Last Update 30 Oct 25

Fair value Increased 4.40%Analysts have raised their fair value estimate for GSK to $17.36 from $16.63. They cite higher profit margin expectations and improved sector sentiment following significant technology rollouts and favorable policy signals.

Analyst Commentary

Analyst sentiment around GSK has been notably influenced by recent sector-specific milestones and broader policy signals. Following the successful Vault CRM rollout and tangible progress by peers, perspectives on GSK's valuation and growth potential have become both more nuanced and constructive.

Bullish Takeaways- Bullish analysts highlight GSK’s completed Vault CRM rollout as a key milestone. This demonstrates successful technology execution and sets GSK apart from competitors lacking this scale of implementation.

- GSK is positioned as one of several large-cap drugmakers benefiting from a more favorable U.S. policy outlook and positive news flow around domestic manufacturing initiatives. These trends could help de-risk future earnings.

- Recent improvements in sector sentiment, including increased optimism about regulatory stability and ongoing policy support, have contributed to a higher valuation outlook for GSK and its peers.

- Momentum in pharma digital transformation is evident. GSK’s swift embrace of advanced IT systems, including AI-driven CRM platforms, supports expectations for operational efficiencies and revenue growth.

- Bearish analysts caution that despite technology advancements, the broader pharmaceutical sector remains exposed to potential political volatility, especially with policy measures that could impact pricing or international operations.

- Some are wary that current valuation levels may already price in much of the expected upside from digital transformation and factory investments. This could limit incremental gains unless GSK demonstrates sustained outperformance.

- Competitive pressures within large-cap pharma, especially as more companies announce similar technology upgrades, could make it challenging for GSK to maintain a distinct advantage in future quarters.

- Execution risk persists as GSK continues to scale new systems. Analysts note that operational issues or delays in broader adoption could weigh on near-term margins.

What's in the News

- GSK raised its 2025 earnings guidance, now forecasting turnover growth of 6% to 7%, core operating profit growth of 9% to 11%, and core EPS growth of 10% to 12%. (Key Developments)

- The FDA approved GSK’s Blenrep (belantamab mafodotin-blmf) in combination with bortezomib and dexamethasone for patients with relapsed or refractory multiple myeloma. This expands treatment options for those who have received at least two prior therapies. (Key Developments)

- GSK reported positive Phase III data for a next-generation, low-carbon propellant Ventolin MDI, supporting regulatory submissions and a launch beginning in 2026. This new inhaler is aimed at providing sustainable respiratory treatment options. (Key Developments)

- Luke Miels was named CEO Designate and will assume GSK’s top leadership role on January 1, 2026, succeeding Dame Emma Walmsley. (Key Developments)

- GSK announced a $30 billion investment in U.S. innovation, including new advanced manufacturing facilities and a $1.2 billion upgrade in biopharma factories and laboratories. (Key Developments)

Valuation Changes

- Fair Value Estimate has risen slightly, increasing from $16.63 to $17.36 per share.

- Discount Rate remains essentially unchanged at 6.82%.

- Revenue Growth estimate has fallen modestly, shifting from 4.44% to 4.17% annually.

- Net Profit Margin forecast has improved, rising from 18.37% to 19.30%.

- Future P/E has fallen notably, declining from 12.10x to 9.06x. This indicates higher expected earnings relative to price.

Key Takeaways

- Robust growth in vaccines and specialty medicines, alongside innovation in oncology and immunology, positions GSK for sustained revenue and margin expansion.

- Diversification, operational efficiencies, and accelerated R&D enhance resilience, supporting strong long-term sales and earnings potential despite industry pressures.

- Patent expiries, pricing pressure, legal liabilities, stagnating core segments, and high-risk R&D threaten GSK's ability to offset revenue loss and maintain earnings growth.

Catalysts

About GSK- Engages in the research, development, and manufacture of vaccines, specialty medicines, and general medicines to prevent and treat disease in the United Kingdom, the United States, and internationally.

- GSK is well-positioned to benefit from the global rise in demand for vaccines and specialty medicines, driven by an aging population and higher healthcare access in emerging markets-evidenced by robust ongoing growth in Shingrix, meningitis vaccines, and double-digit expansion in specialty medicines-which supports sustained revenue growth and greater resilience in future cash flows.

- Strong volume growth in key high-margin areas like oncology (Jemperli, Blenrep), immunology (Benlysta, Nucala, depemokimab), and HIV (long-acting injectables) demonstrates GSK's ability to capture premium pricing and leverage long-term trends toward innovative, biologic, and personalized therapies, positively impacting future earnings and supporting margin expansion as these portfolios scale.

- Strategic R&D investments and business development (multiple Phase III starts, advanced modality deals, new manufacturing capacity, and collaborations such as with Hengrui) are accelerating pipeline momentum, with expectations for meaningful late-stage readouts and new launches through 2026 and beyond, increasing the visibility and durability of future revenue growth.

- Ongoing operational improvements, including cost efficiencies post-Haleon spin-off, SG&A productivity initiatives, and supply chain optimization (with a shift toward U.S. manufacturing), are enhancing net margins and underpinning stronger long-term free cash flow, enabling reinvestment and greater shareholder returns.

- GSK's diversification across vaccines, specialty medicines, and geographic markets positions the company to mitigate pressures from drug price controls and competitive threats, while large, unmet needs in chronic and infectious diseases (COPD, hepatitis, UTIs, HIV) provide a long-term runway for growth, supporting confidence in its medium

- and long-term sales and earnings outlook.

GSK Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming GSK's revenue will grow by 4.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.8% today to 18.4% in 3 years time.

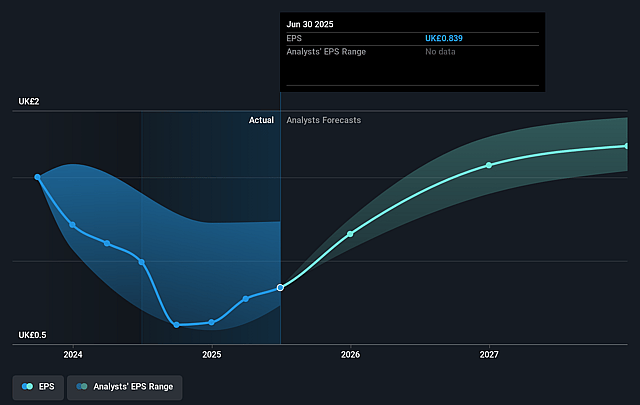

- Analysts expect earnings to reach £6.6 billion (and earnings per share of £1.81) by about September 2028, up from £3.4 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as £7.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.0x on those 2028 earnings, down from 17.3x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 21.9x.

- Analysts expect the number of shares outstanding to decline by 0.81% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.82%, as per the Simply Wall St company report.

GSK Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Loss of exclusivity (LOE) for key drugs, notably dolutegravir in HIV and respiratory products, is flagged as a future revenue risk-management guidance and analyst questions indicate patent expiries post-2028 could hit earnings and net margins, especially if new launches like Blenrep face timing risks or fail to compensate for these losses.

- GSK faces rising pricing and regulatory headwinds, including Medicare Part D redesign and increasing governmental scrutiny on drug pricing and tariffs in the U.S. and Europe. These could structurally erode revenue growth and pressure net margins over the long term, especially given the repeated reference to pricing headwinds and assumptions of future mitigation actions.

- Legal risks from legacy issues, specifically significant Zantac litigation payments (noted as £1.1 billion expected in H2 and nearly £3 billion in total outflows for Zantac and other settlements), are directly reducing cash flow and increasing net debt, with further negative implications for reinvestment, R&D, and shareholder returns if unresolved.

- The vaccines and general medicines segments are facing either flattening or outright declining sales due to tough comparators, generic competition, and slower-than-expected recovery in key markets such as China. This stagnation limits overall revenue growth and offsets gains in specialty medicines.

- Although GSK is making large R&D investments and expanding its pipeline, the text notes the risk of escalating R&D costs with uncertainty around the probability of converting late-stage programs into commercial blockbusters. This risk is heightened by increasing industry competition in areas like oncology and immunology, raising the chance of underwhelming returns on R&D and constraining long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £16.508 for GSK based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £25.2, and the most bearish reporting a price target of just £11.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £36.0 billion, earnings will come to £6.6 billion, and it would be trading on a PE ratio of 12.0x, assuming you use a discount rate of 6.8%.

- Given the current share price of £14.68, the analyst price target of £16.51 is 11.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.