cost management amidst volatility concerns.

- Navigate through the intricacies of Hainan Shennong Seed Industry Technology with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Hainan Shennong Seed Industry Technology's track record.

Next Steps

- Access the full spectrum of 1,153 Asian Penny Stocks by clicking on this link.

- Contemplating Other Strategies? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002388

Sunyes Manufacturing (Zhejiang) Holding

Sunyes Manufacturing (Zhejiang) Holding Co., Ltd.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives