- Japan

- /

- Basic Materials

- /

- TSE:5285

3 Asian Dividend Stocks To Watch With Up To 5.1% Yield

Reviewed by Simply Wall St

As geopolitical tensions in the Middle East escalate and trade talks between the U.S. and China show signs of progress, Asian markets have been navigating a complex landscape with mixed results. In this environment, dividend stocks can offer investors a measure of stability and income, making them an attractive option to consider amidst market fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.63% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.38% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.14% | ★★★★★★ |

| NCD (TSE:4783) | 4.23% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.30% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.19% | ★★★★★★ |

| Daicel (TSE:4202) | 5.00% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.89% | ★★★★★★ |

Click here to see the full list of 1240 stocks from our Top Asian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

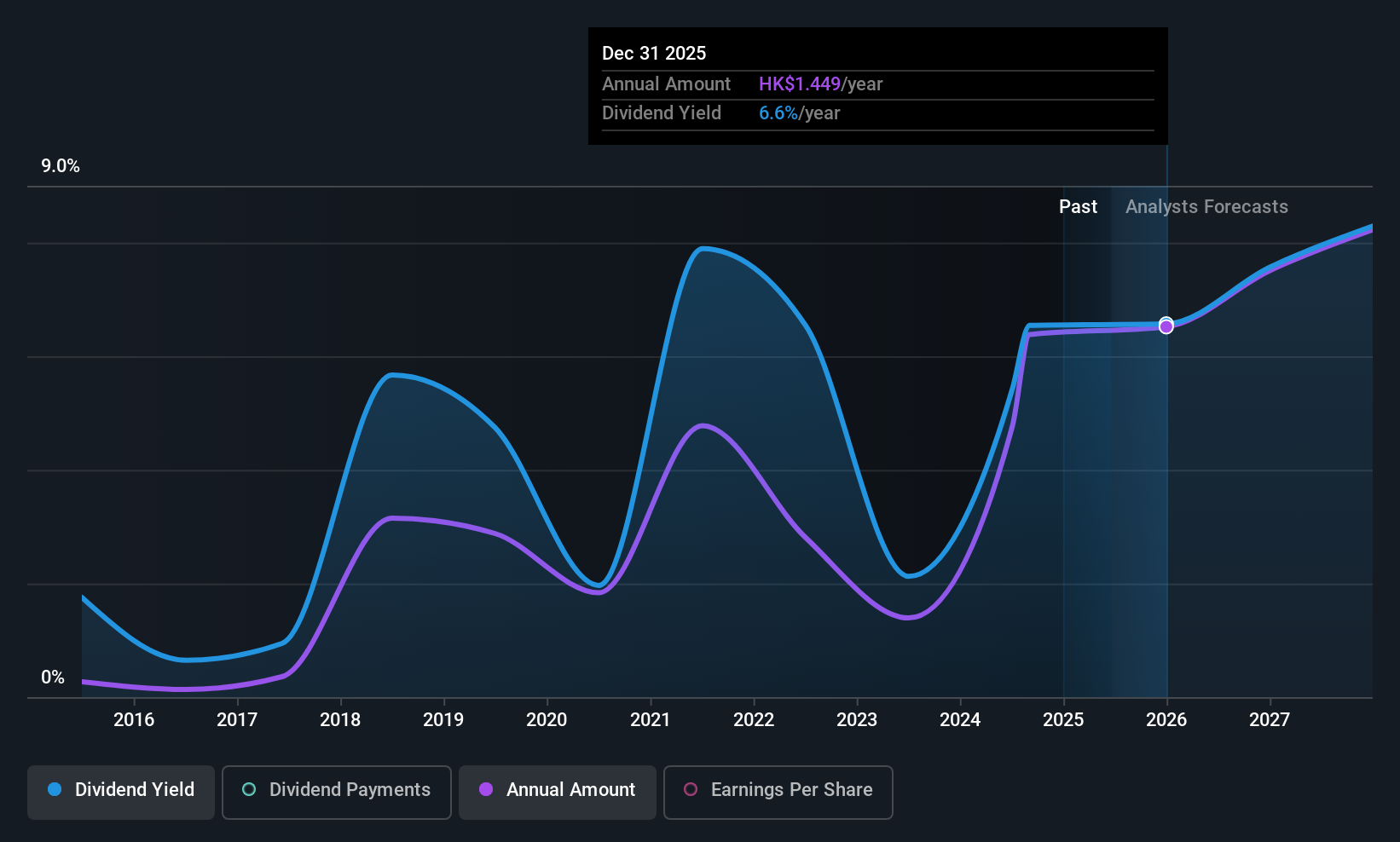

Sinotruk (Hong Kong) (SEHK:3808)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sinotruk (Hong Kong) Limited is an investment holding company involved in the research, development, manufacture, and sale of heavy-duty trucks, medium-heavy duty trucks, light duty trucks, buses, and related parts and components both in Mainland China and internationally with a market cap of approximately HK$59.91 billion.

Operations: Sinotruk (Hong Kong) Limited generates revenue from several segments, including Heavy Duty Trucks at CN¥84.15 billion, Engines at CN¥13.92 billion, Light Duty Trucks and Others at CN¥11.16 billion, and Finance at CN¥1.48 billion.

Dividend Yield: 5.1%

Sinotruk (Hong Kong) offers a mixed outlook for dividend investors. While the company's dividends are well-covered by earnings and cash flows, with payout ratios of 54.8% and 35.9% respectively, its dividend history has been volatile over the past decade. Recent announcements include a final dividend of HK$1.52 billion or RMB1.41 billion for 2024, subject to shareholder approval in June 2025. Despite trading at good value compared to peers, its yield is lower than top-tier payers in Hong Kong.

- Get an in-depth perspective on Sinotruk (Hong Kong)'s performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Sinotruk (Hong Kong)'s share price might be too pessimistic.

