Last Update 25 Feb 26

ZDGE: Share Repurchases And Cost Controls Will Support Future Upside Potential

Analysts have trimmed their Zedge price target by $16 to $46, reflecting recent Q4 revenue and EBITDA shortfalls and ongoing Tech and Shopping headwinds, while still seeing value supported by expectations for modest EBITDA growth over the next two years.

Analyst Commentary

Bullish Takeaways

- Bullish analysts see the trimmed US$46 price target as still implying room for upside versus current trading levels, supported by what they view as deep value in the shares.

- They highlight that, despite the Q4 revenue and EBITDA miss of 2% and 7% versus Street expectations, consolidated EBITDA is still expected to grow slightly in FY26 and at a low single digit rate in FY27, which they see as enough to support the valuation.

- Expectations for cost rationalization in the Tech and Shopping segment are viewed as an execution lever that could help stabilize group profitability even while that segment remains under pressure.

- Some bullish analysts argue that, while the near term rerating path is unclear, the current share price already reflects a lot of pessimism, so modest EBITDA growth could be enough to improve sentiment over time.

Bearish Takeaways

- Bearish analysts focus on the Q4 miss versus Street estimates as a sign that execution risk remains, especially with Tech and Shopping being the primary source of underperformance.

- They see management’s expectation for double digit declines in Tech and Shopping in the first half of 2026, even if moderating later in the year, as a headwind to both growth and any quick improvement in valuation.

- The ongoing search driven affiliate pressure in Tech and Shopping is viewed as a structural challenge that could weigh on revenue quality and limit EBITDA expansion, even with cost cuts.

- The lack of a clear rerating catalyst is a key concern for more cautious analysts, who worry that the stock could remain range bound if execution in weaker segments does not improve convincingly.

What's in the News

- Zedge completed a share repurchase of 239,000 shares between August 1, 2025 and October 31, 2025, representing 1.81% of the company, for a total of US$0.78 million (Key Developments).

- Across the full buyback program announced on September 16, 2024, Zedge has repurchased 1,342,913 shares, representing 9.76% of the company, for a total of US$4.4 million (Key Developments).

Valuation Changes

- Fair Value: Model fair value remains at $6.0 per share, with no change from the prior $6 level.

- Discount Rate: The discount rate is essentially unchanged at 8.23%, moving only slightly from 8.23% previously.

- Revenue Growth: Assumed long-term revenue growth stays steady at 2.61%, with no adjustment from the earlier 2.61% assumption.

- Net Profit Margin: Expected net profit margin is effectively flat at 29.72%, compared with 29.72% before.

- Future P/E: The future P/E assumption remains very close to prior levels at 7.95x, versus 7.95x previously.

Key Takeaways

- Restructuring and workforce reduction aim to improve profitability while enhancing monetization channels to boost revenue.

- Deployment of AI capabilities and subscription growth suggest potential for sustained revenue growth and user engagement.

- Heavy reliance on new products like AI features must succeed to offset declining legacy segments, amid regulatory risks and restructuring-related operational disruptions.

Catalysts

About Zedge- Zedge, Inc. builds digital marketplaces and competitive games around content that people use to express themselves.

- The return of TikTok to the app stores is expected to boost advertising demand and increase CPMs, positively impacting Zedge's advertising revenue in the coming quarters.

- The company's restructuring plan, which includes a substantial reduction in workforce and closure of the Norway office, aims to save approximately $4 million annually, thus improving net margins and profitability.

- The growing subscription revenue, which increased by 13% year-over-year, and the expansion of new and higher-value subscription offerings indicate sustained revenue growth and enhanced earnings potential.

- The development and deployment of Gen AI capabilities, such as image-to-image editing and AI audio creation tools, are expected to drive user engagement and open new monetization opportunities, potentially increasing revenue.

- Zedge's focus on optimizing and expanding monetization channels, including Zedge Premium and rewarded video usage, is likely to boost gross transaction volume (GTV) and improve overall earnings.

Zedge Future Earnings and Revenue Growth

Assumptions

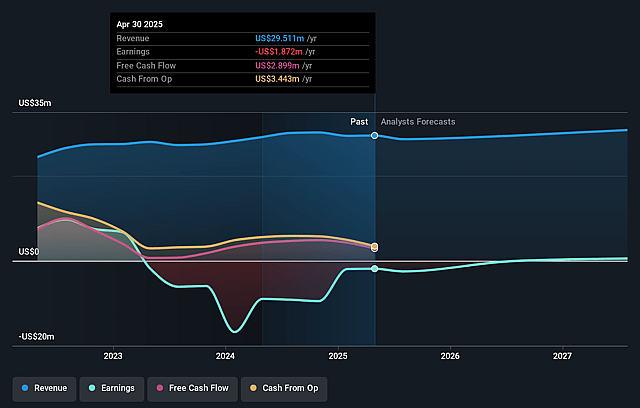

How have these above catalysts been quantified?- Analysts are assuming Zedge's revenue will grow by 1.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -6.3% today to 2.6% in 3 years time.

- Analysts expect earnings to reach $798.2 thousand (and earnings per share of $0.06) by about September 2028, up from $-1.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 94.7x on those 2028 earnings, up from -22.3x today. This future PE is greater than the current PE for the US Interactive Media and Services industry at 16.9x.

- Analysts expect the number of shares outstanding to decline by 3.62% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.0%, as per the Simply Wall St company report.

Zedge Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The unclear regulatory status and temporary ban of TikTok caused a significant decline in ad revenue, which remains a risk if future restrictions or issues arise, potentially recurring impacts on Zedge's revenue.

- The company experienced a 10% year-over-year decline in total revenue primarily due to industry-wide advertising headwinds, impacting overall financial performance.

- Continued challenges with GuruShots, with a 33% year-over-year revenue decline, highlight potential weaknesses in sustaining or growing user engagement, impacting revenue generation.

- Restructuring efforts, while aimed at improving profitability, include significant workforce reductions, which may lead to short-term operational disruptions and affect long-term growth prospects, impacting net margins and earnings.

- Heavy reliance on new or emerging products such as AI features and other innovations must be successfully executed to compensate for declining legacy segments, posing execution and market acceptance risks that could affect future revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.0 for Zedge based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $31.2 million, earnings will come to $798.2 thousand, and it would be trading on a PE ratio of 94.7x, assuming you use a discount rate of 8.0%.

- Given the current share price of $3.06, the analyst price target of $5.0 is 38.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Zedge?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.