Last Update 18 Dec 25

Fair value Decreased 0.20%NUVOCO: Planned Energy Acquisition Will Drive Future Upside Potential

Analysts have trimmed their price target on Nuvoco Vistas slightly, reducing fair value by about ₹0.90 per share as they factor in a marginally higher discount rate, slightly softer revenue growth expectations, and a modestly lower projected profit margin, which is only partially offset by a higher anticipated future P/E multiple.

What's in the News

- Nuvoco Vistas plans a private placement of convertible debentures to raise INR 6,000 crore, providing funding flexibility for growth and balance sheet needs (company announcement).

- The board has scheduled a meeting on November 3, 2025, to consider a Securities Purchase Agreement to acquire all securities of Algebra Endeavour Private Limited, the holding company of Vadraj Energy with power plants in Kutch and Surat, from JSW Cement and Alpha Alternatives (board agenda).

- A separate board meeting on October 15, 2025, will review and approve the unaudited standalone and consolidated financial results for the quarter and half year ended September 30, 2025, which will offer investors an updated view of operating performance (board agenda).

Valuation Changes

- Fair Value: Trimmed slightly from approximately ₹447.59 to ₹446.71 per share, reflecting a marginal downward revision in intrinsic value.

- Discount Rate: Increased slightly from about 15.73 percent to 15.74 percent, implying a marginally higher required return for investors.

- Revenue Growth: Eased modestly from roughly 10.09 percent to 10.01 percent, indicating slightly softer top line expectations.

- Net Profit Margin: Reduced slightly from around 5.52 percent to 5.42 percent, pointing to a small downgrade in profitability assumptions.

- Future P/E: Raised modestly from about 31.29x to 31.89x, suggesting a slightly higher valuation multiple applied to future earnings.

Key Takeaways

- Infrastructure growth, premium product focus, and expanded distribution strengthen demand outlook, margin improvement, and brand advantage for Nuvoco Vistas.

- Operational efficiencies, cost optimization, and disciplined funding reduce risks, enhance profitability, and improve market positioning in Western India.

- Aggressive expansion and rising costs, along with regional and regulatory risks, threaten Nuvoco's profitability, margin stability, and long-term revenue growth potential.

Catalysts

About Nuvoco Vistas- Manufactures and sale of cement and building materials products in India.

- Strong government-led infrastructure and housing initiatives, alongside India's ongoing urbanization and demographic growth, are expected to drive robust industry demand in the medium-to-long term, providing Nuvoco Vistas with sustained volume growth and revenue visibility.

- Nuvoco's increased focus on premium products (now ~41% of total volume), distribution expansion, and trade channel optimization is raising realizations and net margins, with further upside as product mix shift and brand rollout deepen-supporting ongoing EBITDA expansion.

- The integration and ramp-up of recently acquired Vadraj Cement assets (Kutch/Surat), along with planned railway sidings and captive power plant addition, are set to unlock operational efficiencies, improve capacity utilization, boost regional market share in Western India, and drive both top-line and bottom-line improvement.

- Ongoing cost optimization through Project Bridge, increased use of alternative fuels (AFR), allied slags, waste heat recovery, and logistics geo-optimization is structurally reducing production and freight costs, protecting margins against input volatility and inflationary pressures.

- Demonstrated deleveraging discipline and prudent funding (equity-type instruments for acquisitions) lower balance sheet risk and future interest expenses, supporting improved reported earnings and return on capital as new capacity is commissioned and EBITDA/tonne remains high.

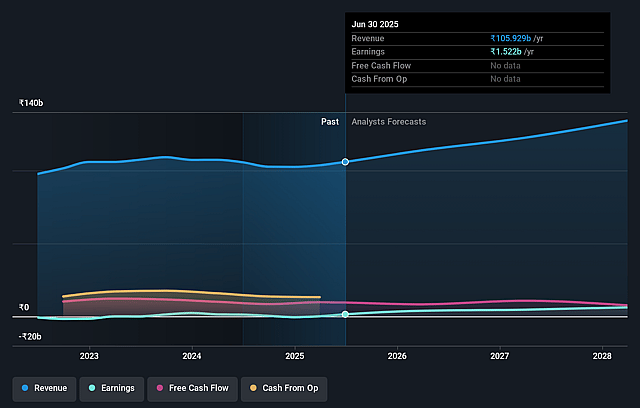

Nuvoco Vistas Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Nuvoco Vistas's revenue will grow by 8.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.4% today to 5.6% in 3 years time.

- Analysts expect earnings to reach ₹7.6 billion (and earnings per share of ₹17.56) by about September 2028, up from ₹1.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹9.8 billion in earnings, and the most bearish expecting ₹4.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.2x on those 2028 earnings, down from 108.6x today. This future PE is lower than the current PE for the IN Basic Materials industry at 34.1x.

- Analysts expect the number of shares outstanding to decline by 0.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.4%, as per the Simply Wall St company report.

Nuvoco Vistas Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's aggressive expansion, including the Vadraj Cement acquisition and associated CapEx of ₹3,600+ crores, pushes debt back up toward ₹5,000 crore, reintroducing significant leverage; this could constrain future expansion, increase interest costs, and suppress net earnings, especially if sector growth underperforms expectations.

- Nuvoco's geographic concentration in East and North India (and soon, Gujarat) leaves the company vulnerable to region-specific economic downturns or adverse state policies, which may lead to revenue volatility and increased risk to long-term sales growth.

- Tightening availability and rising auction prices of key raw materials (notably slag in the East) could structurally elevate input costs; if Nuvoco cannot fully pass these onto customers in a competitive environment, margin compression and lower EBITDA are likely.

- Persistent industry-wide threats-including entry of larger pan-India cement majors and intensifying price competition-may undermine Nuvoco's market share ambitions in newly entered regions like Gujarat, threatening both revenue growth and sustainable improvements in profitability and return on capital employed (ROCE).

- Long-term regulatory risks, such as accelerating climate change mandates and the global transition toward lower-carbon construction materials, may drive up compliance and capex costs faster than Nuvoco's current pace of carbon footprint reduction, potentially eroding future margins and cash flows.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹420.667 for Nuvoco Vistas based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹480.0, and the most bearish reporting a price target of just ₹330.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹136.5 billion, earnings will come to ₹7.6 billion, and it would be trading on a PE ratio of 29.2x, assuming you use a discount rate of 14.4%.

- Given the current share price of ₹462.5, the analyst price target of ₹420.67 is 9.9% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Nuvoco Vistas?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.