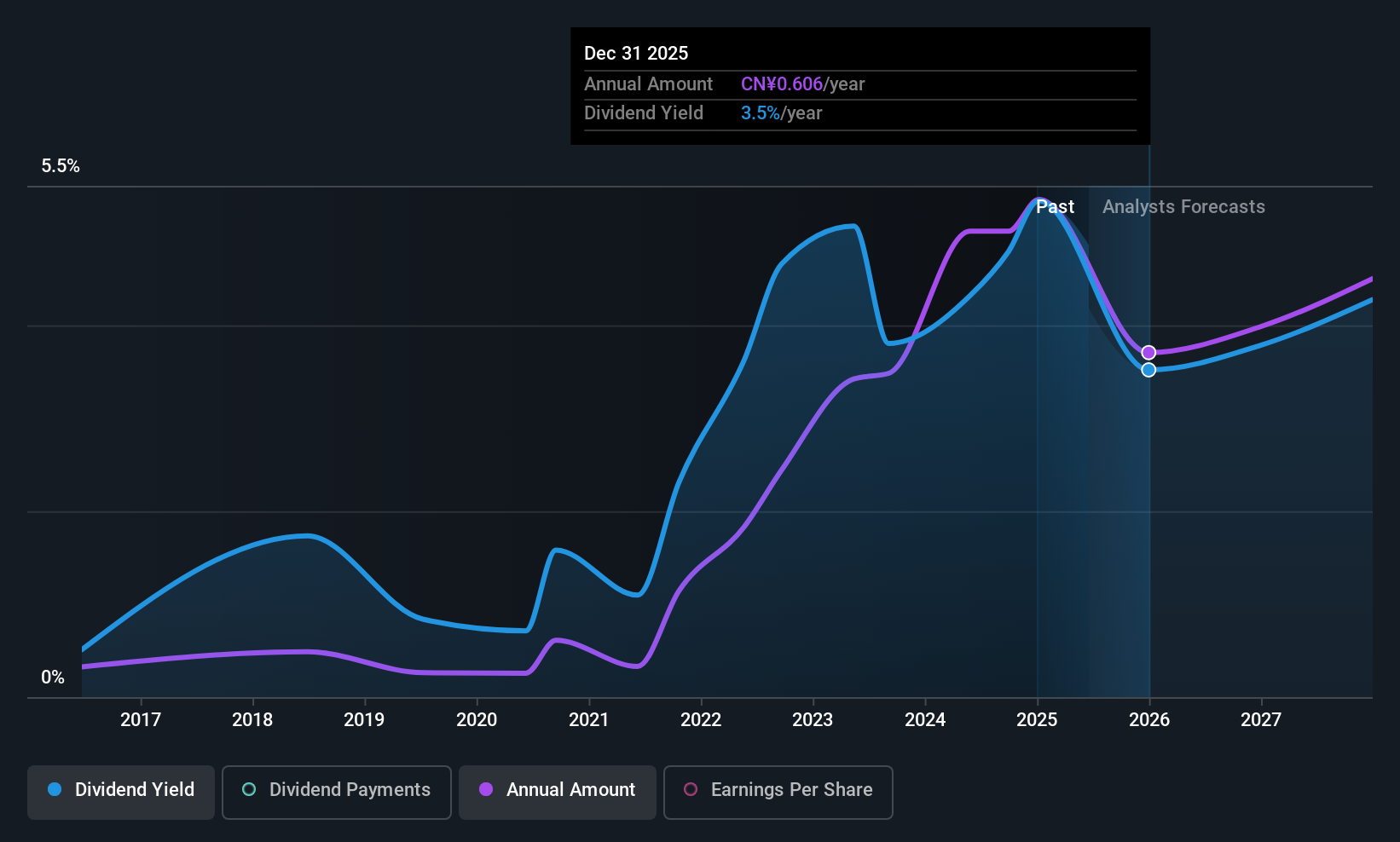

Huaming Power EquipmentLtd (SZSE:002270)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Huaming Power Equipment Co., Ltd specializes in providing tap changer products in China with a market cap of CN¥15.37 billion.

Operations: Huaming Power Equipment Co., Ltd generates its revenue primarily from the sale of tap changer products in China.

Dividend Yield: 3.2%

Huaming Power Equipment Ltd. presents a nuanced picture for dividend investors. The company has declared a cash dividend of CNY 2.20 per 10 shares for 2024, with dividends covered by earnings and cash flows at payout ratios of 73.8% and 72.6%, respectively. However, its dividend history is marked by volatility over the past nine years despite recent growth in payments and being among the top-tier yields in the Chinese market at 3.18%.

- Take a closer look at Huaming Power EquipmentLtd's potential here in our dividend report.

- Our valuation report here indicates Huaming Power EquipmentLtd may be undervalued.

