Key Takeaways

- Escalating regulatory costs and shifting building material trends threaten profitability and sustained revenue growth amid evolving industry standards and customer preferences.

- High debt and persistent sector overcapacity limit financial flexibility and pricing power, increasing risks to earnings stability and expansion potential.

- Robust government infrastructure investment, capacity expansion, premium product focus, and operational efficiencies position Nuvoco Vistas for sustained growth and margin improvement despite industry headwinds.

Catalysts

About Nuvoco Vistas- Manufactures and sale of cement and building materials products in India.

- The increasing stringency of environmental regulations and aggressive global carbon reduction commitments are likely to force significantly higher compliance expenditures and sustained capital outflows, which will erode Nuvoco Vistas' net margins and ultimately weigh on long-term profitability as the costs of decarbonization technologies and carbon credits escalate.

- The rising adoption of alternative building materials such as engineered timber and modular construction presents a structural risk to traditional cement demand, and as these solutions become more widespread and accepted in India's urban and infrastructure ecosystems, Nuvoco's revenue growth prospects are at risk of chronic stagnation or decline.

- Nuvoco Vistas' persistently elevated net debt levels, exacerbated by the heavily-leveraged Vadraj acquisition and the ongoing burden of bridge financing, will constrain future capacity expansion, amplify interest expenses, and leave the company financially inflexible during industry downturns-ultimately threatening earnings stability and shareholder returns.

- The persistent overcapacity in India's cement sector will drive fierce pricing competition over the coming years, compressing industry margins; as a result, even with operating cost initiatives, Nuvoco could face sustained pressure on both revenue growth and EBITDA per tonne as volume-led expansion loses effectiveness.

- Long-term urbanization trends in India risk plateauing, with construction activity gradually shifting toward densification, redevelopment, and renovations, significantly reducing new greenfield cement demand and resulting in lower plant utilization rates and declining pricing power, thereby threatening the company's topline and operating leverage.

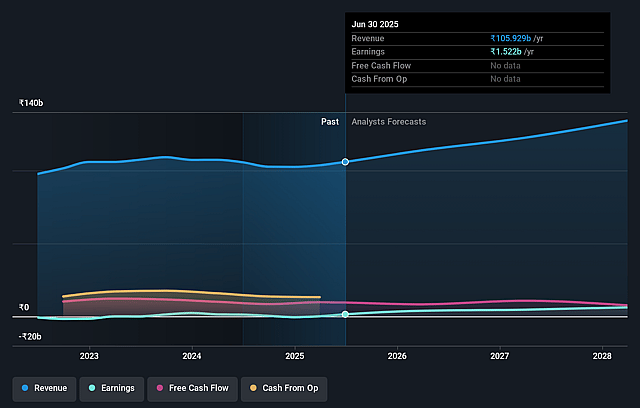

Nuvoco Vistas Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Nuvoco Vistas compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Nuvoco Vistas's revenue will grow by 6.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.4% today to 3.8% in 3 years time.

- The bearish analysts expect earnings to reach ₹4.8 billion (and earnings per share of ₹13.42) by about September 2028, up from ₹1.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 36.7x on those 2028 earnings, down from 108.9x today. This future PE is greater than the current PE for the IN Basic Materials industry at 34.3x.

- Analysts expect the number of shares outstanding to decline by 0.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.6%, as per the Simply Wall St company report.

Nuvoco Vistas Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained government infrastructure spending and large CapEx outlays, including central and state government allocations of over ₹20 lakh crores and targeted housing programs, are likely to provide strong support for cement demand, thereby underpinning volume growth and revenue expansion for Nuvoco Vistas in coming years.

- Nuvoco's successful execution of capacity expansion, as demonstrated by the integration of Vadraj Cement and the ramping up of new clinker and grinding units in Western India, positions the company to capture incremental market share and drive long-term increases in earnings.

- Increasing focus on premiumization-reflected in 41% premium product mix and 76% trade share-combined with strong brand and distribution strategies, is likely to structurally improve net margins and profitability over time due to higher realizations and product differentiation.

- Demonstrated ability to achieve operational efficiencies, such as consistent reduction in fuel costs, aggressive cost-saving programs (Project Bridge, Project Sprint), and value chain optimization, indicates long-term enhancements to EBITDA per tonne and resilient net profits even in volatile input price environments.

- Favorable secular trends, including urbanization, government push for affordable housing, and a growing emphasis on sustainable materials-where Nuvoco leads in low-carbon cement-offer significant tailwinds for revenue and earnings growth, potentially contradicting expectations of share price decline.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Nuvoco Vistas is ₹330.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Nuvoco Vistas's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹560.0, and the most bearish reporting a price target of just ₹330.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹126.2 billion, earnings will come to ₹4.8 billion, and it would be trading on a PE ratio of 36.7x, assuming you use a discount rate of 14.6%.

- Given the current share price of ₹463.9, the bearish analyst price target of ₹330.0 is 40.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Nuvoco Vistas?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.