As global markets grapple with trade policy uncertainties and economic slowdowns, Asian markets have also felt the impact, with indices in Japan and China experiencing declines amid renewed tariff concerns. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for investors seeking to navigate these turbulent times.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.24% | ★★★★★★ |

| NCD (TSE:4783) | 4.02% | ★★★★★★ |

| JW Holdings (KOSE:A096760) | 4.43% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.11% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.57% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.05% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.37% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

| Daicel (TSE:4202) | 4.68% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

Click here to see the full list of 1154 stocks from our Top Asian Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Sanki Engineering (TSE:1961)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sanki Engineering Co., Ltd. offers a range of social infrastructure services both in Japan and internationally, with a market cap of ¥239.76 billion.

Operations: Sanki Engineering Co., Ltd.'s revenue is derived from its Mechanical System segment at ¥10.93 billion, Real Estate Business at ¥2.59 billion, Building Equipment Business at ¥208.98 billion, and Environmental Systems Business at ¥31.30 billion.

Dividend Yield: 3.6%

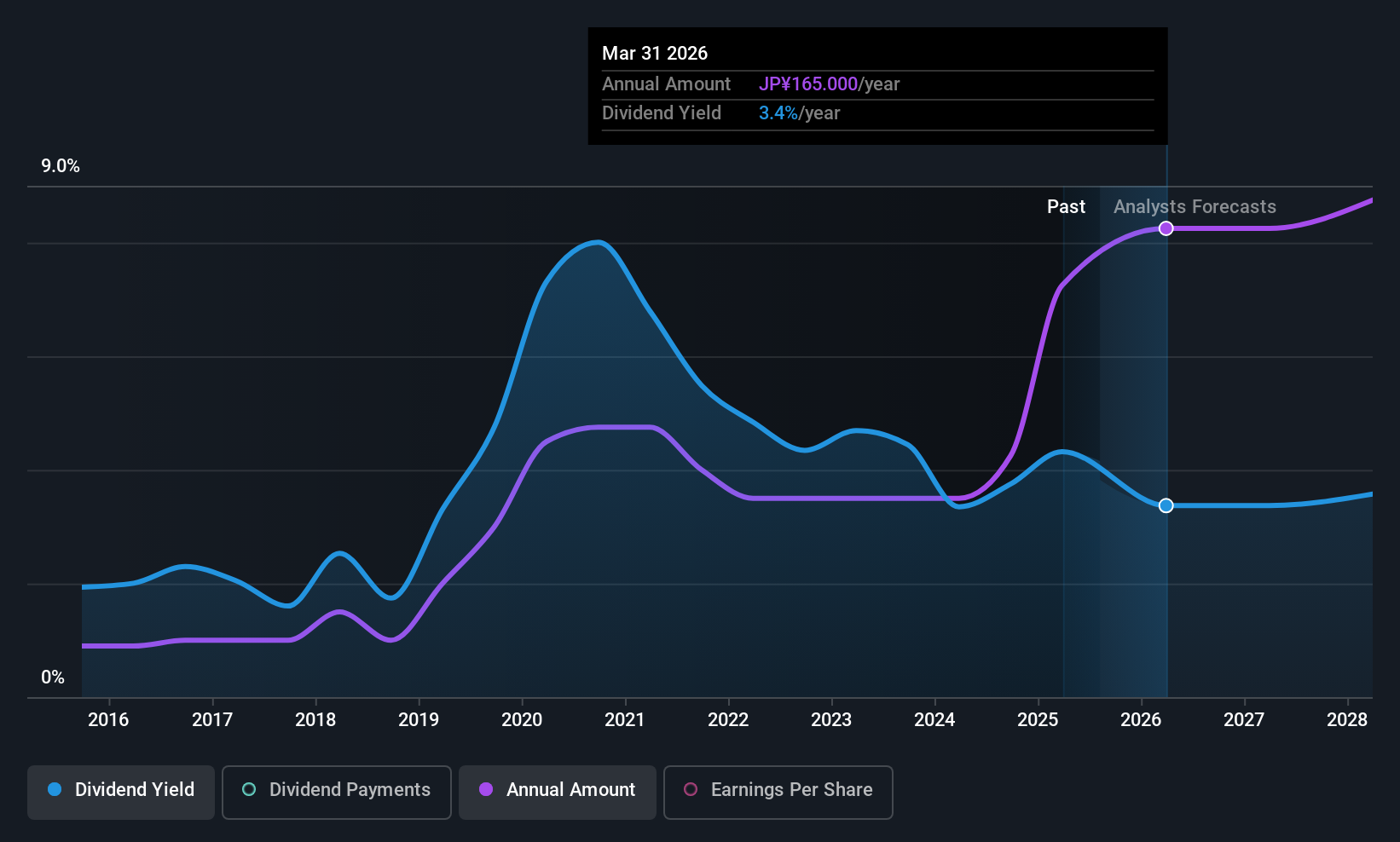

Sanki Engineering's recent dividend increase to ¥110 per share for the fiscal year ended March 2025 highlights its commitment to returning value to shareholders, despite a volatile dividend history. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 50.6% and 29.8%, respectively. However, the anticipated decrease in dividends to ¥82.50 per share for fiscal year ending March 2026 suggests caution due to potential instability in future payouts.

- Dive into the specifics of Sanki Engineering here with our thorough dividend report.

- The valuation report we've compiled suggests that Sanki Engineering's current price could be quite moderate.

Japan Tobacco (TSE:2914)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Japan Tobacco Inc. is a company that manufactures and sells tobacco products, pharmaceuticals, and processed foods both in Japan and internationally, with a market cap of ¥8.13 trillion.

Operations: Japan Tobacco Inc. generates revenue primarily from its tobacco segment, which accounts for ¥3.05 trillion, followed by processed foods at ¥160.14 billion and pharmaceuticals at ¥98.74 billion.