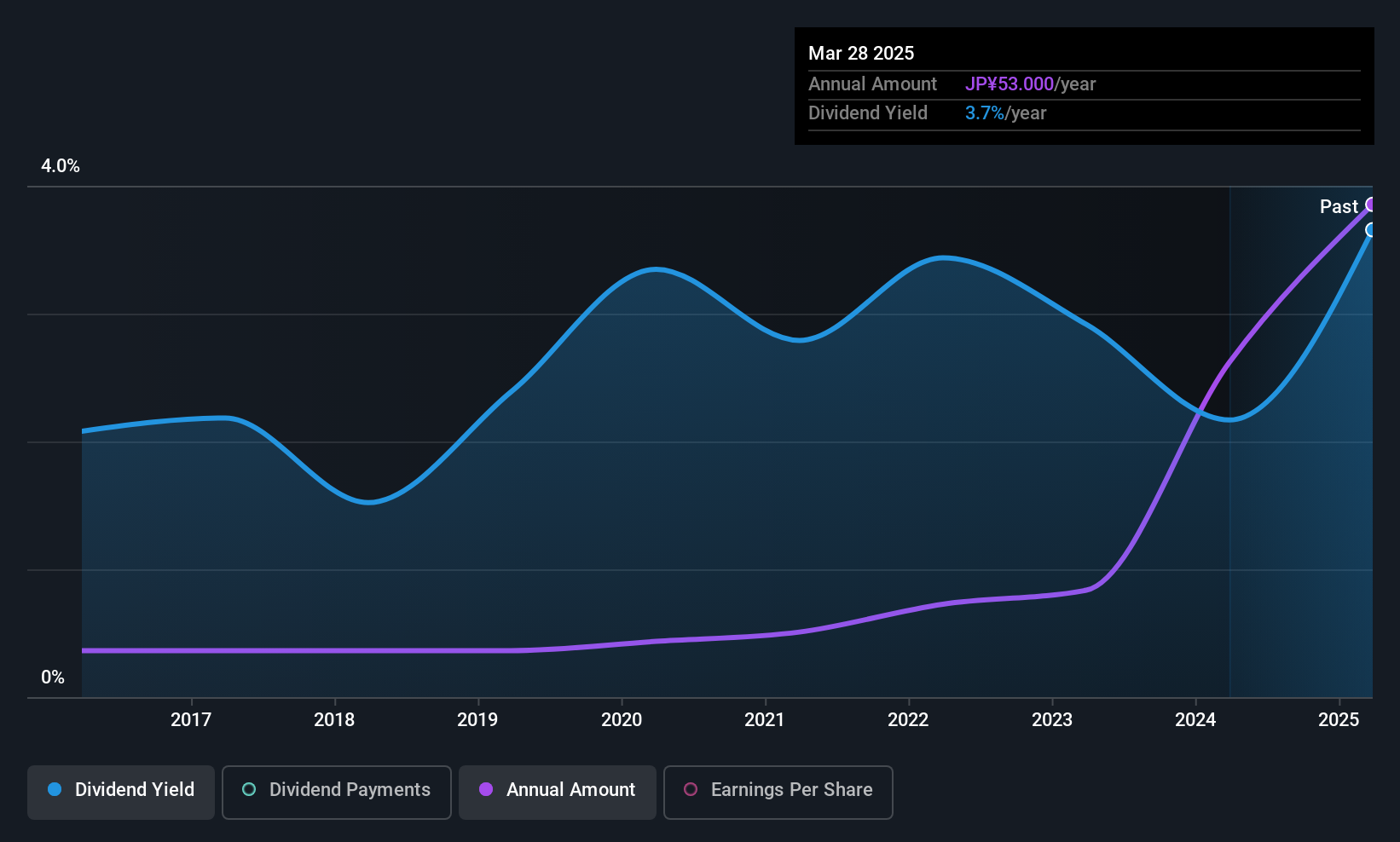

Yamax (TSE:5285)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yamax Corp. is involved in the manufacture and sale of concrete and cement products for construction and civil engineering projects in Japan, with a market cap of ¥16.35 billion.

Operations: Yamax Corp.'s revenue primarily comes from its Architectural Cement Products segment, generating ¥6.28 billion, and its Cement Manufacture for Engineering Works segment, contributing ¥16.15 billion.

Dividend Yield: 3.9%

Yamax's dividend payments are well-supported by earnings, with a payout ratio of 28.5%, and are covered by cash flows at a cash payout ratio of 85.9%. Over the past decade, dividends have been stable and growing, though the yield of 3.91% is slightly below Japan's top quartile payers. Despite recent share price volatility, Yamax offers good value with a P/E ratio of 8.3x compared to the market average of 13.1x.

- Dive into the specifics of Yamax here with our thorough dividend report.

- Our valuation report here indicates Yamax may be overvalued.

Next Steps

- Delve into our full catalog of 1240 Top Asian Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5285

Yamax

Engages in the manufacture and sale of concrete and cement products for the construction and civil engineering projects in Japan.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives