3 Asian Dividend Stocks To Consider With At Least 3.6% Yield

Reviewed by Simply Wall St

As global markets face challenges from renewed tariffs and trade policy uncertainties, Asian economies are also navigating their own set of complexities, including fluctuating economic indicators and evolving monetary policies. In this environment, dividend stocks can offer a measure of stability and income potential for investors seeking to balance risk with reliable returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.17% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.79% | ★★★★★★ |

| NCD (TSE:4783) | 4.00% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.04% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.47% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.11% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.20% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.76% | ★★★★★★ |

| Daicel (TSE:4202) | 4.56% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.79% | ★★★★★★ |

Click here to see the full list of 1129 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

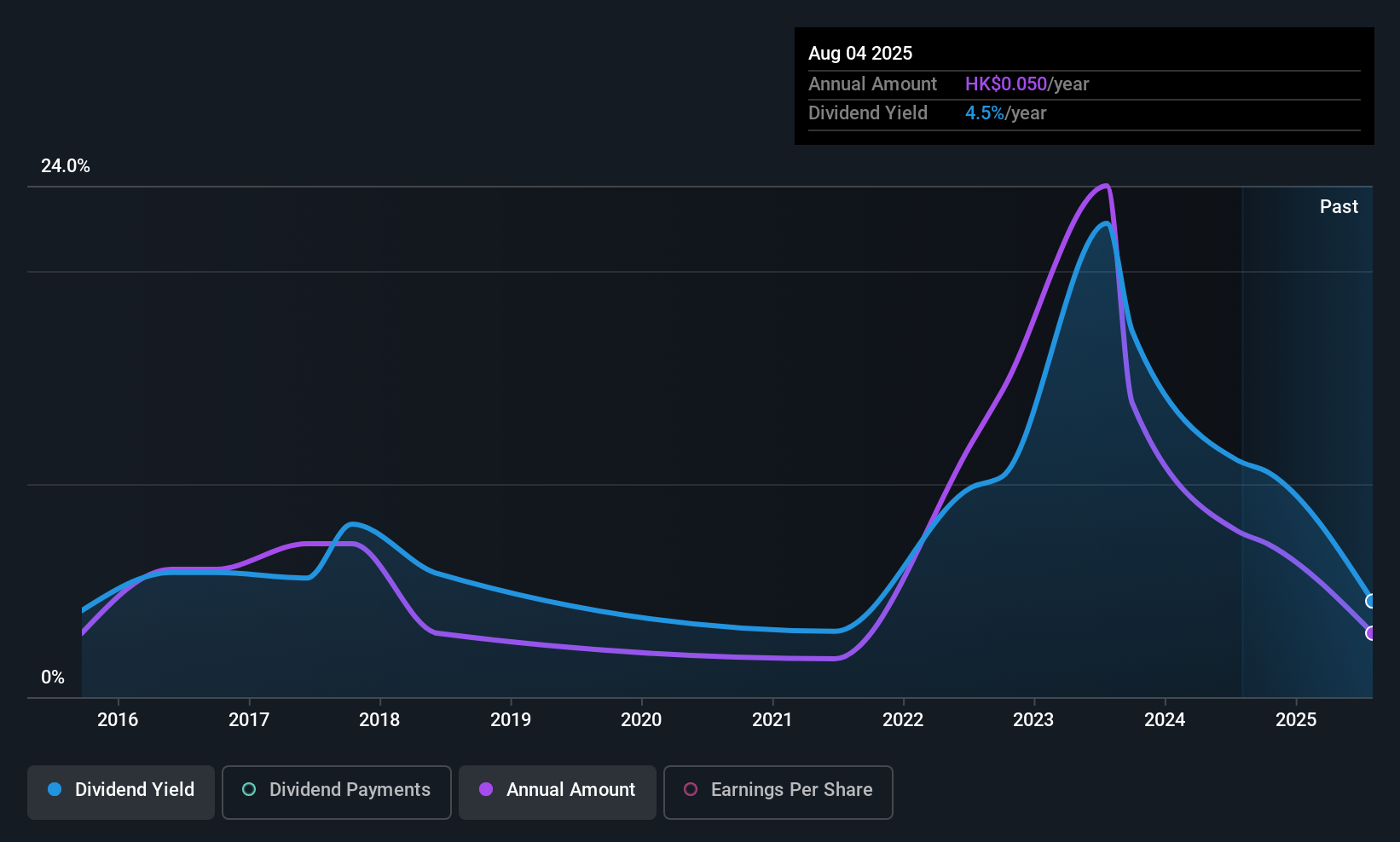

Tiande Chemical Holdings (SEHK:609)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tiande Chemical Holdings Limited is an investment holding company that focuses on the research, development, manufacture, and sale of fine chemical products across various international markets including China, India, Switzerland, the United States, and the United Arab Emirates; it has a market capitalization of approximately HK$1.20 billion.

Operations: Tiande Chemical Holdings Limited generates revenue primarily from its research, development, manufacture, and sale of fine chemical products, amounting to approximately CN¥1.87 billion.

Dividend Yield: 3.6%

Tiande Chemical Holdings offers a mixed dividend profile. The company's dividends are covered by earnings and cash flows, with payout ratios of 61.4% and 20.5%, respectively, indicating sustainability in payments. However, the dividend yield of 3.64% is below the top tier in Hong Kong, and past volatility raises concerns about reliability. Recent approval of a HK$0.03 per share dividend highlights ongoing shareholder returns despite profit margin declines from last year’s levels.

- Click here to discover the nuances of Tiande Chemical Holdings with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Tiande Chemical Holdings is priced lower than what may be justified by its financials.

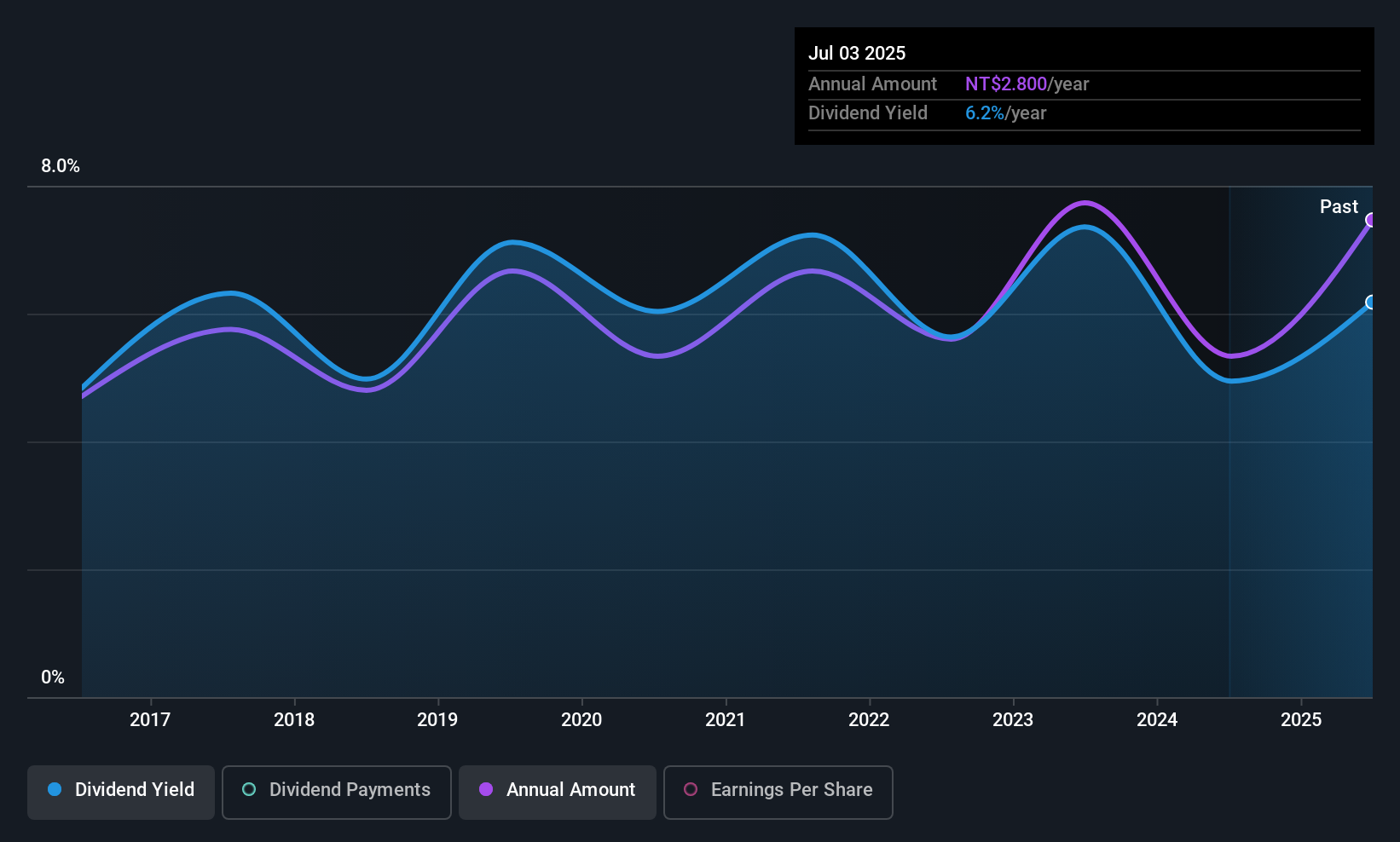

King Chou Marine Technology (TPEX:4417)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: King Chou Marine Technology Co., Ltd. operates globally under the King Net brand, specializing in the manufacturing, processing, exporting, and importing of fishing nets for marine industries with a market cap of NT$4.09 billion.

Operations: King Chou Marine Technology Co., Ltd.'s revenue primarily derives from the production and international trade of fishing nets, serving various sectors within the marine industries.

Dividend Yield: 5.7%

King Chou Marine Technology's dividend profile shows both strengths and weaknesses. While the dividend yield is in the top 25% of Taiwan's market, past volatility raises concerns about reliability. The company maintains a strong earnings and cash flow coverage with payout ratios of 47% and 33.5%, respectively, suggesting sustainability. Recent earnings growth supports potential for future dividends, with net income rising significantly year-over-year. A recent TWD 2.8 per share dividend was approved for distribution in July 2025.

- Click to explore a detailed breakdown of our findings in King Chou Marine Technology's dividend report.

- In light of our recent valuation report, it seems possible that King Chou Marine Technology is trading behind its estimated value.