Dividend Yield: 4.5%

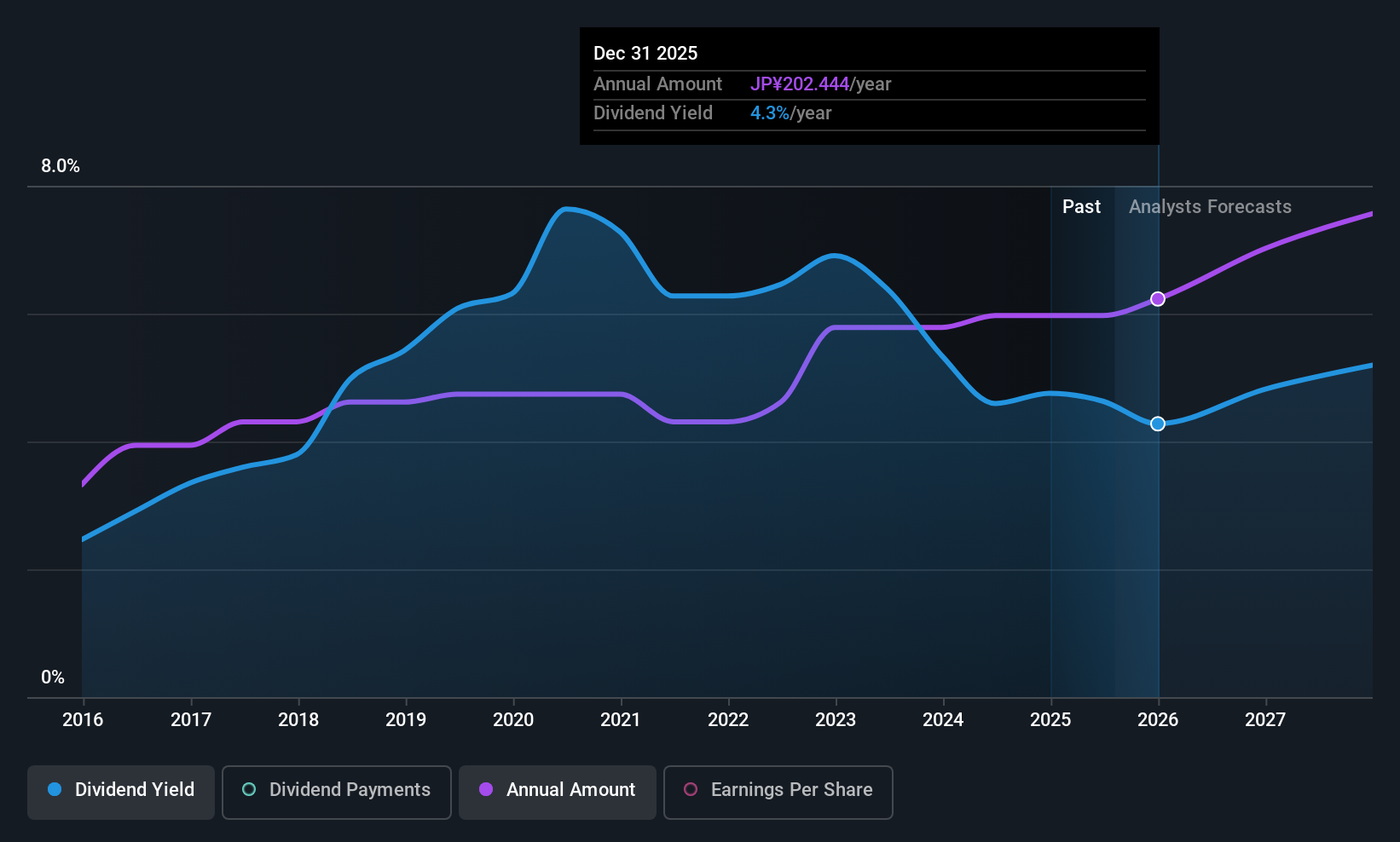

Japan Tobacco's recent dividend increase to ¥104 per share for the second quarter, alongside an upward revision in year-end dividend guidance, underscores its focus on rewarding shareholders. Despite a volatile dividend history and high cash payout ratio of 95.1%, dividends are covered by earnings with a payout ratio of 74.6%. The company's raised earnings forecast for 2025 suggests potential stability, though free cash flow coverage remains weak, indicating possible sustainability concerns.

- Click here and access our complete dividend analysis report to understand the dynamics of Japan Tobacco.

- Our valuation report here indicates Japan Tobacco may be undervalued.

EM Systems (TSE:4820)

Simply Wall St Dividend Rating: ★★★★★★

Overview: EM Systems Co., Ltd. develops and sells IT systems for pharmacies, clinics, and care/welfare businesses in Japan, with a market cap of ¥53.51 billion.

Operations: EM Systems Co., Ltd. generates revenue through the development and sale of IT systems tailored for pharmacies, clinics, and care/welfare sectors in Japan.

Dividend Yield: 4.5%

EM Systems' dividend outlook for 2025 shows a mixed picture, with second-quarter dividends rising to ¥17 per share compared to last year's ¥9, yet the annual forecast is reduced from ¥26 to ¥18. Despite this cut, dividends remain well-covered by earnings and cash flows with payout ratios of 81.7% and 48.4%, respectively. The company’s recent strategic focus on healthcare technology has boosted interim earnings forecasts, potentially supporting future dividend stability amidst office repair expenses.

- Get an in-depth perspective on EM Systems' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that EM Systems is priced lower than what may be justified by its financials.

Key Takeaways

- Discover the full array of 1154 Top Asian Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2914

Japan Tobacco

A tobacco company, manufactures and sells tobacco products, pharmaceuticals, and processed foods in Japan and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives