Key Takeaways

- Accelerated integration of recent acquisitions and operational efficiencies could drive market share gains, stronger margins, and robust revenue growth beyond consensus expectations.

- Premiumization, deleveraging focus, and favorable infrastructure demand trends position the company for sustained earnings expansion and long-term strategic flexibility.

- High debt burden, sector overcapacity, regional concentration, tightening environmental norms, and muted long-term demand outlook threaten profitability and sustainable growth prospects.

Catalysts

About Nuvoco Vistas- Manufactures and sale of cement and building materials products in India.

- While analyst consensus expects the Vadraj Cement acquisition to increase Nuvoco's capacity and regional footprint, this may understate the upside as Nuvoco's best-in-class execution and rapid integration record could enable early ramp-up, faster-than-anticipated volume growth, and substantial market share gains in the fast-growing Western region, translating to step-changes in revenue as well as operating leverage benefits.

- Whereas analysts broadly forecast margin improvement from ongoing cost initiatives, these estimates may be conservative, as new debottlenecking, logistics optimization (notably railway siding and reduced lead distance), and industry-leading alternative fuels ramp-up could combine to unlock sustained structural EBITDA per tonne gains well above recent historic highs, materially boosting net margins.

- Nuvoco's rapid premiumization strategy, which has already driven premium product share up to 41 percent, positions the company to capitalize on the rising demand for high-quality, green construction materials as urbanization and environmental standards intensify, unlocking consistently higher realizations and supporting robust revenue and margin expansion.

- The focus on deleveraging, with net debt reduced by over Rs 3,400 crores in four years and future asset funding aimed at limiting leverage impact, gives Nuvoco significant headroom to undertake further value-accretive expansions or product diversification, positioning free cash flow and earnings for meaningful multi-year compounding.

- With India set for multi-year infrastructure and affordable housing surges-supported by government outlays exceeding Rs 20 lakh crores and robust Eastern state allocations-Nuvoco's broad-based capacity, strong brand, and trade network leave it ideally situated to benefit from secular demand tailwinds, sustaining compounded volume growth and driving superior topline and bottom-line outperformance.

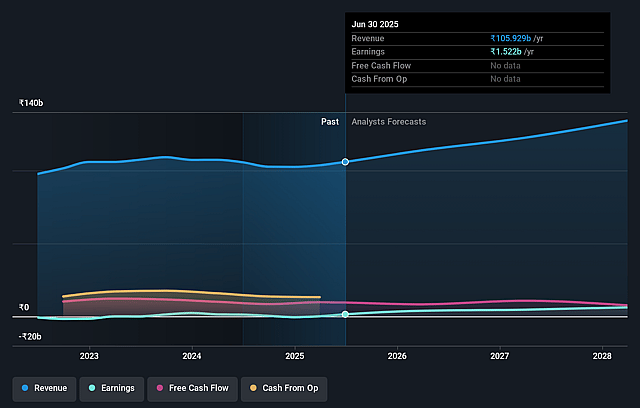

Nuvoco Vistas Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Nuvoco Vistas compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Nuvoco Vistas's revenue will grow by 13.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.4% today to 9.3% in 3 years time.

- The bullish analysts expect earnings to reach ₹14.4 billion (and earnings per share of ₹40.5) by about September 2028, up from ₹1.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 19.5x on those 2028 earnings, down from 103.9x today. This future PE is lower than the current PE for the IN Basic Materials industry at 34.4x.

- Analysts expect the number of shares outstanding to decline by 0.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.63%, as per the Simply Wall St company report.

Nuvoco Vistas Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- High net debt levels, including substantial new borrowings related to the Vadraj Cement acquisition, leave Nuvoco Vistas exposed to rising interest costs and could constrain future investments, directly impacting net margins and long-term earnings.

- Continued overcapacity and price competition in the Indian cement sector threaten to erode Nuvoco's pricing power even as the company invests heavily in new capacity, risking compression of both revenues and margins over the medium to long term.

- The company's regional concentration in North, East, and now partially Western India-in markets prone to localized demand shocks, policy changes, and supply tightness (such as in slag procurement)-raises the risk of uneven volume growth and limited revenue expansion.

- Accelerating regulatory requirements for carbon neutrality and environmental compliance may drive up operating costs and require significant capital expenditure, posing a threat to profitability as stricter emission norms become the industry standard.

- Long-term demographic and secular trends such as plateauing urbanization, the rise of alternative eco-friendly building materials, and a structural slowdown in infrastructure growth post-2030 could restrain cement demand growth, limiting Nuvoco Vistas' future topline and earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Nuvoco Vistas is ₹529.21, which represents two standard deviations above the consensus price target of ₹426.0. This valuation is based on what can be assumed as the expectations of Nuvoco Vistas's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹560.0, and the most bearish reporting a price target of just ₹330.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹156.1 billion, earnings will come to ₹14.4 billion, and it would be trading on a PE ratio of 19.5x, assuming you use a discount rate of 14.6%.

- Given the current share price of ₹442.45, the bullish analyst price target of ₹529.21 is 16.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.