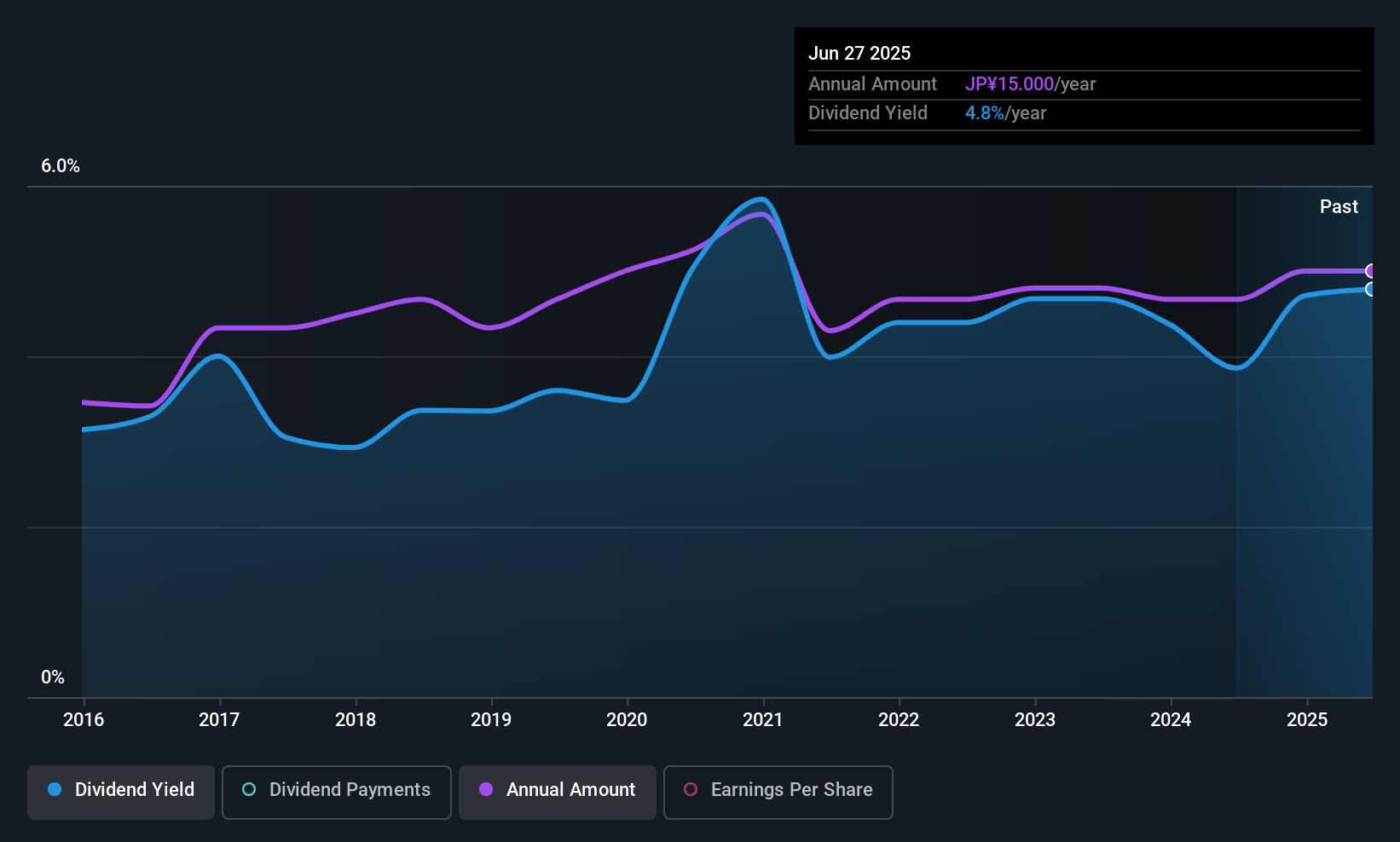

TOWLtd (TSE:4767)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TOW Co., Ltd. specializes in the planning, production, construction, creation, and management of events and seminars primarily in Japan with a market cap of approximately ¥15 billion.

Operations: TOW Co., Ltd. generates revenue primarily from its Business Services segment, which amounts to ¥16.88 billion.

Dividend Yield: 4.1%

TOW Ltd.'s dividend yield ranks in the top 25% of Japan's market, offering a competitive return. However, the company's dividends have been volatile over the past decade, raising concerns about reliability. Despite this, dividends are sustainably covered by earnings and cash flows with payout ratios of 49% and 53.3%, respectively. Currently trading at a significant discount to its estimated fair value, TOW Ltd.'s valuation may appeal to some investors seeking dividend opportunities in Asia.

- Unlock comprehensive insights into our analysis of TOWLtd stock in this dividend report.

- The analysis detailed in our TOWLtd valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Delve into our full catalog of 1129 Top Asian Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tiande Chemical Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:609

Tiande Chemical Holdings

An investment holding company, engages in the research, development, manufacture, and sells fine chemical products in the People’s Republic of China, India, Switzerland, the United States, United Arab Emirates, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives